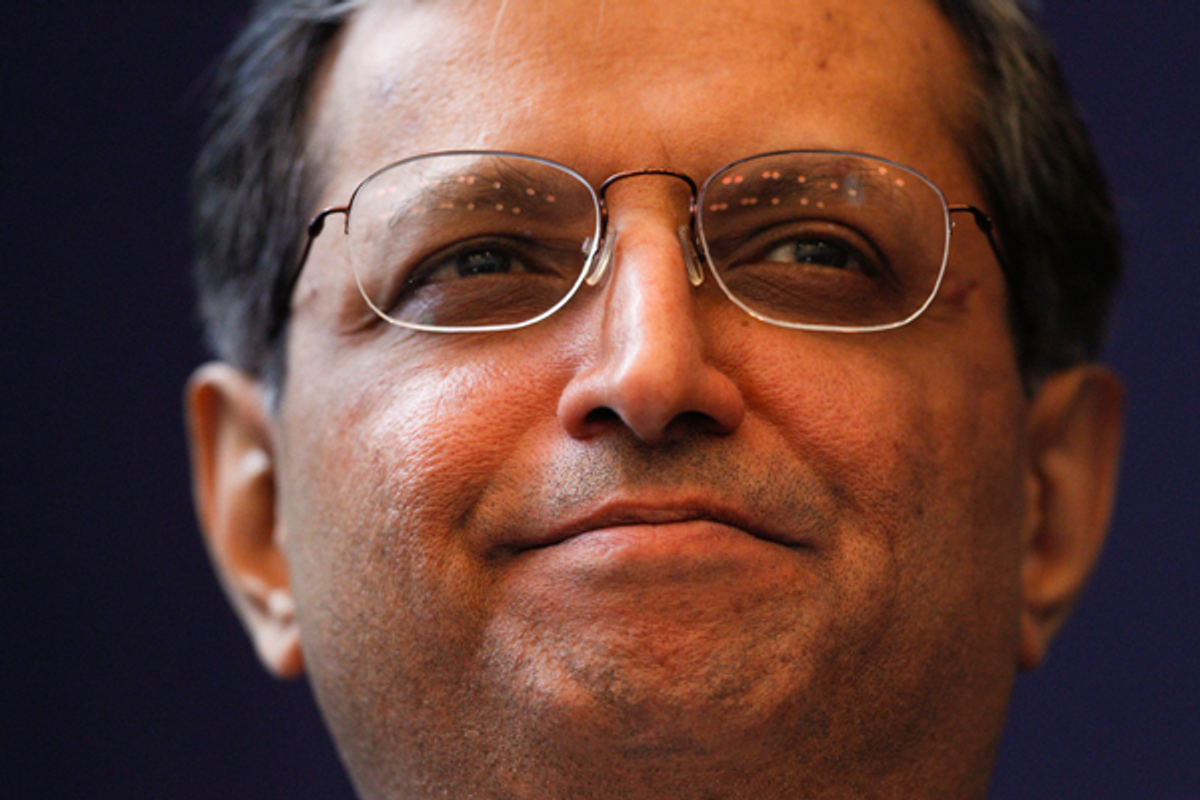

The shareholders of Wall Street giant Citigroup are out to prove that corporate democracy isn’t an oxymoron. They’ve said no to the exorbitant $15 million pay package of Citi’s CEO Vikram Pandit, as well as to the giant pay packages of Citi’s four other top executives.

The vote, at Citigroup’s annual meeting in Dallas Tuesday, isn’t binding on Citigroup. But it’s a warning shot across the bow of every corporate boardroom in America.

Shareholders aren’t happy about executive pay.

And why should they be? CEO pay at large publicly-held corporations is now typically 300 times the pay of the average American worker. It was 40 times average worker pay in the 1960s and has steadily crept upward since then as corporations have morphed into “winner-take-all” contraptions that reward their top executives with boundless beneficence and perks while slicing the jobs, wages, and benefits of almost everyone else.

Meanwhile, too many of these same corporations have failed to deliver for their shareholders. Citigroup, for example, has delivered the worst stock performance mong all large banks for the last decade but ranked among the highest in executive pay.

The real news here is new-found activism among institutional investors – especially the managers of pension funds and mutual funds. They’re the ones who fired the warning shot Tuesday.

Institutional investors are catching on to a truth they should have understood years ago: When executive pay goes through the roof, there’s less money left for everyone else who owns shares of the company.

For too long, most fund managers played the game passively and obediently. Some have been too cozy with top corporate management, forgetting their fiduciary duty to their own investors. How else do you explain the abject failure of fund managers to police Wall Street as it careened toward the abyss in 2008? Or to adequately oversee executives, such as the Enron criminals, who were looting their companies in the years before 2002?

The new Dodd-Frank law, much of which is being eviscerated by Wall Street’s lawyers and lobbyists, at least requires that public companies give shareholders a say on pay. As a practical matter, this gives institutional investors the chance to speak clearly and openly about the scandal of unbridled executive compensation.

Two key questions for the future: Will institutional investors keep the pressure on? And will CEOs and boards of directors get the message?

Shares