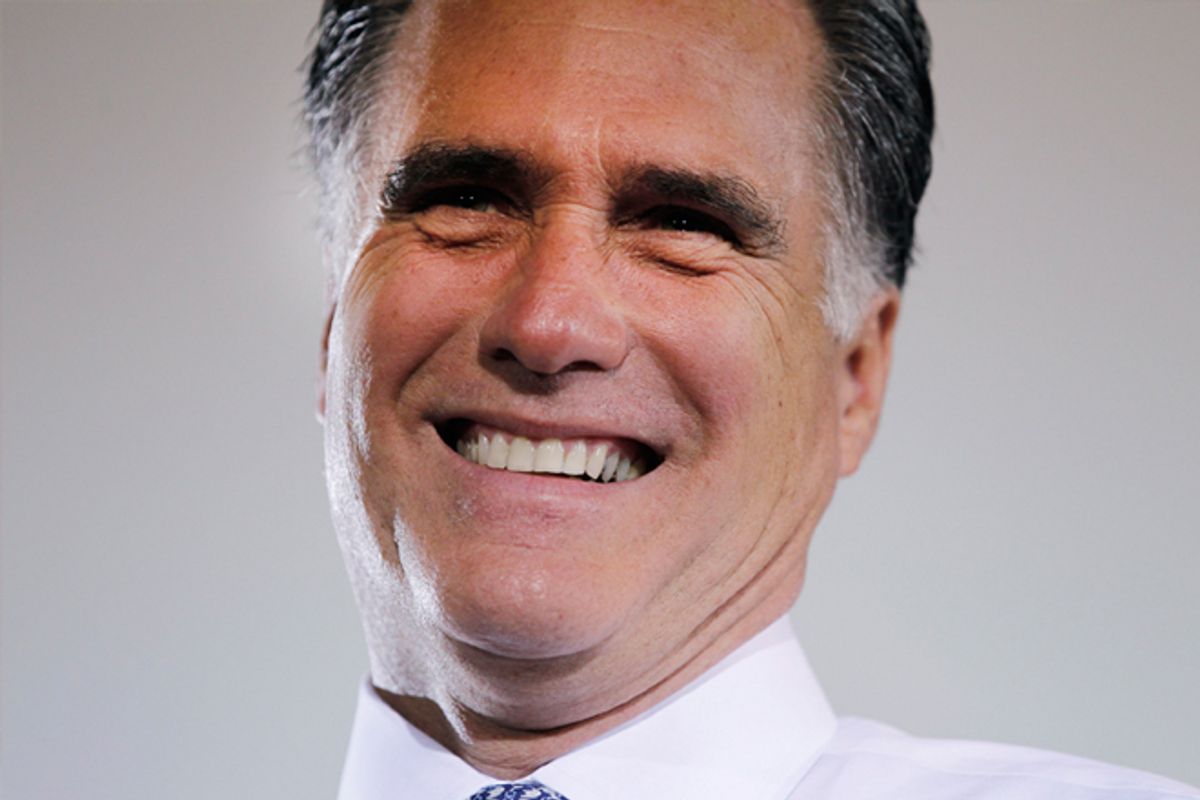

Mitt Romney knows how to do a cost-benefit analysis, and he's determined that it's better to be dogged by reporters for failing to release his tax returns for the duration of the 2012 campaign than it is to make the documents public. Never mind that a majority of Americans – and a third of Republicans – think he should come clean.

It's beyond obvious that whatever's in those returns must be enough to do serious damage to Romney, or even sink his candidacy completely.

What might it be, exactly? In the vacuum Romney has created by not disclosing, any number of theories have been floated as to what his returns could reveal. For your convenience, we've collected 10 theories that are making the rounds in the political press.

1. Mormon Tithes

Mormons are expected to fork over 10 percent of their income to the Church of Latter Day Saints. And that fact leads us to two theories.

First, Rachel Zoll of the Associated Press speculated that Romney doesn't want to remind evangelical Christians that he belongs to what many consider a non-Christian “cult.” “The Republican candidate's commitment to the church is a double-edged sword in the contest for the presidential nomination,” she wrote. “Many GOP voters are Christians who do not consider Mormons to be part of historic Christianity. Romney supporters worry that details of his church donations contained in the tax returns could fuel opposition to him based on his religion.”

But it may be the other way around – perhaps he doesn't want to piss off Mormons. After all, the right-wing Daily Caller reported that in 2010 and 2011, the two years for which Romney released partial returns, it looks like the former Mormon bishop under-tithed the church, paying 7 percent of his income one year and 9.7 percent over the two-year period. As the Caller noted, “Romney recently told Fox News Sunday host Chris Wallace, 'I made a commitment to my church a long, long time ago that I would give 10 percent of my income to the church, and I’ve followed through on that commitment. So, if I had given less than 10 percent, then I think people would have to look at me and say, ‘Hey, what’s wrong with you fella — don’t you follow through on your promises?’”

Of course, if he were sheltering additional income in offshore accounts, then the degree to which the Caller says he shortchanged the Mormons might be even greater.

2. Things That Might Infuriate the Base

Mitt Romney, who just four years ago was dubbed the “conservative alternative” to John McCain is probably, as he claims, “severely conservative.” But when he wanted to become governor of Massachusetts, he played to that state's politics, swearing to protect a woman's right to choose, saying that climate change isn't a socialist plot and generally being reasonable. He passed the precursor to Obamacare, which he now condemns as a sign of looming tyranny.

Rick Newman at US News and World Report wonders whether Romney really stopped supporting those causes when he claims to have converted himself into a far-right Republican. Could he have a bunch of itemized deductions to, say, Planned Parenthood listed on those returns? We'd be wrong not to speculate.

3. Harry Reid, Lazy Blogger

That's how Wonkette characterized Senate Majority Leader Harry Reid's unsourced, secondhand rumor that Mitt Romney paid no taxes at all over a 10-year period. (This is very unlikely, due to the Alternative Minimum Tax.)

But many, many people have speculated that the reason Mitt doesn't want to reveal his tax returns is that they will show that he paid a significantly lower rate than his campaign has claimed in the years prior to 2010.

4. It's the IRAs

Mitt Romney has an Individual Retirement Account, just like you probably do! But unlike you, Mitt has somewhere between $20 million and $101 million in his account.

We know that the maximum amount one can contribute to an IRA account is $17,000 per year (employers can match that with up to $30,000). So that would be a pretty impressive performance – what an investor!

Or what a cheat. Michael Graetz, a professor of tax law at Columbia University and a former official in the senior Bush's Treasury Department, suggested that to get such a fat IRA, “we have to presume that Mr. Romney valued the assets he put in his retirement account at far less than he would have sold them for.”

He continues:

The I.R.A. also allows Mr. Romney to diversify his large holdings tax-free, avoiding the 15 percent tax on capital gains that would otherwise apply. His financial disclosure further reveals that his I.R.A. freed him from paying currently the 35 percent income tax on hundreds of thousands of dollars of interest income each year.

5. The Mini-Mitts

Graetz has a second theory about what Mitt might be hiding, and it also has to do with dramatically under-valuing his assets in order to screw over Uncle Sam.

It has to do with a trust he set up for his five sons in 1995. Graetz explains that until this year, there was a $1 million life-time exemption on such gifts, and after that they should have been taxed at between 29-44 percent. So Mitt would have been on the hook for between $29 and $44 million in gift taxes.

“Based on his aggressive tax planning,” writes Graetz, “my bet is that — if Mr. Romney filed a gift tax return for these transfers at all — he put a low or even zero value on the gifts, certainly a small fraction of the price at which he would have sold the transferred assets to an unrelated party.”

Wouldn't he get busted with such a brazen strategy to avoid paying taxes? After all, that's some pretty serious tax fraud. Well, catching Mitt in this kind of scheme might be harder than one would think. Graetz explains that “every good tax professional knows that gift tax returns are rarely audited, except after the transferer’s death. And normally the I.R.S. cannot challenge such a return after three years from its filing.”

6. Is It All About 2009?

BusinessWeek's Joshua Green thinks Romney may not want to reveal his taxes for one year in particular – 2009. That's because Romney probably took some significant losses when the economy crashed in 2008. Green explains:

It’s possible he suffered a large enough capital loss that, carried forward and coupled with his various offshore tax havens, he wound up paying no U.S. federal taxes at all in 2009. If true, this would be politically deadly for him...

The “zero tax in 2009” theory—again, this is sheer speculation—gains further sustenance when you consider it’s the only year for which nobody knows anything about Romney’s taxes. He’s revealed what’s in his 2010 and 2011 returns, and he reportedly submitted 20-some years’ worth of returns to the McCain campaign when he was being vetted for vice president in 2008. Steve Schmidt, McCain’s chief strategist in that campaign, said on MSNBC,,, that while he didn’t examine Romney’s returns himself, nothing that McCain’s vetters found in them disqualified Romney from consideration.

7. CEO, President and Chairman of Bain

You probably know that Mitt claims he retired – or perhaps retired “retroactively” – from Bain Capital in 1999. You probably also know that almost three years later, as the Huffington Post reported, “Romney was listed as the CEO, chairman and president of the company... in documents filed with the Securities and Exchange Commission; took a six-figure salary; signed corporate documents related to major and minor deals and attended board meetings for at least two Bain-affiliated companies.”

It's possible that releasing his returns could clarify exactly what involvement he had with Bain after 1999. And that might reveal that Romney was, contrary to his claims, involved in Bain's decision to invest in Stericycle, a medical waste company that disposed of aborted fetuses. Ben LaBolt, an Obama campaign spokesman, told Fox News: "If he released more documents, like further tax returns, we would know the extent of his involvement at Bain during this period.”

8. Is Mitt a Felon?

Relatedly, in 2011, Mitt Romney signed a financial disclosure form and sent it to the Federal Election Commission. In it, he stated emphatically that he had no active role in the company after February 1999. That claim appears to be contradicted by a number of other documents.

It's a felony to lie on an FEC financial disclosure form. Some forms of tax evasion are also felonies. Mitt's tax returns might offer proof that he committed a crime.

9. Are There Other Non-Disclosures?

There's lying on a disclosure form, and then there's not filing required forms. The LA Times reports that “at least 23 funds and partnerships listed in [Mitt's] 2010 tax returns did not show up or were not listed in the same fashion on Romney’s most recent financial disclosure, including 11 based in low-tax foreign countries such as Bermuda, the Cayman Islands and Luxembourg.”

More tax returns might reveal other investments that Romney has failed to disclose, as he is required to do by law.

10. There's Nothing – It's Just His Sense of Entitlement

Esquire's James Wolcott doesn't think there's any there there. Sure, Romney's tax returns would provide an object lesson in how the ultra-rich avoid paying their fair share of taxes, but everyone already knows that those at the top of the pile game the system. For Wolcott, the issue comes down to Romney refusing to bow to the little people on principle.

It is helpful always to remind yourself that, in the mind of Willard Romney, there are only two kinds of people — himself and his family, and the Help. Throughout his career, and especially throughout his brief political career, Romney has treated the Help with a kind of lordly disdain...

The Help has no right to go pawing through the family books, giggling at the obvious loopholes and tax dodges, running amok through all the tax shelters, and probably getting their chocolate-y fingerprints all over the pages of the Romney family ledger. And, certainly, those members of the Help in the employ of the president of the United States, who is also part of the Help, have no right to use the nearly comically ostentatious wealth of the Romney as some sort of scrimey political weapon. He does not have to answer to the Help. I mean, jeepers, he's running for office.

This isn't stubbornness. That's often an acquired trait. What this is, fundamentally, is contempt. Contempt for the process, and contempt for the people who make their living in that process, and contempt for the people whose lives depend on that process. There are rules for the Help with which Willard Romney never has had to abide, and he has no intention of starting now. My dear young fellow, this simply is not done.

The Most Likely Explanation

Given Romney's refusal to release his returns, this kind of speculation is entirely predictable. But the most likely reason Romney doesn't want to release his returns is that they'll cast a bright light on the aggressive tax avoidance strategies the super-rich use every day – strategies David Cay Johnston outlined so well in his excellent book, Perfectly Legal. The Romney campaign keeps assuring us that he paid all taxes required by law, and that very well might be the problem.

A Vanity Fair investigation into the trickle of tax documents that Romney has disclosed – under intense pressure – found that they “provided a lavish smorgasbord for Romney’s critics. Particularly jarring were the Romneys’ many offshore accounts.”

To give but one example, there is a Bermuda-based entity called Sankaty High Yield Asset Investors Ltd., which has been described in securities filings as “a Bermuda corporation wholly owned by W. Mitt Romney.” It could be that Sankaty is an old vehicle with little importance, but Romney appears to have treated it rather carefully. He set it up in 1997, then transferred it to his wife’s newly created blind trust on January 1, 2003, the day before he was inaugurated as Massachusetts’s governor. The director and president of this entity is R. Bradford Malt, the trustee of the blind trust and Romney’s personal lawyer. Romney failed to list this entity on several financial disclosures, even though such a closely held entity would not qualify as an “excepted investment fund” that would not need to be on his disclosure forms. He finally included it on his 2010 tax return. Even after examining that return, we have no idea what is in this company, but it could be valuable, meaning that it is possible Romney’s wealth is even greater than previous estimates. While the Romneys’ spokespeople insist that the couple has paid all the taxes required by law, investments in tax havens such as Bermuda raise many questions, because they are in “jurisdictions where there is virtually no tax and virtually no compliance,” as one Miami-based offshore lawyer put it.

While James Wolcott thinks that it's “hardly a secret anymore” that “our tax code — and, indeed, our entire economic system — has been gamed to benefit the folks in Romney's economic stratum,” most people probably don't have a firm grasp on precisely how the vaunted “job creators” avoid paying their fair share, and the release of Romney's returns would offer a teachable moment.

As real estate billionaire Leona Helmsley once said, “Only the little people pay taxes.” That's not the message Mitt Romney wants to convey during a campaign that has a lot to do with tax cuts for the wealthiest.

Joshua Holland is an editor and senior writer at AlterNet. He's the author of The 15 Biggest Lies About the Economy. Drop him an email or follow him on Twitter.

Shares