During remarks at the White House yesterday evening, President Obama offered his opinions on the Treasury Department Inspector General's report [PDF] finding that the IRS used "inappropriate criteria to identify organizations applying for tax-exempt status," in order to review those groups "for indications of significant political campaign intervention."

He described "the misconduct that is uncovered" in the report as "inexcusable". He said that "Americans are right to be angry about it, and I am angry about it," adding that he "will not tolerate this kind of behavior in any agency, but especially in the IRS, given the power that it has and the reach that it has into all of our lives."

Obama then announced that his Treasury Secretary, Jack Lew, had requested and accepted the resignation of the Acting Commissioner of the IRS --- the man who wasn't even in that role during the period in question at the IRS --- "because given the controversy surrounding this audit, it's important to institute new leadership that can help restore confidence going forward."

That all sounds very tough and decisive(!), but after having slogged through the full IG's report, I'm not sure what "misconduct" the President is actually referring to. That word would seem to imply that someone at the IRS was purposely or criminally misbehaving. They may have been, and further investigation may uncover such behavior, but if there was purposeful or criminal misconduct by anyone in the office, the IG's report doesn't seem to offer any actual evidence of it.

The IG's report offers evidence of much confusion, poor training, unclear directives and what seems to be pretty lousy, or, at least, extremely ineffective management at the department of the IRS tasked with approving or rejecting tax-exempt status for 501(c)(3) "charitable groups" and 501(c)(4) "social welfare organizations". Members of Congress, as well as government watchdog groups have long argued that many of those tax-payer subsidized organizations have abused the privilege and violated the legal restrictions on political activity by such groups. The abuse has been particularly widespread, they argue, in the wake of the Citizens United decision and the flood of largely unrestricted, often completely anonymous money funneled to those types of groups for often purely-political purposes.

Further investigation, including a criminal investigation promised by the Dept. of Justice, may uncover the type of "misconduct" the President claims to be outraged by, but the evidence for it is not found in the IG's report, no matter how much Republicans are currently suggesting the opposite.

Also NOT found in the IG's report:

- Any evidence that "Tea Party" related groups were identified during this process for nefarious reasons;

- Any type of identification, political or otherwise, for the groups whose applications were similarly flagged and delayed ("Tea Party" related groups made up only a minority, approximately 1/3 of the groups whose applications were delayed and held for further examination);

- Any indication or evidence whatsoever that the White House, or anybody outside of the IRS units handling these cases, had anything to do with what happened;

- Any response to the other question the IG's office was tasked by Congress to investigate, namely: "whether existing social welfare organizations are improperly engaged in a substantial, or even predominant, amount of campaign activity."

Allow me to offer some quick details in support of each of the bullet points above...

• No evidence that "Tea Party" groups were targeted for political reasons

The IG's report is unambiguous that words such as "Tea Party" and "Patriots" and "9/12 Project" in the names of groups seeking tax-exempt status were inappropriately used to identify some applicants that might have been inappropriately and illegally using taxpayer-subsidized tax-exempt status for political purposes in violation of the tax code. But there is no evidence offered in the report that those words were chosen to target or disadvantage such groups for political reasons.

For now, while the IG notes that it was inappropriate and unfair to use words in the titles of the organizations as a way of identifying groups that might be participating in illegal campaign activity, the report makes no charge that they were doing so for political reasons.

Again, it could very well end up being the case that those groups were, in fact, targeted for nefarious reasons. Once we learn more about what happened, and about the individuals who decided to use those words to identify groups for further review, we might learn that they really did have it out for those who identified themselves as part of the "Tea Party". But the IG's report doesn't speak to that, offers no evidence to support that very serious assertion, and doesn't even identify the individuals responsible for determining that inappropriate and unfair criteria.

The report does, however, note that as soon as the criteria being used came to the attention of upper-management, the lower-ranking staffers were ordered to use different, more fair criteria to flag groups for closer review. It took way too long to change the criteria, and the criteria was changed later again in a way that was also seen as inappropriate by upper management, but the IG's report offers no evidence that any of it was done in order to knowingly disadvantage "Tea Party" related groups in a political fashion.

• Tea Party groups comprised a minority of flagged organizations --- Who were the other ones?

"According to the Director, Rulings and Agreements," the IG's report explains, "the fact that the team of specialists worked applications that did not involve the Tea Party, Patriots, or 9/12 groups demonstrated that the IRS was not politically biased in its identification of applications for processing by the team of specialists."

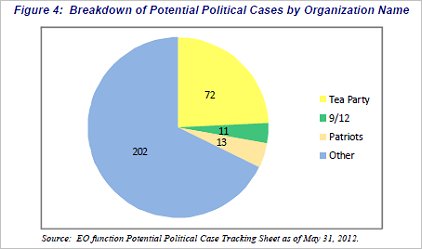

While, even if true, that doesn't excuse the inappropriate and unfair use of those terms to identify which applications to flag, the IG's report bears out the general assertion. As you can see in the following chart [from page 8 of the IG's report, page 14 in the PDF], of the 298 cases flagged as "potential political cases" by the IRS during the period reviewed by the Inspector General from early 2010 through May 2012, just 96 of them (less than one-third) were flagged due to the inappropriate name criteria...

What sort of groups made up the majority two-thirds of flagged organizations? The IG's report doesn't tell us --- it wasn't in their mission to examine that particular aspect, it seems --- but I'd love to know.

The IG's report says only that, during the use of the inappropriate criteria being examined, the IRS Exempt Organizations unit searched "for applications with Tea Party, Patriots, or 9/12 in the organization’s name as well as other 'political-sounding' names." [Emphasis mine.] The report does not tell us what other "political-sounding" names were examined.

It should also be noted here that none of the flagged organizations --- Tea Party or non-Tea Party --- were eventually denied tax-exempt status. None of them. That is true, even if the applications were finally approved after an absurdly long time, and after inappropriate, unnecessary follow-up questions (such as the names of donors, etc.) were sent to the organizations by the IRS.

The only group known to have actually lost their tax exempt status during the period in question, according to Joan Walsh at Salon, was a progressive organization, "the Maine chapter of Emerge America, which trains Democratic women to run for office."

• No evidence of White House involvement

If Obama and his tyrannical henchmen were pulling the strings at the IRS in order to oppress the "Tea Party" groups, no one has yet to present any evidence to support that assertion, and none is found in the IG's report.

The IG says that during its interviews with IRS staffers, "All of these officials stated that the criteria were not influenced by any individual or organization outside the IRS. Instead, the Determinations Unit developed and implemented inappropriate criteria in part due to insufficient oversight provided by management. Specifically, only first-line management approved references to the Tea Party in the BOLO ["Be On the Look Out"] listing criteria before it was implemented."

Those officials, of course, could certainly be lying to protect themselves or others, and perhaps further investigation will demonstrate as much. But while folks on the Right, particularly at Fox "News" and the Republicans in Congress have been howling about this scandal to suggest impeachment of a sitting President may well be just around the corner once again for this outrage, it's important to note that there iszero known evidence that President Obama, the White House, or anyone who worked for him or his political organization --- or anyone at all, outside of the IRS unit in question --- was involved in developing the inappropriate IRS criteria for examining tax-exempt applications in any way, shape, or form at this time. Such evidence may emerge later, but anyone who claims that the IG's report supports that conclusion at this time is lying.

To be sure, the IG's report details an absolute mess at a number of levels within the IRS office tasked with handling the influx of applications for tax-exempt status. Very bad decisions were made by a number of people, and they should all be held accountable for those decisions. Moreover, there are many questions unanswered in the report that bear further investigation. If criminal activity is discovered --- at anylevel --- through that process, so be it. But as of now, there is no such criminal "misconduct" detailed in this report.

• The question the IG was supposed to look at, but didn't

Finally, examination of the question of whether "Tea Party"-related groups were inappropriately targeted by the IRS was only part of what the Treasury Department's Inspector General was tasked by Congress to do. The IG was also asked to look at whether or not existing 501(c)(4) groups were abusing their status and running political operations in violations of the law.

As explained in the IG's report [on page 3 of the report, page 9 of the PDF]: "During the 2012 election cycle, some members of Congress raised concerns to the IRS about selective enforcement and the duty to treat similarly situated organizations consistently. In addition, several organizations applying for I.R.C. § 501(c)(4) tax-exempt status made allegations that the IRS 1) targeted specific groups applying for tax-exempt status, 2) delayed the processing of targeted groups’ applications for tax-exempt status, and 3) requested unnecessary information from targeted organizations. Lastly, several members of Congress requested that the IRS investigate whether existing social welfare organizations are improperly engaged in a substantial, or even predominant, amount of campaign activity." [Emphasis added.]

In the wake of this scandal, many good government and campaign reform advocates,including The BRAD BLOG, have decried the fact that serious concerns about the many well-known abuses by so-called non-partisan 501(c)(3) and (c)(4) groups, which use their tax-exempt status for blatant campaigning and politicking, might now go unexamined, as the IRS becomes skittish about holding such groups accountable for fear of political backlash.

A report from the IG, responding to the request for an investigation into "whether existing social welfare organizations are improperly engaged in a substantial, or even predominant, amount of campaign activity," is desperately needed.

The only word we currently have on that comes from a footnote on page 4 of the IG report [page 10 in the PDF], announcing vaguely that "A future audit is being considered to assess how the EO [Exempt Organizations] function monitors I.R.C. §§ 501(c)(4)–(6) organizations to ensure that political campaign intervention does not constitute their primary activity."

Yes, that's right. For now, it seems, Karl Rove, the Koch Brothers and even the Democratic-supporting 501(c)(4)'s who all paid millions for blatant campaign ads throughout the 2010 and 2012 campaign cycles, in violation of the tax code, are all off the hook, even if President Obama who --- as of now --- appears to have had absolutely nothing to do with the IRS failures, remains on the hot seat and feels a need to display outrage at "misconduct" that even the Treasury Department IG's report doesn't seem to have been able to identify.

But with Benghazi a pretend "scandal" from the jump, and the real scandal of Obama's Dept. of Justice secretly spying on journalists, in the way that Republicans and the Bush Administration had long supported, it looks like we're going to be stuck with this whole IRS thing for a while, whether there eventually turns out to be any actual criminal "misconduct" there or not.

Shares