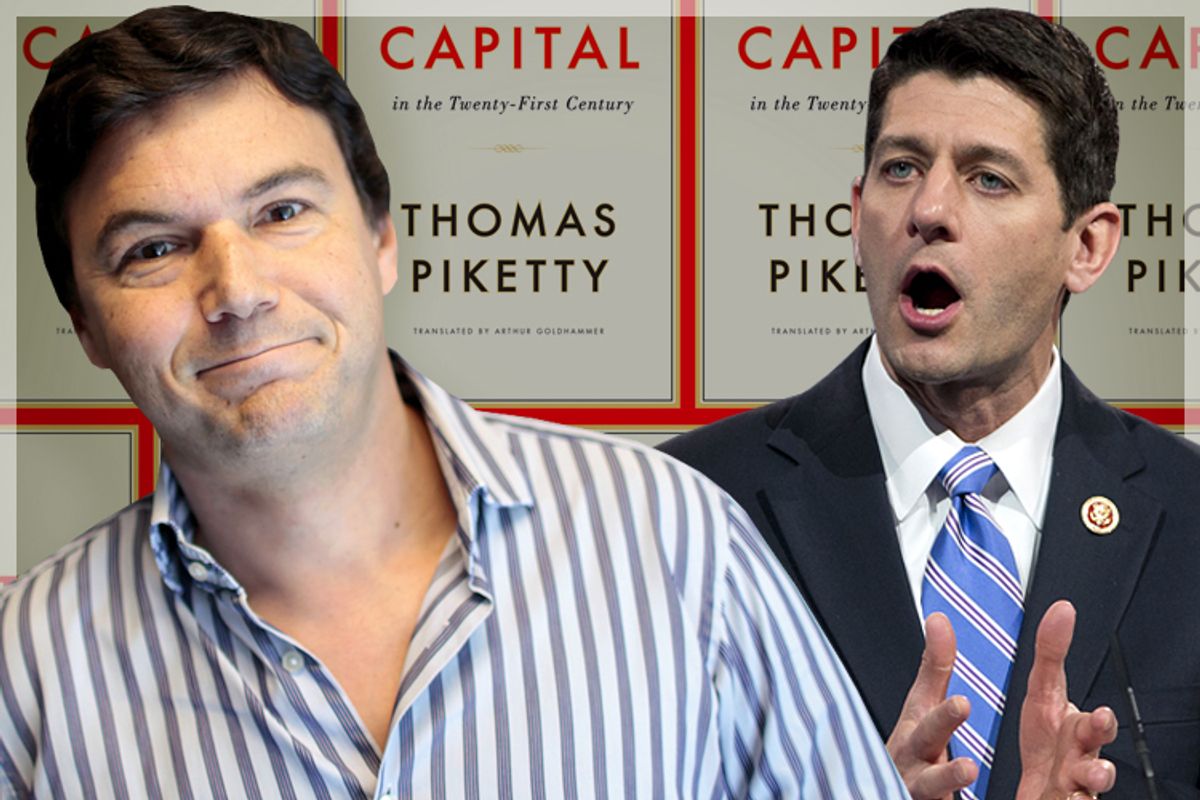

Thomas Piketty's "Capital in the 21st Century" hit No. 1 at Amazon, right around the time that Elizabeth Warren released her book "A Fighting Chance." Far from being the only figures addressing the failure of unregulated market capitalism to produce fair outcomes and broad prosperity, they embody two key facets of that criticism: the intellectual/academic and pragmatic/political. But there are a host of other figures criticizing the workings of actually existing capitalism and the increasingly destructive inequalities of wealth we see it producing all around us.

It may have taken more than five years since the financial crisis hit in late 2008, but are we finally seeing signs of a coherent response coming together? A number of recent developments suggest that we are. Just in the last few weeks, for example, another hot new book is "Flash Boys," the latest from Michael Lewis on the most recent form of mass-scamming on Wall Street, and there's new attention being drawn to the work of Martin Gilens demonstrating the power of elite control of our political system. His book "Affluence and Influence: Economic Inequality and Political Power in America" was an award-winner in political science last year, but his follow-up study with Benjamin I. Page, the essay “Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens,” has touched a broader nerve, with stories at the New Yorker, Huffington Post, and by Michael Lind here at Salon, among others, with added notice on cable TV. And of course, Pope Francis keeps mouthing off against inequality, too (which routinely causes Paul Ryan to comically insist – almost Stephen Colbert-style – that the pope is actually inveighing against the welfare state).

What makes Piketty and Warren stand out, in particular, is that real change needs both a framework of shared knowledge and possibility — which Piketty's vast store of data helps provide — and exemplars of articulate, high-level struggle setting the terms of public debate, which is where Warren comes in.

This is not to say that Piketty's work is something simply to rally around. That's more of the pope's territory. There is plenty to debate about Piketty's work. But so far, criticism from the right has been ludicrous, while criticism from the left has been largely overlooked — a situation that must inevitably change if something is really to be done about inequality.

A neat summary of the right's real source of upset comes from Lynn Stuart Parramore in an Alternet article republished here at Salon:

As fellow-economist James K. Galbraith has underscored in his review of the book, Piketty “explicitly (and rather caustically) rejects the Marxist view” of economics.

But he does do something that gives right-wingers in America the willies. He writes calmly and reasonably about economic inequality, and concludes, to the alarm of conservatives, that there is no magical force that drives capitalist societies toward shared prosperity.

This is not a new problem. “Free markets” and capitalism are actually quite contrary in their foundations. The essence of free markets are competition, driving down prices to nearly the cost of production. The essence of capitalism is the accumulation of capital, which depends on hefty profits, and thus limited competition. Hence, “free markets” are mostly mythical, sometimes fleetingly appearing here or there, only to be quickly contained, if possible. If not, the results can be massive ruination, as happened with successive mass railroad bankruptcies in both Britain and America in the 19th century, a subject explored in depth in Michael Perelman's 2006 book, "Railroading Economics: The Creation of the Free Market Mythology."

As Perelman's subtitle suggests, the mythology was actually created against the backdrop of certain knowledge that it spelled ruin, if taken seriously. But nothing works better to suppress contradictions than having an outside enemy. So long as there was Marxism to kick around, the contradictions of “free market capitalism” were relatively easy to contain. With Piketty's data exposing the downside of capitalist accumulation from a different angle, it's hardly surprising to hear the “Marxism” charge raised again, in a desperate attempt to suppress critical inquiry. Now, however, too many people have been hurt to be so easily scared off by baseless name-calling.

If the right is merely reflexively, defensively name-calling, on the left there are some very serious questions with Piketty's work. They are too deep and serious to do in-depth justice to here, but see, for example, Galbraith's review in Dissent, which Parramore quoted from above, Doug Henwood of the Left Business Observer, at Bookforum, and Dean Baker at Huffington Post.

Piketty himself first told MSNBC's Chris Hayes (long-form interview) that his book was “about history, I'm trying to put history into this … very hot debate about inequality ... I want everybody to be able to make their own mind ... I don't pretend I know what's going to happen next, but I want to give people a lot of historical material that was not available before, so that they make their own mind.” He then added, regarding his own views:

One of the conclusions that I take from my own work is that we don't need 19th century economic inequality to grow. One lesson of the 20th Century is that the kind of extreme concentration of wealth that we had in the 19th Century was not useful, and probably even harmed growth, because it reduced mobility and access of new groups of the population into entrepreneurship and power. It lead to the capture of our political institutions prior to World War i. We don't want to return to this." Now, there is a tendency to move in that direction, and we should be worried about that."

Although they vary somewhat, critiques from the left tend to focus first on one of three areas — the disconnect between the hard-nosed severity of the data collected and the lack of realism in his proposed responses (many, not just on the left, have noted this, but Henwood expresses it particularly well), the questionable nature of some of his theoretical assumptions (Galbraith begins immediately with “capital” itself, critiquing how Piketty has continued and extended the neo-classical divorce of capital from its sociopolitical matrix), or the lack of empirical realism in dealing with actual economic institutions (Dean Baker's forte, which lucidly connects theoretical and pragmatic/political concerns).

And yet, for the most part, all the critics agree it's a very good thing this book has been written, and that it's getting so much attention. Whatever it's flaws may be, we are much better off having this sort of data, across this range of time, clearly showing the growing concentration of wealth, as opposed to the trickle-down fantasies of yore. The question is: What more do we need?

That's where Elizabeth Warren comes in. Not because she's perfect, but because she complements some of what's missing with Piketty, and has a knack for making sometimes murky connections strikingly clear. There are confusions surrounding Warren as well, but hers are relatively simplistic compared to Piketty. She's written a book, she's out there promoting it, she's getting lots of positive attention, ergo she must be running for president. Why else would a politician write a book? Well, in Warren's case, because she's a writer, an educator, an issue advocate and an activist — and has been all of these much longer than she's been a politician, which she only became out of necessity and in service to her earlier roles. She's not really writing a personal political biography; she's writing a history of her political education as a citizen fighting for others just like her. Given her passions and interests, and the state of the world and politics today, the real question for her would have been, “Why haven't you written a book?” if she were not doing just as she is.

What may well matter most about Warren in relation to all the above is her experience in dealing with some of the specific institutional realities that Baker refers to, and making coherent sense of them in a way that's easy for ordinary citizens to grasp. In his criticism of Piketty's book, Baker noted:

In questioning his contribution to advancing technology, Piketty asks: "Did Bill [Gates] invent the computer or just the mouse?" (To be fair, the comment is a throwaway line.) Of course the mouse was first popularized by Apple, Microsoft's rival. It's a trivial issue, but it displays the lack of interest in the specifics of the institutional structure that is crucial for constructing a more egalitarian path going forward.

Think of this on the one hand, and think of Elizabeth Warren's deft use of the humble toaster in explaining the logic of her proposal for a Financial Product Safety Commission:

It is impossible to buy a toaster that has a one-in-five chance of bursting into flames and burning down your house. But it is possible to refinance an existing home with a mortgage that has the same one-in-five chance of putting the family out on the street–and the mortgage won’t even carry a disclosure of that fact to the homeowner. Similarly, it’s impossible to change the price on a toaster once it has been purchased. But long after the papers have been signed, it is possible to triple the price of the credit used to finance the purchase of that appliance, even if the customer meets all the credit terms, in full and on time. Why are consumers safe when they purchase tangible consumer products with cash, but when they sign up for routine financial products like mortgages and credit cards they are left at the mercy of their creditors?

The difference between the two markets is regulation. Although considered an epithet in Washington since Ronald Reagan swept into the White House, the “R-word” supports a booming market in tangible consumer goods. Nearly every product sold in America has passed basic safety regulations well in advance of reaching store shelves.

This is hardly the only reason Warren is important. She is, obviously, the only straightforward economic populist who's even being mentioned as a possible presidential candidate, regardless of her current expressed lack of interest in running. But even if there were half a dozen such candidates, this intuitive feel for the perfect specific detail (and how to unpack it with Martha Stewart-like perfection) exactly matching what's missing in Piketty, along with her fighting spirit, are a vital part of what makes her such a particularly important figure, not just for what she may do in the years to come, but for qualities she models and inspires in others. A true populist leader does a lot of that — modeling and inspiring others. It's something that most good teachers know and do instinctively. So there's that, too.

But there's one more point that needs making here in terms of how Piketty and Warren complement each other. Perhaps the most serious flaw in Piketty's approach is his theoretical dependency on growth, matched with his failure to value natural capital, along with ecosystem services that nature provides [U.N. reports here]. Significantly, in their commentary about Piketty's work, at the American Prospect, political scientists Jacob S. Hacker of Yale, and Paul Pierson at Univerisity of California, Berkeley, wrote:

Inequality is becoming a “wicked” problem like climate change—one in which a solution must not only overcome powerful entrenched interests in individual countries but must be global in scope to be effective.

In fact, it is even worse than they describe, because the two problems are inter-linked — and because economists, at least, seem utterly blind to the fact.

Consider this admiring description of Piketty's work from Branko Milanovic, formerly lead economist in the World Bank's research department, and a leading expert on international inequality (who also wrote a highly detailed review here), in a short piece on the same page at the American Prospect:

Piketty’s key message is both simple and, once understood, almost self-evident. Under capitalism, if the rate of return on private wealth (defined to include physical and financial capital, land, and housing) exceeds the rate of growth of the economy, the share of capital income in the net product will increase. If most of that increase in capital income is reinvested, the capital-to-income ratio will rise. This will further increase the share of capital income in the net output. The percentage of people who do not need to work in order to earn their living (the rentiers) will go up. The distribution of personal income will become even more unequal.

The story elegantly combines theories of growth, functional distribution of income (between capital and labor) and income inequality between individuals. It aims to provide nothing less than the description of a capitalist economy.

This is arguably the most positive short description I've seen of Piketty's work — and yet, look at what it leaves out: the looming potential destruction of the world economic system due to global warming in the next 100 to 300 years. (Almost 40 percent of scenarios project a 25 percent to 100 percent decrease in yield by the 2090-2109 time-frame [chart] according to the most recent IPCC Working Group II report.) And global warming is only one of nine environmental failure modes from crossing planetary boundaries that could undermine our global civilization.

This is not to say such destruction is certain, but it is a very real possibility — just as the 2008 financial crisis was a real possibility for years before it finally appeared. And yet, it is not a possibility within the framework Milanovic has just described. I want to be clear: it could be entirely possible that we can have a healthy growing economy and start paying down our enormous environmental debt — but we will never know if that's possible if we don't first develop the analytical tools to put the question in terms that can be measured.

It is worth noting that in early October 2008, just after the financial crisis first hit, George Soros appeared on "Bill Moyers Journal," and proposed a kind of “Green New Deal” as the logical way forward for America and the world:

GEORGE SOROS: ….for the last 25 years the world economy, the motor of the world economy that has been driving it was consumption by the American consumer who has been spending more than he has been saving, all right? Than he's been producing. So that motor is now switched off. It's finished. It's run out of - can't continue. You need a new motor. And we have a big problem. Global warming. It requires big investment. And that could be the motor of the world economy in the years to come.

BILL MOYERS: Putting more money in, building infrastructure, converting to green technology.

GEORGE SOROS: Instead of consuming, building an electricity grid, saving on energy, rewiring the houses, adjusting your lifestyle where energy has got to cost more until it you introduce those new things. So it will be painful. But at least we will survive and not cook.

We failed to turn on that new motor when it could have prevented enormous needless suffering. But we still face much the same dilemma today. The logic of a Green New Deal remains as compelling as ever.

But how does this connect to Elizabeth Warren? Funny you should ask. Two words: Dust bowl. Elizabeth Warren is from Oklahoma. Oklahoma is the epicenter of America's most devastating experience of the human cost of preventable environmental destruction. While organizers, activists and everyday concerned citizens have struggled mightily for decades trying to weave together the interests and outlooks of labor and environmentalists — interests that capitalist accumulation effortlessly plays off against each other even in its sleep — Elizabeth Warren's people have the lived historical experience of how economic and environmental suffering are not trade-offs, one against the other, but are intimately joined together. Warren has already shown how deeply rooted she is in where and who she came from. If anyone can help lead America forward toward a Green New Deal, odds are, Elizabeth Warren can.

For all its flaws, Piketty's "Capital in the 21st Century" has helped set the stage for a struggle that's long overdue —and one that, of necessity, needs to be expanded even further. And Warren is the most high-profile person in America today working to figure out how that struggle can succeed. This is their moment — but it's all of our futures.

Shares