The Dow Jones Industrial Average crossed the 10,000 mark in March of 1999, a figure so incomprehensibly great that it was anyone’s guess what it signified. The leaders of American opinion reacted as though we had achieved some heroic national goal, as though, through some colossal feat of collective optimism, we had entered at long last into the promised land of riches for all. On television, the rounds of triumphal self-congratulation paused for a nasty rebuke to the very idea of financial authority brought to you by the online brokerage E*Trade, a company that had prospered as magnificently as anyone from the record-breaking run-up: “Your investments helped pay for this dream house,” declared a snide voice-over. “Unfortunately, it belongs to your broker.” And behold: There was the scoundrel himself, dressed in a fine suit and climbing out of a Rolls Royce with a haughty-looking woman on his arm. Go ahead and believe it, this sponsor cajoled: Wall Street is just as corrupt, as elitist, and as contemptuous toward its clients as you’ve always suspected. There should be no intermediaries between you and the national ATM machine in downtown Manhattan. You needed to plug yourself in directly to the source of the millions, invert the hierarchy of financial authority once and for all. “Now the power is in your hands.”

In the rival series of investment fairy tales broadcast by the Discover online brokerage (a curious corporate hybrid of Sears and J. P. Morgan) a cast of rude, dismissive executives, yawning and scowling, were getting well-deserved payback at the hands of an array of humble everymen. Again the tables of traditional workplace authority were rudely overturned by the miracle of online investing: The tow-truck drivers, hippies, grandmas, and bartenders to whom the hateful company men had condescended were revealed to be Midases in disguise who, with a little help from the Discover system, now owned their own countries, sailed yachts, hobnobbed with royalty, and performed corporate buyouts—all while clinging to their humble, unpretentious ways and appearances just for fun. And oh, how the man in the suit would squirm as his social order was turned upside down!

In the commercials for his online brokerage, Charles Schwab appeared in honest black and white, informing viewers in his down-home way how his online brokerage service worked, how it cut through the usual Wall Street song and dance, how you could now look up information from your own home. “It’s the final step in demystification,” he said. “This internet stuff is about freedom. You’re in control.” To illustrate the point other Schwab commercials paraded before viewers a cast of regular people (their names were given as “Howard,” “Rick,” and “Marion”) who shared, in what looked like documentary footage, their matter-of-fact relationship with the market—the ways they used Schwab-dot-com to follow prices, how they bought on the dips, how they now performed all sorts of once-arcane financial operations completely on their own. The stock market was about Rick and Marion, not Charlie Schwab.

In another of the great stock market parables of that golden year, the Ricks and Marions of the world were imagined in a far more insurgent light. Now the common people were shown smashing their way into the stock exchange, breaking down its pretentious doors, pouring through its marble corridors, smashing the glass in the visitors’ gallery windows and sending a rain of shards down on the money changers in the pit—all to an insurgent Worldbeat tune. As it turned out, this glimpse of the People Triumphant in revolution—surely one of the only times, in that century of red-hunting and labor-warring, that Americans had ever been asked by a broadcasting network to understand such imagery as a positive thing—was brought to you by Datek, still another online trading house. What the people were overthrowing was not capitalism itself but merely the senseless “wall” that the voice-over claimed always “stood between you and serious trading.”

Exactly! As the century spun to an end, more and more of the market’s biggest thinkers agreed that “revolution” was precisely what was going on here. Thus it occurred to the owners of Individual Investor magazine to send gangs of costumed guerrillas, dressed in berets and armbands, around Manhattan to pass out copies of an “Investment Manifesto” hailing the “inalienable right” of “every man and woman . . . to make money—and lots of it.”

Meanwhile, the National Association of Real Estate Investment Trusts ran ads in print and on TV in which a casually dressed father and his young son capered around the towering office blocks of a big city downtown. “Do we own all this, Dad?” queried the tot. “In a way we do,” answered his father. This land is their land—not because they have bought it outright, like Al, the country-owning tow-truck driver in the Discover spots, but in a more intangible, populist, Woody Guthrie sort of way: Because they have invested in REITs.

Not to be outdone by such heavy-handed deployment of 1930s-style imagery, J. P. Morgan, the very personification of Wall Street’s former power and arrogance, filled its ads with hyper-realistic black and white close-ups of its employees, many of them visibly non-white or non-male. Literally putting a face on the secretive WASP redoubt of financial legend, the ads reached to establish that Morgan brokers, like Schwab brokers, were people of profound humility. “I will take my clients seriously,” read one. “And myself, less so." The ads even gave the names and e-mail addresses of the Morgan employees in question, a remarkable move for a firm whose principal had once been so uninterested in serving members of the general public that he boasted to Congress that he didn’t even put the company’s name on its outside door.

Faced with this surprisingly universal embrace of its original populist campaign against Wall Street, E*trade tried to push it even farther: The changes in American investing habits that had brought it such success were in fact nothing less than a social “revolution,” an uprising comparable to the civil rights and feminist movements. In its 1999 annual report, entitled “From One Revolution To the Next,” E*trade used photos of black passengers sitting in the back of a bus (“1964: They Said Equality Was Only For Some of Us”) and pre-emancipated white women sitting in the hilarious hairdryers of the 1960s (“1973: They Said Women Would Never Break Through the Glass Ceiling”) to establish E*Trade itself as the rightful inheritor of the spirit of “revolution.” The brokerage firm made it clear that the enemy to be overthrown on its sector of the front was social class: Next to a photo of a man in a suit and a row of columns, a page of text proclaimed, “They said there are ‘the haves’ and the ‘have-nots.’” But E*trade, that socialist of the stock exchange, was changing all that: “In the 21st century it’s about leveling the playing field and democratizing individual personal financial services.” The company’s CEO concluded this exercise in radicalism with this funky rallying cry: “Bodacious! The revolution continues.”

*

Whatever mysterious forces were propelling the market in that witheringly hot summer of 1999, the crafters of its public facade seemed to agree that what was really happening was the arrival, at long last, of economic democracy. While the world of finance had once been a stronghold of WASP privilege, an engine of elite enrichment, journalist and PR-man alike agreed that it had been transformed utterly, been opened to all. This bull market was the götterdammerung of the ruling class, the final victory of the common people over their former overlords. Sometimes this “democratization” was spoken of as a sort of social uprising, a final victory of the common people over the snobbish, old-guard culture of Wall Street. Sometimes it was said to be the market itself that had worked these great changes, that had humiliated the suits, that handed out whole islands to mechanics, that had permitted little old ladies to cavort with kings. And sometimes “democratization” was described as a demographic phenomenon, a reflection of the large percentage of the nation’s population that was now entrusting their savings to the market.

However they framed the idea, Wall Street had good reason to understand public participation as a form of democracy. As the symbol and the actual center of American capitalism, the financial industry has both the most to lose from a resurgence of anti-business sentiment and the most to gain from the ideological victory of market populism. For a hundred years the financial industry had been the chief villain in the imagination of populist reformers of all kinds; for sixty years now banks, brokers, and exchanges have labored at least partially under the regulations those earlier populists proposed. And Wall Street has never forgotten the melodrama of crash, arrogance, and New Deal anger that gave birth to those regulations. To this day Wall Street leaders see the possibility of a revived New Deal spirit around every corner; they fight not merely to keep the interfering liberals out of power, but to keep order in their own house, to ensure that the public relations cataclysm of 1929-32 is never repeated. This is why so much of the bull market culture of the Nineties reads like a long gloss on the experience of the 1930s, like a running battle with the memory of the Depression.

Take the stagnant-to-declining real wages of American workers, for example. A central principle of “New Economy” thought is that growth and productivity gains have been severed from wage increases and handed over instead to top management and shareholders. Since the redistributionist policies of “big government” are now as impermissible as union organizing, stocks of necessity have become the sole legitimate avenue for the redistribution of wealth. In other eras such an arrangement would have seemed an obvious earmark of a badly malfunctioning economic system, a system designed to funnel everything into the pockets of the already wealthy, since that’s who owns most of the stock. After all, workers can hardly be expected to buy shares if they can’t afford them.

But toss the idea of an ongoing financial “democratization” into the mix, and presto: Now the lopsided transformation of productivity gains into shareholder value is an earmark of fairness—because those shareholders are us! Sure, workers here and there are going down, but others, through the miracle of stocks, are on their way up. Furthermore, ownership of stock among workers themselves, an ideologue might assert, more than made up for the decade’s stagnant wages. What capital took away with one hand, it was reasoned, it gave back with the other—and with interest.

This idea of stock prices compensating for lost or stagnant wages had long been a favorite ideological hobbyhorse of the corporate right, implying as it did that wealth was created not on the factory floor but on Wall Street and that workers only shared in it by the grace of their options-granting CEO. What was different in the 1990s was that, as the Nasdaq proceeded from triumph to triumph, economists and politicians of both parties came around to this curious notion, imagining that we had somehow wandered into a sort of free-market magic kingdom, where the ever-ascending Dow could be relied upon to solve just about any social problem. Now we could have it all: We could slash away at the welfare state, hobble the unions, downsize the workforce, and send the factories overseas—and no one got hurt!

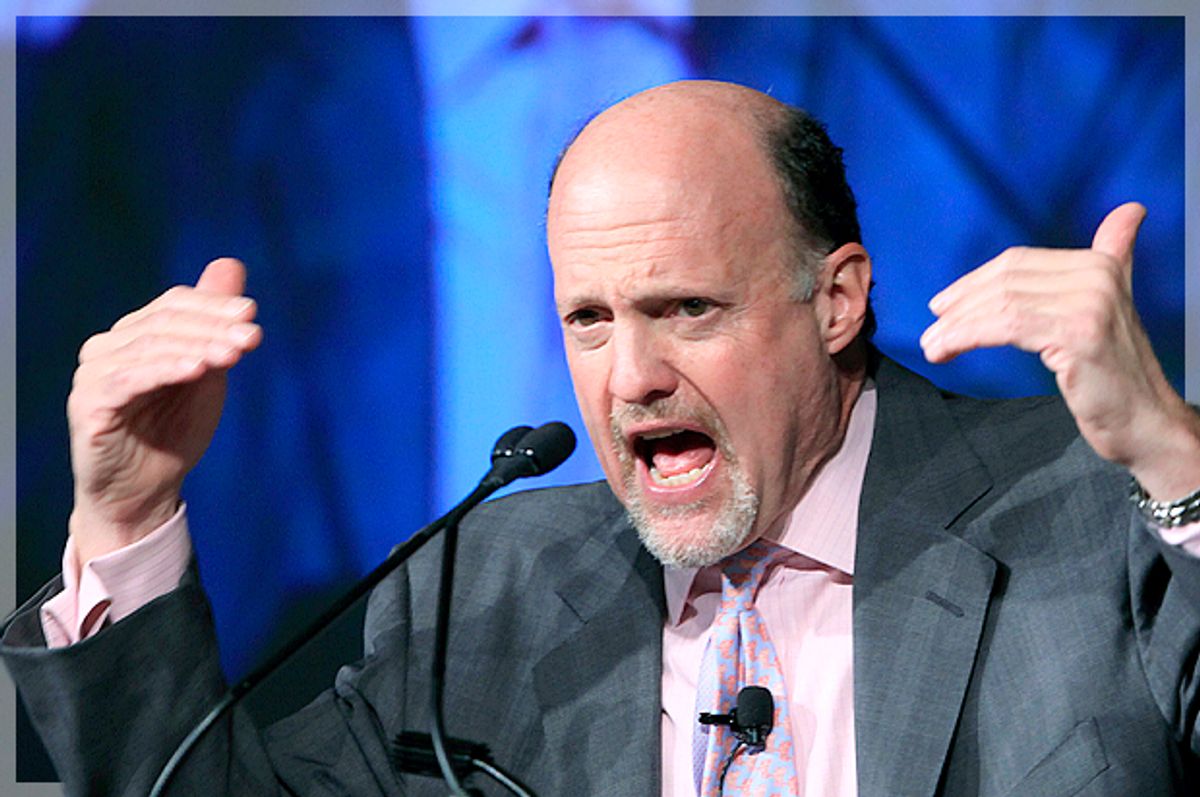

Naturally the idea was first rolled out for public viewing in the aftermath of a serious public relations crisis for Wall Street. One fine day in January, 1996, AT&T announced it was cutting 40,000 white-collar jobs from its workforce; in response Wall Street turned cartwheels of joy, sending the company’s price north and personally enriching the company’s CEO by some $5 million. The connection of the two events was impossible to overlook, as was its meaning: What’s bad for workers is good for Wall Street. Within days the company was up to its neck in Old Economy-style vituperation from press and politicians alike. Then a golden voice rang through the din, promoting a simple and “purely capitalist” solution to “this heartless cycle”: “Let Them Eat Stocks,” proclaimed one James Cramer from the cover of The New Republic. “Just give the laid-off employees stock options,” advised Cramer, a hedge fund manager by trade who in his spare time dispensed investment advice on TV and in magazines, and “let them participate in the stock appreciation that their firings caused.” There was, of course, no question as to whether AT&T was in the right in what it had done: “the need to be competitive” justified all. It’s just that such brusque doings opened the door to cranks and naysayers who could potentially make things hot for Wall Street. Buttressing his argument with some neat numbers proving that, given enough options, the downsized could soon be—yes—millionaires, Cramer foresaw huge benefits to all in the form of bitterness abatement and government intervention avoidance. He also noted that no company then offered such a “stock option severance plan.” But the principle was the thing, and in principle one could not hold the stock market responsible; in principle the interests of all parties concerned could be fairly met without recourse to such market-hostile tools as government or unions.

And in ideology all one requires is principle. Thus it turned out to be a short walk indeed from Cramer’s modest proposal to a generalized belief in the possibility of real social redress through stocks. After all, since anyone can buy stocks, we had only ourselves to blame if we didn’t share in the joy. The argument was an extremely flexible one, capable of materializing in nearly any circumstance. In a November, 1999 think-piece addressing the problem of union workers angered by international trade agreements, a New York Times writer found that they suffered from “confusion” since even as they protested, their 401(k)s were “spiking upward” due to “ever-freer trade.” To Lester Thurow, the answer to massive and growing inequality was not to do some kind of redistribution or reorganization but to “widen the skill base” so that anyone could “work for entrepreneurial companies” and thus have access to stock options. For lesser bull market rhapsodists the difference between “could” and “is” simply disappeared in the blissful haze. Egalitarian options were peeking out of every pocket. The cover of the July, 1999 issue of Money carried a photo of a long line of diverse, smiling workers—a familiar populist archetype—under the caption, “The employees of Actuate all get valuable stock options.” Inside, the magazine enthused about how options “are winding up in the shirt pockets of employees with blue collars, plaid collars and, increasingly, no collars at all.”

By decade’s end the myth of the wage/stock tradeoff was so widely accepted that its truest believers were able to present it as a historical principle, as our final pay-off for enduring all those years of deindustrialization and downsizing. In a January, 2000 Wall Street Journal feature story on how the good times were filtering down to the heartland folks of Akron, Ohio—a rust belt town that had been hit hard by the capital flight of the Seventies and Eighties—the soaring stock market was asserted to have gone “a long way in supplanting the insecurity of the 1980s, when the whole notion of employment for life was shattered, with something else: a sense of well-being.” Yes, their factories had closed—but just look at them now! The Journal found a blue-collar Akron resident who played golf! And an entrepreneur who drove a Mercedes! Who needed government when they options?

The actual effect of widespread use of stock options in lieu of wages, of course, was the opposite. Options did not bring about some sort of New Economy egalitarianism; they were in fact one of the greatest causes of the ever widening income gap. It was options that inflated the take home pay of CEOs to a staggering 419 times what their average line-worker made; it was options that unleashed the torrent of downsizing, outsourcing, and union busting. When options were given out to employees—a common enough practice in Silicon Valley by decade’s end—they often came in lieu of wages, thus permitting firms to conceal their payroll expenses. In any case, the growth of 401(k)s, even in the best of markets, could hardly be enough to compensate for declining wages, and it was small comfort indeed for those whose downsizing-induced problems came at age 25, or 35, or 45. Options were a tool of wealth concentration, a bridge straight to the Nineteenth century.

And yet the fans of the bull market found it next to impossible to talk about options in this way. Only one interpretation, one explanatory framework seemed to be permissible when speaking of investing or finance—the onward march of democracy. Anything could be made to fit: The popularity of day trading, the growth of the mutual fund industry, the demise of Barings bank, the destruction of the Thai currency. The bubble being blown on Wall Street was an ideological one as much as it was anything else, with succeeding interpretations constantly heightening the rhetoric of populist glory. It was an “Investing Revolution!” It was all about “empowerment”!

And there were incredible prizes to be won as long as the bubble continued to swell, as long as the fiction of Wall Street as an alternative to democratic government became more and more plausible. Maybe the Glass-Steagall act could finally be repealed; maybe the SEC could finally be grounded; maybe antitrust could finally be halted. And, most enticingly of all, maybe Social Security could finally be “privatized” in accordance with the right-wing fantasy of long standing. True, it would be a staggering historical reversal for Democrats to consider such a scheme, but actually seeing it through would require an even more substantial change of image on Wall Street’s part. The financiers would have to convince the nation that they were worthy of the charge, that they were as public-minded and as considerate of the little fellow as Franklin Roosevelt himself had been. Although one mutual fund company actually attempted this directly—showing footage of FDR signing the Social Security Act in 1935 and proclaiming, “Today, we’re picking up where he left off”—most chose a warmer, vaguer route, showing us heroic tableaux of hardy midwesterners buying and holding amidst the Nebraska corn, of World War II vets day-trading from their suburban rec-rooms, of athletes talking like insiders, of church ladies phoning in their questions for the commentator on CNBC; of mom and pop posting their very own fire-breathing defenses of Microsoft on the boards at Raging Bull. This was a boom driven by democracy itself, a boom of infinite possibilities, a boom that could never end.

Excerpted with permission from "One Market Under God" (Doubleday Books).

Shares