What's happening in Russia? Amid a dramatic fall in the ruble's value, the country's central bank frantically moved this week to correct course, sharply raising interest rates and sparking renewed discussion of Russia's economic woes. In his year-end news conference yesterday, President Vladimir Putin sought to steel Russians for a medium-term slump, warning that the economic turmoil could last two years.

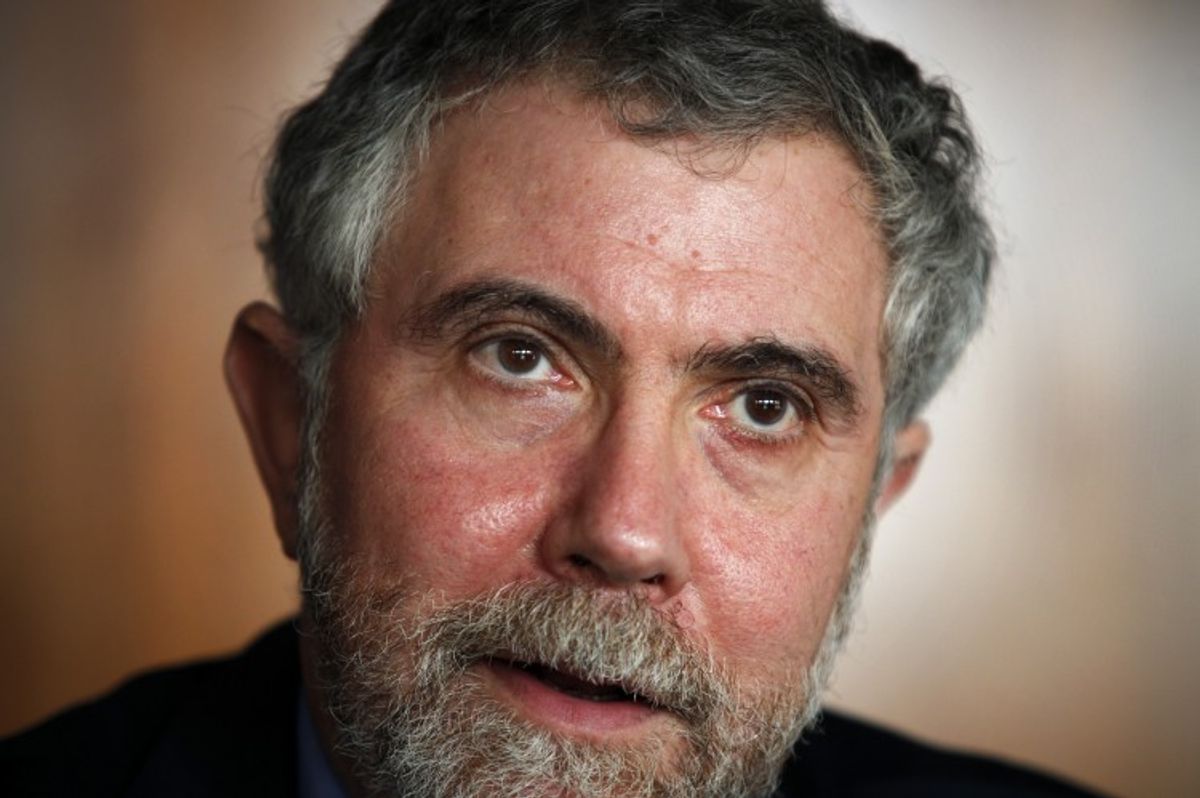

In his New York Times column today, economist Paul Krugman sets out to explain how Russia arrived at this point. A variety of factors contributed to the ruble's plunge, including Russia's incursion into Ukraine, but the immediate cause of the collapse is the dramatic fall in global oil prices, largely owing to factors like increased shale production and reduced demand from countries like China. But, Krugman points out, the ruble's value has plummeted far more dramatically than oil prices have decreased. What gives?

"The kind of crisis Russia now faces is what you get when bad things happen to an economy made vulnerable by large-scale borrowing from abroad — specifically, large-scale borrowing by the private sector, with the debts denominated in foreign currency, not the currency of the debtor country," Krugman explains.

Unlike most countries that experience currency crises, however, Russia has been running trade surpluses, not trade deficits. So what's with the "large-scale borrowing"? Here's Krugman:

Well, you can answer the second question by walking around Mayfair in London, or (to a lesser extent) Manhattan’s Upper East Side, especially in the evening, and observing the long rows of luxury residences with no lights on — residences owned, as the line goes, by Chinese princelings, Middle Eastern sheikhs, and Russian oligarchs. Basically, Russia’s elite has been accumulating assets outside the country — luxury real estate is only the most visible example — and the flip side of that accumulation has been rising debt at home.

As for how Russia extricates itself from its current mess, Krugman predicts that the country will "muddle through on its own." There's no way the prideful Putin will subject his country to the harsh terms of an International Monetary Fund rescue, he reasons.

The key lesson from the crisis: Krugman argues that a "more open, accountable regime" would not have landed Russia in its present state. It would be less heavily indebted, less corrupt, and better-positioned to grapple with the gyrations of the oil market.

"Macho posturing, it turns out, makes for bad economies," Krugman concludes.

At any rate, Russia's economic turbulence promises to make life difficult for Putin, whom American conservatives -- from the paleoconservative Pat Buchanan to the neoconservative Rudy Giuliani -- were praising mere months ago as a strong leader, whether you liked his policies (as Buchanan does) or not (Giuliani isn't a big fan). While the recent unrest is humiliating for Putin, his American fanboys should be eating crow, as well.

Shares