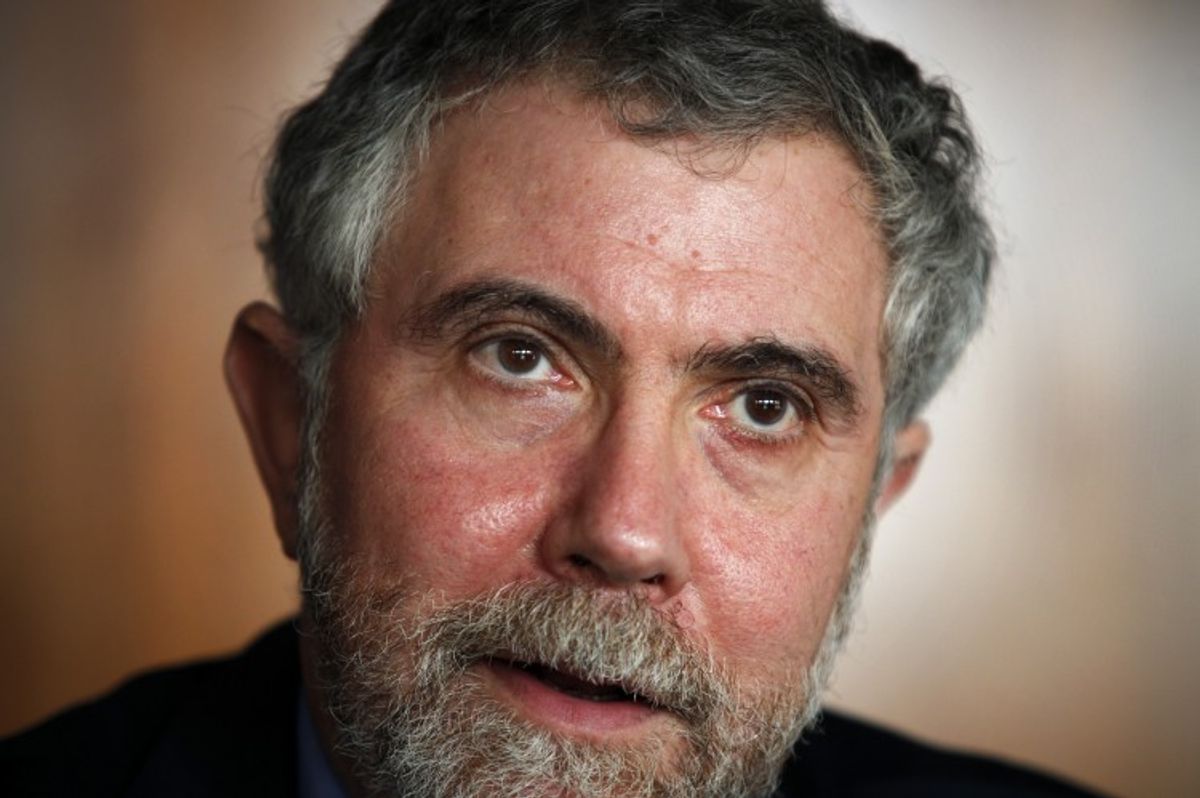

All eyes are on Federal Reserve chair Janet Yellen following Friday's jobs report, which found that the U.S. added 295,000 jobs in February, bringing the unemployment rate down to 5.5 percent. With the economy moving closer to what the Fed considers full employment, observers of the central bank expect it to begin raising interest rates in the coming months, so as to stave off the threat of inflation. But in his New York Times column today, Nobel Prize-winning economist Paul Krugman sounds a note of caution, arguing that Fed policymakers should wait before they "yank away the punch bowl."

Take one of the more disappointing statistics in Friday's report. While the 295,000 jobs added beat economists' forecasts, wages barely budged, rising just 0.1 percent in February and two percent over the year. "[I]f the job market really were tight, wages would be rising quickly," raising the risk of inflation, Krugman notes, "whereas they are in fact going nowhere."

Krugman points out that the Fed held off raising rates in the mid-1990s, when the economy found itself at a similar juncture, with rising employment but little discernible inflationary pressure. That decision paid off, as the U.S. continued its robust recovery. While Krugman says we can't be sure that we're in an equivalent situation now, such uncertainty does not justify action that could kill "millions of jobs":

To me, as to a number of economists — perhaps most notably Lawrence Summers, the former Treasury secretary — the answer seems painfully obvious: Don’t yank away that punch bowl, don’t pull that rate-hike trigger, until you see the whites of inflation’s eyes. If it turns out that the Fed has waited a bit too long, inflation might overshoot 2 percent for a while, but that wouldn’t be a great tragedy. But if the Fed moves too soon, we might end up losing millions of jobs we could have had — and in the worst case, we might end up sliding into a Japanese-style deflationary trap, which has already happened in Sweden and possibly in the eurozone.

What’s worrisome is that it’s not clear whether Fed officials see it that way. They need to heed the lessons of history — and the relevant history here is the 1990s, not the 1970s. Let’s party like it’s 1995; let the good, or at least better, times keep rolling, and hold off on those rate hikes.

Shares