In the United States, money spent on candidates, politics, or public policy is protected speech under the First Amendment. What happens when protected speech is wrapped in a cloak of secrecy?

How to reconcile Citizens United, which gave corporations the same rights as individuals with regard to political speech while shielding them for any accountability for that speech?

This is the story of how one government agency struggled with these questions and how it was defanged before it could implement rules to force nonprofit organizations who are spending on political campaigns to disclose donors.

It is also a story about the unbridled freedom given to political nonprofits in the absence of campaign-finance laws or Internal Revenue Service rules regulating disclosure.

In late 2013, after years of consideration, the Internal Revenue Service proposed a rule regarding the political activity of social welfare organizations classified by the agency as 501(c)(4) organizations: If tax-exempt organizations engage in direct campaign activity, they must disclose the identity of donors funding that activity in a format similar to what is required of political action committees. Disclosure would be required in a more compressed time frame than the current 18-month delay, providing voters the ability to understand who is paying for the blizzard of political ads and literature on their doorsteps, televisions, and mailboxes.

When the IRS released the proposed rule for public comment, a political firestorm erupted over the definition of “political activity.” More than 150,000 comments regarding the rule were filed with the agency, as groups such as the American Conservative Union claimed the IRS was plotting to suppress conservative political activism. The proposed rule was quickly withdrawn, so the definition could be narrowed to one that targeted all groups—liberal and conservative—that spent a large portion of their revenue on direct campaign activity.

While liberal advocacy groups had pushed for rules on campaign financing and “dark money”—political contributions from undisclosed sources—conservatives manufactured a crisis to pressure IRS Commissioner John Koskinen into delaying a transparency rule that would apply to dark money in the 2016 election cycle.

The rule the agency had put on hold was intended to mitigate the impact of the Supreme Court’s Citizens United v. Federal Election Commission decision, which permits corporations to spend unlimited funds on political campaigns. In the majority opinion, Justice Anthony Kennedy wrote: “The First Amendment protects political speech; and disclosure permits citizens and shareholders to react to the speech of corporate entities in a proper way. This transparency enables the electorate to make informed decisions and give proper weight to different speakers and messages.” (Emphasis added.)

A Scandal Is Born

In response to Kennedy’s nod toward disclosure, legislators in the House and Senate worked throughout 2010 to pass the DISCLOSE Act, which would have mandated reporting and disclosure for groups making independent expenditures for or against candidates. The bill passed the House in June 2010 but failed by one vote to overcome a unanimous Republican filibuster in the Senate.

Absent campaign-finance law, and with a deadlocked Federal Election Commission incapable of acting, the IRS was the last defense against opaque and unrestricted political money. Yet as Republicans in Congress blocked efforts to address campaign-finance transparency, nonprofits were inundating the IRS with applications for tax-exempt status, many for social-welfare groups. And media outlets were focused on “Tea Party” groups forming around the country.

Against this backdrop, one IRS case manager in the Los Angeles office forwarded an application to the agency’s Cincinnati office for review, expressing concern that the organization applying for nonprofit status was not being established for social-welfare purposes, but instead for political campaign activity. The Cincinnati office, which oversees nonprofit applications, agreed to review the case.

That questionable applicant was a Tea Party group, whose application triggered the reviewer’s concern over its involvement with direct campaign activity relating to specific candidates.

As applications stacked up, the IRS identified areas with potential for abuse, and began to flag applications that followed a similar format, issuing a “BOLO” (Be On the Lookout) alert for new applications with similar features or organizations with similar names.

Throughout 2010 and 2011, the IRS continued to wrestle with how it should handle these organizations in general (and Tea Party applications in particular), while the agency faced mounting pressure from House and Senate investigative committees concerning tax-exempt organizations and donor identities. Tea Party applications were particularly problematic, because the term “Tea Party” was identified with groups backing specific candidates or opposing the policies of the Obama administration.

Such activities are not covered by the “primary purpose” rule applicable to social-welfare groups, which restricts tax exemption (and freedom from disclosure requirements) to organizations that “operate primarily to further the common good and general welfare of the people of the community.”

In September 2010, Senator Max Baucus (D-MT) wrote to then-IRS Commissioner Douglas Shulman, asking him to conduct a survey of major 501(c)(4), (c)(5), and (c)(6) organizations involved in political campaign activity to see whether they were in compliance with the “primary purpose” rule. He also requested that the IRS look at whether the organizations “were acting as conduits for major donors advancing their own private interests regarding legislation or political campaigns.”

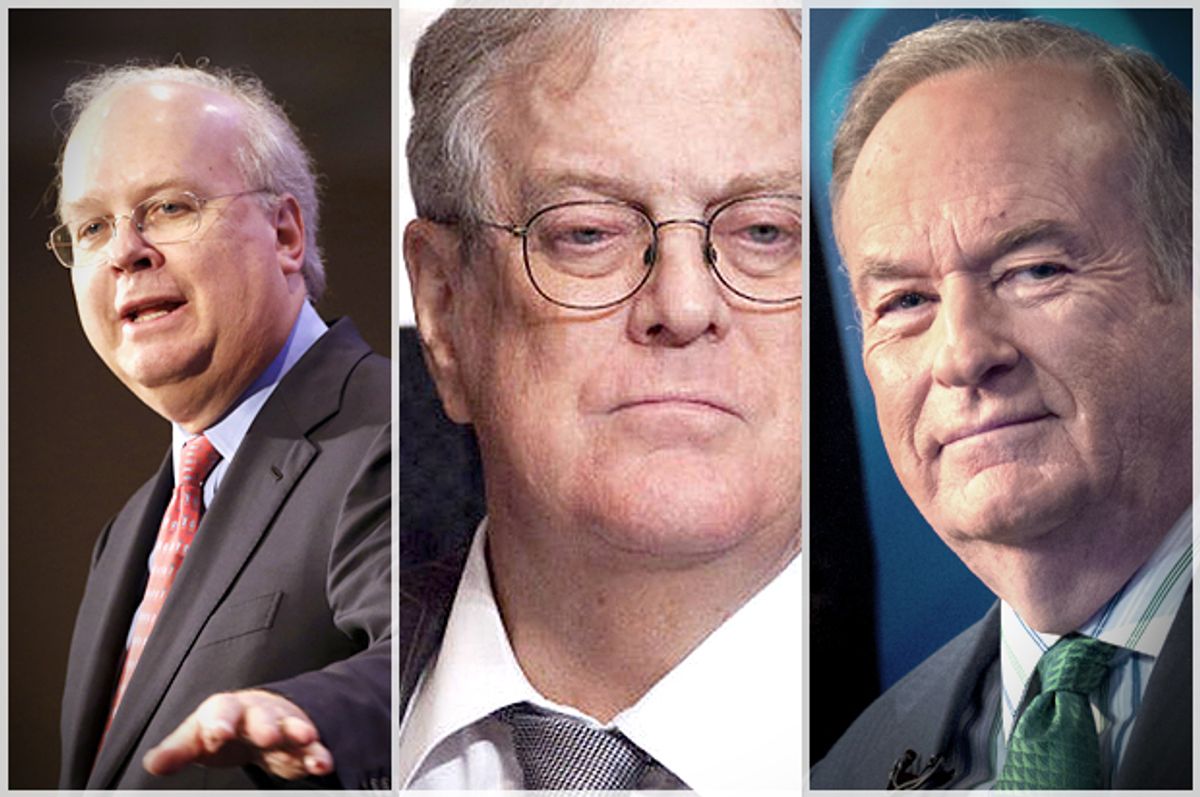

In 2012, Senator Carl Levin (D-MI) made a formal request for the IRS to produce specific information on the activity of several high-profile organizations, including Karl Rove’s Crossroads GPS, the liberal group Priorities USA, Americans for Prosperity, and Patriot Majority USA. As dark money spending increased in 2012, Levin pressed harder, criticizing the IRS decision to interpret the word “exclusively” to promote social welfare as “more than 50 percent” of the organization’s activity. He wanted to know how many tax exemptions had been audited to see if organizations engaged in excessive political activity.

After the 2012 elections, the IRS found itself caught between mounting pressure from Congressional Democrats and from groups receiving information requests from the IRS but no letters approving their tax-exempt status. The agency was requesting that applicants provide all donors’ names and addresses (presumably to satisfy the Baucus inquiry), sparking outrage among conservative groups asked for that information.

Unbridled Freedom

At the same time, Congressional Republicans began to hear from big donors who were concerned about the loss of anonymity—and the tax deductions that some of the nonprofits provided. And from “grass roots” groups impatient with the IRS.

One of these groups was KSP/True the Vote, a Texas-based voter-integrity organization originally known as the King Street Patriots—one of the nonprofit applicants selected by the IRS for closer scrutiny, based upon its application and media reports in 2010 in which KSP/True the Vote activists were accused of intimidating voters at the polls.

In 2010, acting under the name King Street Patriots, conservative Texas activist Catherine Engelbrecht accused a voter-registration group, Houston Votes, of being “the New Black Panthers office” in Texas. Claiming to have found thousands of fraudulent voter registrations in the Houston area, Engelbrecht appeared on Fox News, accusing Houston Votes of massive voter fraud. The King Street Patriots also produced a video that warned: “Our elections are being manipulated by the RADICAL LEFT.” Backed by an ominous soundtrack, the video also included a doctored image of an African American holding a sign that read: “I only got to vote once.”

Ironically, one documented case of voter fraud surfaced in Texas in 2010 when County Commissioner candidate Bruce Fleming, who had been endorsed by Engelbrecht, was found to have cast votes in Pennsylvania and Texas in the 2006, 2008, and 2010 elections, boasting that he “had the chance to vote twice against Barack Obama.”

Indeed, KSP/True the Vote’s literature established that they were operating for campaign purposes, as evidenced by a self-published “Legislative Agenda for Texas” in 2011 and their lobbying for stricter voter-ID laws. The state Democratic Party sued, and in 2011 a Texas court ruled that the King Street Patriots was a PAC and not a nonprofit group. The group was ordered to reveal its donors and pay Houston Votes a substantial settlement.

Despite the court ruling and extensive news coverage, when news broke on May 9, 2013, that the IRS may have singled out conservative groups for scrutiny, Engelbrecht was prepared. On May 21, KSP/True the Vote filed a federal lawsuit against the IRS for targeting them. The suit was dismissed in late 2014.

On February 6, 2014, Engelbrecht testified before the House Committee on Oversight and Reform, contending that True the Vote had been singled out for IRS scrutiny because it was a conservative organization. Tearful and angry, she told committee members that “this government attacked [her] because of [her] political beliefs.” Engelbrecht also claimed that KSP/True the Vote was “a citizen-led liberty group,” suggesting that it was a grassroots organization comprised of concerned citizens who “pass the hat” for funding. Engelbrecht’s testimony was featured on all of the major networks that day, establishing her as the face of an IRS oppression “scandal.”

In fact, KSP/True the Vote is a beneficiary of the Citizens United decision. It doesn’t use its nonprofit status to buy campaign ads, but it does receive large contributions to train and place poll monitors in select districts where large numbers of registered Democrats, minorities, and poor people reside.

From its inception in 2009 to 2013, KSP/True the Vote received total donations of $3,406,177, without disclosing any of its donors. Most of the revenue was characterized as payment for non-deductible services rather than tax-deductible donations, because KSP/True the Vote’s tax-exempt status was still in question. In 2013, after receiving its tax-exempt status from the IRS, the organization received more than a million dollars in tax-deductible donations, enabling it to hire a public relations firm, a professional fundraiser, and social media consultants.

Newly armed with tax-exempt status, in 2013 KSP/True the Vote declared its intention to thwart organizations promoting voting rights and fight the “left-wing Hydra” by training citizen-integrity groups, reviewing voter registry files, lobbying legislatures for voter ID-laws, and monitoring polling places in minority districts, or where KSP/True the Vote perceived voter fraud to be occurring, despite the failure to identify any voting fraud in 2012.

During a message-coordination meeting in May 2013 with Breitbart News Managing Editor Stephen Bannon, former Congressman Allen West, leaders of the Tea Party Patriots, Judicial Watch, Election Law Center, and former Ohio Secretary of State Ken Blackwell, Engelbrecht made her case. “The organized left is preparing a massive campaign to promote universal registration and threatening to block citizen observers from the polls,” Engelbrecht declared. She vowed to defeat the Hydra by “attack[ing] the source of its strengths,” which includes unions, the NAACP, Common Cause, Demos, the Center for American Progress, The Nation Institute, and others.

Yet because True the Vote has 501(c)(3) tax-exempt status, the sources of corporate cash flowing into its coffers will not be disclosed to the public, but its donors will qualify for a “charitable deduction” from the IRS.

Dark Money in Sunny California

In 2012, California voters were asked to consider two ballot measures. The first one—a tax increase on the wealthy to help shore up the state’s public schools—was placed on the ballot by Governor Jerry Brown. The second measure would have limited unions’ ability to spend on elections. (The tax measure prevailed; the anti-union proposition was defeated.)

Shortly before the election, the Small Business Action Committee, a state-based PAC, spent $11 million on ads encouraging voters to defeat the tax measure and vote for the union spending limits. Under California law, individual donors to state PACs must disclose their identity. The only disclosure the PAC made was to say the funds came from a nonprofit organization based in Arizona—Americans for Responsible Leadership.

Determined to reveal individuals behind the funding, state officials went to the California Supreme Court to force disclosure under state law. Ultimately, they were able to trace the money trail but unable to unmask any specific donors. The source of the funds spent by the Small Business Action Committee was Americans for Job Security, a group closely aligned with right-wing billionaires Charles and David Koch. Americans for Job Security revealed it had received the funds from the Center to Protect Patient Rights, another organization closely associated with the Koch network of nonprofit organizations.

In the end, the trail of the mysterious $11 million twisted through four separate nonprofit organizations and three states. None of the organizations was required to disclose their donors. The trail went cold at the doorstep of the Center to Protect Patient Rights (CPPR), which sent over $24 million total to Americans for Responsible Leadership in 2012, all of which was intended for political campaigns. Total campaign spending through CPPR in 2012 was at least $60 million, yet CPPR reported no money spent on campaigns or lobbying in that year.

Surveying the Damage

After numerous congressional hearings on the subject, leaked emails, and a mini-scandal involving IRS executive Lois Lerner’s defective hard drives, House Oversight and Government Reform Chairman Darrell Issa released a 224-page report, saying that improper targeting based on organizations’ names had taken place, a conclusion that had already been drawn by the independent auditors reviewing IRS procedures for auditing applications.

The only nonprofit organization stripped of its tax-exempt status by the IRS was Emerge America, a liberal group formed to train Democratic women to run for office. But for corporate funders, tax-exempt status for political activity was only part of what they sought. It was more important to so strongly discredit the IRS as a consequence of the “scandal” that it would abandon all efforts to bring forward meaningful disclosure rules.

In this atmosphere, the National Rifle Association elected not to disclose $66 million spent on the 2014 midterms as political spending. To do so would have forced it to pay taxes on a portion of what was spent under current law. A defanged IRS means never having to say you’re accountable.

In the 2014 midterm elections, dark money expenditures far outpaced traditional PAC spending. According to OpenSecrets.org, nearly $4 billion was spent on the 2014 midterm elections, of which $768 million is attributable to outside spending by PACs and super-PACs, according to FEC reporting.

Those totals still don’t tell the story.

They don’t include tax-deductible dollars flowing into policy shops, social media, and internet sites that influence votes and should be disclosed as political spending.

In 2015, dark money has already paid for a “government transparency organization” to publish 2016 campaign opposition research on a candidate and market it to national newspapers—with no transparency as to who paid for the research and the motive behind publishing it.

The Government Accountability Institute, a 501(c)(3) nonprofit organization, published Clinton Cash, a book attacking Hillary Clinton and the Clinton Foundation. Author Peter Schweizer serves as president of the Government Accountability Institute, and Breitbart News Managing Editor Stephen Bannon is chairman of its board.

Liberal donors have resolved to form their own dark money network for 2016. The Democracy Alliance, a partnership of 100 wealthy liberals—individual and corporate—announced the formation of a network to build competitive organizations across the states. Like their counterparts on the right, they will not be required to disclose their donors, nor will voters necessarily know who is speaking to them when these groups use their money as “speech.”

At least four Republican presidential candidates are currently raising funds via 501(c)(4) organizations. Bobby Jindal has raised at least $3 million for America Next, which has paid for him to travel and speak at various conferences around the nation. Rick Santorum’s Patriot Voices has raised $8 million since 2012. Rick Perry is backed by Americans for Economic Freedom, which was seeded with leftover money from his 2012 bid for the nomination (he has an ultimate fundraising goal of $15 million for 2016). Ohio Governor John Kasich formed Balanced Budget Forever in late 2014, but hasn’t yet launched a robust fundraising effort. And Jeb Bush’s Right to Rise organization is reportedly on track to raise $100 million for his election bid.

The Ready for Hillary group has been raising funds for Hillary Clinton since early 2014, but is about to dissolve and disclose its large donors when they turn over their assets to her campaign.

Others will form as the race for the presidency unfolds. Unless the nonprofit veil of secrecy is pierced, voters will never know who is buying that political speech and for what purpose.

Because the Congress will not act, and the IRS has been subdued, that veil is unlikely to be lifted before the 2016 presidential election.

Calls to the office of the IRS commissioner, to inquire about when a rule for political nonprofits will be issued, went unanswered.

This story was originally published by the Washington Spectator.

Shares