Contempt for the vultures on Wall Street is one of the few things most Americans share. In the last few decades, neither party has done anything to curb the corruption and greed of the financial industry. Indeed, it was a Democrat, Bill Clinton, who did as much as anyone to deregulate the very banks that later wrecked the economy and plundered the public coffers. Although his mythology remains firmly in tact, Ronald Reagan is equally responsible for what happened in 2008.

Part of the reason Bernie Sanders has touched a nerve is that he's the only candidate running for president who's credible on this issue. Wall Street prefers a Republican, but they can live with a Democrat. In almost every election, bankers give millions to both sides, hedging their bets if you like. Hence they win no matter what happens.

But Sanders hasn't taken a dime from Wall Street, unlike President Obama and Hillary Clinton and every other major party candidate. And it's impossible to overstate the significance of that. It doesn't mean a Sanders presidency would put an end to financial corruption – that's naive. But it does give Sanders a rare credibility; against the backdrop of a recession and massive wealth inequalities, that's a big deal.

Wall Street knows Sanders is a problem, too.

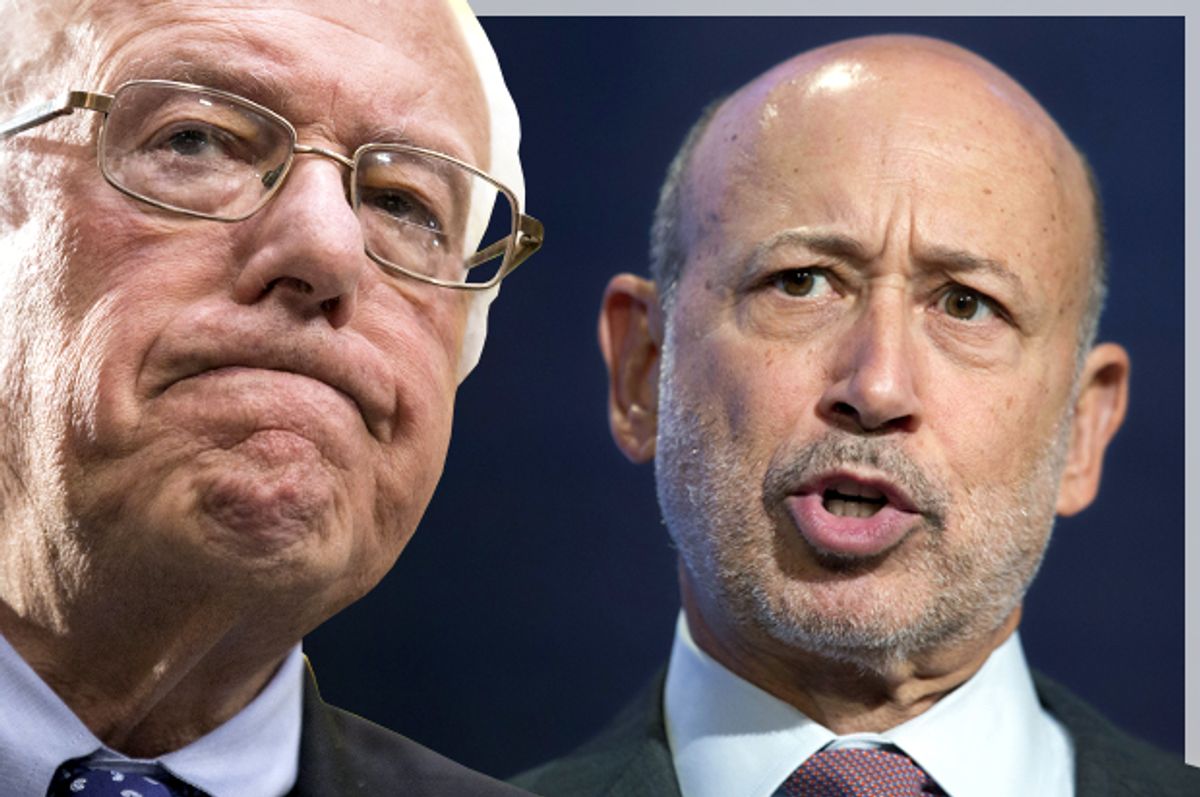

In an interview with CNBC yesterday, the CEO of Goldman Sachs, Lloyd Blankfein, was asked about Sanders and the current presidential campaign. His response was revealing:

“It has the potential to be a dangerous moment. Not just for Wall Street, not just for the people who are particularly targeted but for anybody who is a little bit out of line. We have a moment in time where people are – it's a liability to say I'm willing to compromise, I'm going to get one millimeter off the extreme position I have and if you do you have to back track and swear to people that you'll never compromise. It's just incredible. It's a moment in history. Eventually people, the electorate, will notice nothing is getting done and somebody will come up with a new idea of saying hey send me to Washington and I'll compromise and I'll get things done and that will be the new thing and everybody will rally to that point.”

It's probably not worth decoding this drivel, but it's remarkable that Blankfein (who, incidentally, supported Hillary Clinton in 2008) considers Bernie's ascendance a “dangerous moment.” What, exactly, is dangerous about it? That Sanders doesn't want to “compromise?” Compromising - that's putting it charitably - is what both parties have done with Wall Street since the 1980s, when Reagan gave us neoliberalism and trickle-down economics. Washington has been capitulating ever since, and the results speak for themselves.

Blankfein was responding in part to an interview Sanders gave to Bloomberg last month, in which the Vermont Senator mentioned Blankfein by name. In that interview, Sanders delivered his characteristic critique of Wall Street:

“Wall Street has not yet changed its business model; instead of investing and making affordable loans available to small and medium-sized businesses, they continue to come up with complicated financial instruments which I think have the potential to do serious harm in the future. No one will tell you we have a tough regulatory system looking out for Wall Street crimes – we don't. And yet since 2009, in a weak regulatory environment, these guys have had to pay over 200 billion dollars in fines for illegal action or reaching settlements – that's rather extraordinary for a weak regulatory environment. God only knows what would happen if you had a strong regulatory environment.”

There's nothing especially unique about this argument; it's the kind of thing you could hear from any number of politicians, including Hillary Clinton. The difference, though, is that no one on Wall Street blinks when someone other than Sanders says it. This isn't an attack on Clinton, who I think would make a better president than many Sanders supporters think. But the fact remains: Clinton is compromised on this issue in a way Sanders isn't, and the nervousness of people like Blankfein prove it.

Shares