Los Angeles-based YouTube star Gaby Dunn has never been good with money. Her difficulty with saving isn't unique; a 2015 Google consumer survey found that more than 60 percent of Americans have less than $1,000 in their bank accounts, and 20 percent don't even have a savings account at all. Having been in the former category myself plenty of times in my adult life, I was excited to see that Dunn isn't just bemoaning her cash flow but doing something to further the often hidden cultural conversation about what money means to us.

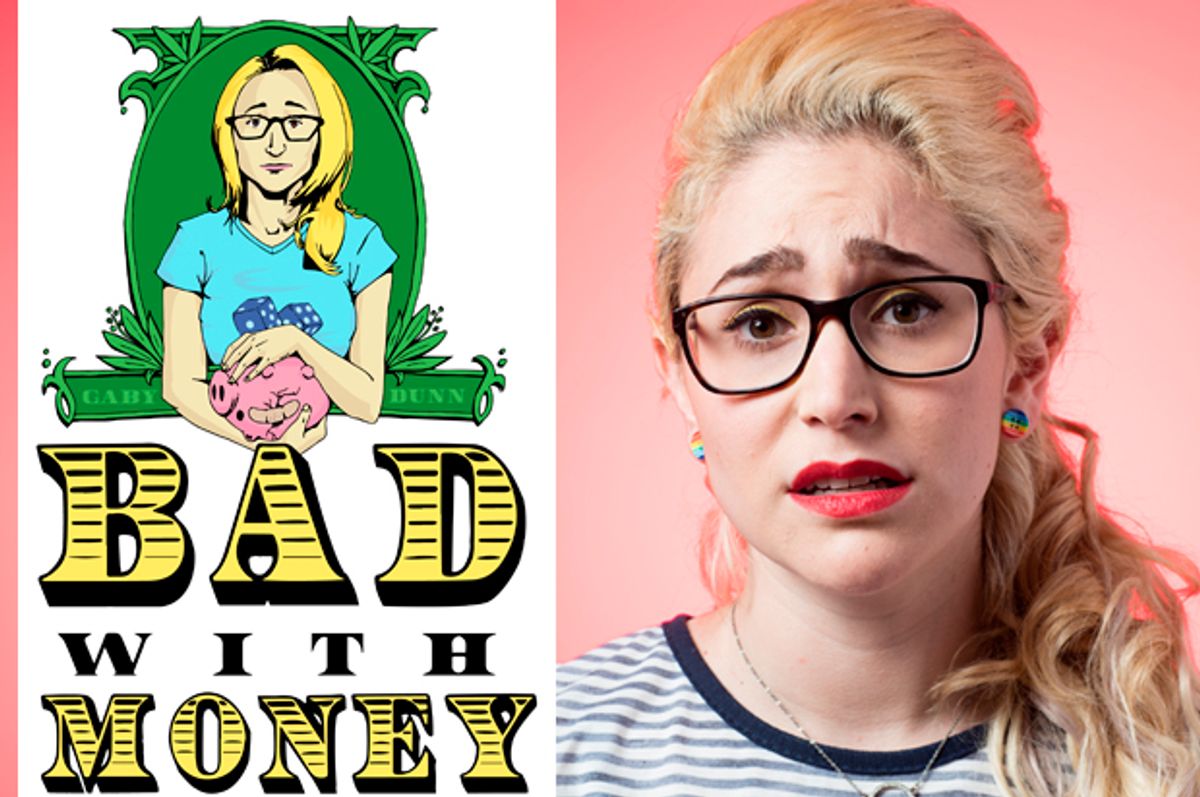

The 28-year-old writer and actress, who stars in her online show "Just Between Us" with Allison Raskin, has taken her financial issues and turned them into our gain with her newly launched 24-episode podcast "Bad With Money With Gaby Dunn" on Panoply. On the show, she interviews everyone from her parents, best friend and boyfriend to guests ranging from Sydney Leathers (the infamous paramour of Anthony Weiner), former child actor Mara Wilson, Hello Giggles co-founder Molly McAleer and Vidcon co-founder Hank Green about what they learned about money growing up and how this has affected their approach to saving and spending.

Salon emailed Dunn about her worst money mistakes, the economics of vlogging and why it's important to get rid of the shame about money.

When did you first realize your family approached money differently than other families?

My dad tells a story on the podcast about me being 17 and convincing him during a freak snowstorm in Chicago to buy cheaper coats, even though we desperately needed them to keep warm.

But I think it started in second grade. I switched from a public school to a private school which I attended on an academic scholarship. It was then that I encountered rich kids for the first time. I didn’t really know anything about how my family handled money per se, but I knew we didn’t have the same house, or jewelry, or even hair styles as the other kids. Straightening your hair was a big thing when I was in middle school and all the girls had hair straighteners and my mom ironed my hair for me with a literal iron. For real.

Have you been “bad with money” since as far back as you can remember? Do you recall a time when you were ever good with money?

I’ve always been bad with it. Though, like I said, my dad seemed to think I was more cautious about it than he or my mom were and that came from worrying about the two of them. I definitely would yell at them for spending or tell them they were overspending for no reason, while doing pretty much the same thing in my own life.

So I knew it was wrong, but I kept doing it. Largely because I thought anyone who wasn’t a Wall Street trader or an international arms dealer was living like me, paycheck to paycheck. Since no one talked about it, I presumed we were normal and life was always a financial hellscape unless you were super wealthy.

What’s the worst money mistake you’ve ever made?

Oh, there’s been a few. I sink so much money into repairs for my car, which I am constantly damaging. I wasn’t keeping good track of my taxes so I owed the IRS $7,000 one year. I had to get emergency dental surgery and that was such a big expense, thousands of dollars, that I feel like I’m going to have to keep paying for it as more issues arise. (I think fixing my teeth is just a never-ending saga due to genetics and also working in Hollywood on-camera.)

I’m constantly over-paying for things because I get too worked up or anxious and I think just throwing money at the problem will fix it, like parking tickets I could fight but I don’t because time/energy is money.

How did you get the idea for the podcast? Did you have any hesitation about talking so openly about your money issues?

The idea for the podcast came from the Fusion article I wrote called "Get Rich or Die Vlogging." And that article came out of frustration with comments on my YouTube channel claiming I was a sell-out for doing sponsored videos when honestly, the brands were never really paying me that much and that was often my sole source of income. The misunderstanding that YouTube fame equaled millions of dollars and therefore meant I was deserving of public scorn was a sharp contrast to my real life of looking through my car for spare quarters.

So I was mad. And I wrote about it. And apparently, this was a topic that no YouTuber had ever covered before? Because the response was insane. People really appreciated it. So then a friend of mine named Andrea Silenzi, who worked in podcasting at Slate/Panoply, approached me about turning it into a podcast in November 2015. Andrea paired me with Sam Dingman, my producer, who has been a God among men in terms of putting this together.

I didn’t really have any hesitation about talking about money, except I wasn’t interested in being mansplained to. I think men see a woman who is figuring something out on her own and they’re like “DAMSEL IN DISTRESS MUST SAVE.” So the only annoying thing was opening my email and DMs to men I didn't know sending me long condescending messages about what I should be doing. Many of them were like, “If I were you, here’s how I’d easily become a billionaire.” And like, that’s great, Trevor, but if you’re so smart, why not do it for yourself? (I named them all Trevor.)

Has monetizing YouTube videos and having a sustainable career as a vlogger gotten easier since you wrote that piece?

For me it has gotten easier, because we’ve become more notable and famous. So the deals are bigger now. But we don’t subsist just on YouTube. Allison and I have sold two television shows to networks in the last year. We sold a digital series. We’re working on a book. She writes for Fullscreen. I have this podcast. We both take writing and acting gigs. So we do a lot of things outside YouTube to make money.

The problem is we were never vloggers. "Just Between Us" isn’t a vlog. So placing brands into a scripted web series is a bit of a bigger challenge, other than like, Allison drinking a soda in the beginning going, “I love this soda.” Which fans see coming a mile away. Luckily, there have been brands who get our humor and let us do weird sponsored videos but those are fewer and more far between than what a traditional vlogger would get offered. But yes, the YouTube stuff has parlayed itself into better paying gigs. After two years of making videos for free.

Do you have any sense of whether millennials generally view money differently than Generation X or their parents’ generation?

I don’t know! My parents are Baby Boomers. They have a very Yoko-and-John view of money which is, “Hey, man, you can’t take it with you.” Millennials actually seem pretty responsible money-wise because they have the confidence to ask for more money or to get paid for their work. There’s this big push for valuing yourself and your time. Boomers and Gen X got these singular jobs and stayed there for 40 years and hoped for promotions and bonuses and deferred to their bosses.

Millennials are like, “My boss doesn’t pay me enough or treat me well, so see ya.” And yeah, it’s the old “entitled” argument but also for women? For marginalized people? For black people? For gay people? This sort of attitude toward feeling enough self-worth to ask for money? That’s revolutionary and should be celebrated. It’s bomb to know your worth and be confident!

In the first episode, you interview your parents, and confront them on what you see as some of their deep-seated money issues, from your dad spending without regard for saving to your mom bartering her lawyering skills for a haircut. Do you understand their approaches to money better after having done the podcast?

I do understand it, even if it’s frustrating. I knew my dad was an addict and spent recklessly and wracked up hospital and other bills. I knew my mom bartered instead of got paid for her job. And it’s funny, my mom on the show comes off equally sweet and wonderful and also too much of a martyr, if that makes sense. She’s a fantastic woman but she puts people above herself to her own detriment. Which I know is probably something from her own childhood. It’s all cyclical.

Your parents say that you’re their retirement plan, and it’s hard to tell how much they’re joking. Does that sentiment feel like pressure to you?

I just spoke to my dad about that yesterday and he claims they’re joking. I am skeptical! I do know there are people in my family who think I am a money pot. And that sucks. Whenever I see like, US Weekly with Jen Aniston being like “She doesn’t talk to her family anymore!” I sort of am like, “I get it Jen. I get it.” (Not my parents. They don’t ask for anything from me now.) But also, you know, I wanna be Kanye buying his mom a house. I wanna be that for them. They deserve it.

You also talk to your best friend and fellow "Just Between Us" star Allison Raskin about what it was like for her to grow up with money, and that it’s not as perfect as it may seem from the outside. Do you think our culture conflates having money with being happy in dangerous ways?

Definitely. Money can’t buy happiness. Now, it can buy other things, like therapy and doctors and things to help you with happiness. But also, it’s lucky that Allison had attentive parents who also cared to give her those things. So it had to be a perfect storm. It couldn’t have just been the money. She needed to be loved too.

Did anyone turn you down? Was it challenging to get people to open up as much as you are about money?

Some people did turn me down. A big reason was “I’m okay talking about it but my partner would not be.” (Partner as in husband, wife, spouse.) It’s not something they felt okay to share on their own because the information affected someone else. Many people were stoked to talk about it.

It felt like, as I did the interviews, people had been waiting for these questions all their lives. Molly cried. Sydney was very proud of how she’d made a living for herself and become independent, paying for college through sex work. YouTubers just wanted haters to know their jobs are real work. It was something people were passionate about and just needed a platform to speak about it. Hence, the podcast.

What’s the biggest lesson you’ve learned about money by talking to such a wide range of people? Has doing the podcast changed your relationship to money and work?

It has changed the way I feel about money, definitely. It feels less like this big scary, secret problem in my life that I have to hide from everyone. I feel like I can ask for help and no one will shun me for being a fool. Just talking about something takes away its power little by little. I believe Hermione Granger taught us that.

You close the first episode by asking strangers to tell you their favorite sexual position followed by how much money is in their bank accounts. Nobody told you both; they were more squeamish about telling you about their financial details than those about their sex life. Why do you think that is? Is that reticence to talk about money something you want to change with the podcast?

That idea came from the reality that there are so many sex and dating podcasts. So many. And people are called brave all the time for making work about sex or their bodies, which is great and I love that. I’ve been praised a lot for sex-positivity and sex is obviously still a shameful topic for women. So it’s dope for women to be taking that shame back, but I think because we’re paid less than men generally (and minority women even less so), there’s another, even more secret shame, which is money.

So I’ve always felt very comfortable talking about my sex life or my body, but I’ve never been comfortable talking about money and why is that? Why is money the thing I won’t touch when I share everything else? So now I’m a woman with a money podcast. And hopefully there will be 10 more women with 10 more money podcasts and then this becomes a cliché topic too. And then everyone has equal pay.

Of course I have to ask: What’s your favorite sexual position? How much money is in your bank account?

My favorite is the one where a woman is using her hand. What’s that one called? Is it just “lesbian stuff?” With dudes, it’s dude on top. I am a traditional lady, thank you.

I have the most money I’ve ever had in my life right now, which is about $20,000 all told. I can’t even look at that number because it’s insane to me. I have had two dollars before. I didn’t even know my account could hold that much. I had to call and ask if it could because I didn’t know. That’s between savings and checking. I put $11,000 in savings and I’m not touching it. I’m trying to grow it, I guess. The rest I kept to pay bills and my rent and my car. I still have an $8,000 auto loan so even if I have $9,000 dollars in checking right now, I feel like I only have $1,000 until that auto loan is paid off. See, it’s so complicated!

Shares