Whatever shred of doubt you may have harbored about the determination of congressional Republicans to keep the economy in the dumps through Election Day should now be gone.

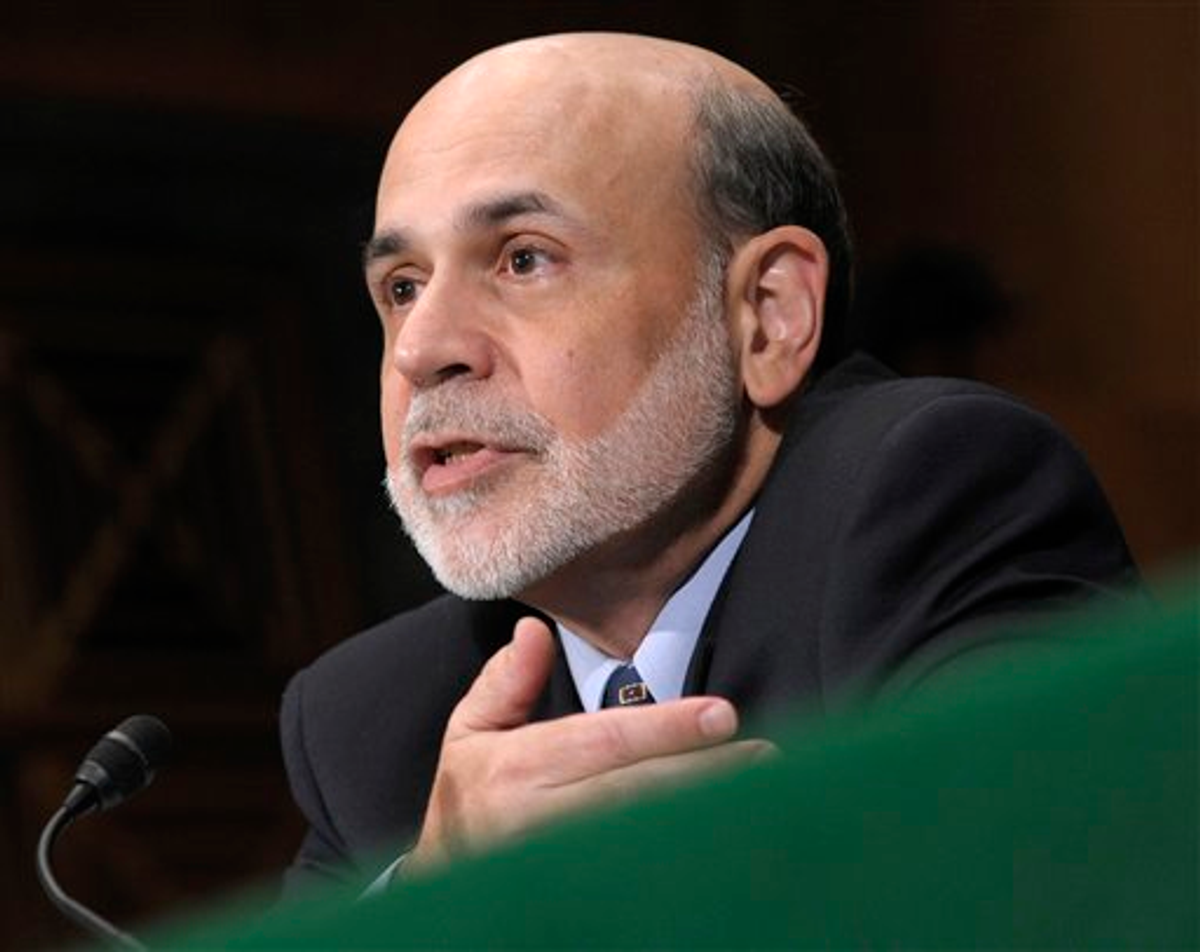

On Tuesday, in advance of a key meeting of the Federal Reserve Board's Open Market Committee to decide what to do about the continuing awful economy and high unemployment, top Republicans wrote a letter to Fed Chief Ben Bernanke.

They stated in no uncertain terms the Fed should take no further action to lower long-term interest rates and juice the economy. "We have serious concerns that further intervention by the Federal Reserve could exacerbate current problems or further harm the U.S. economy."

They didn't threaten to "treat him pretty ugly" -- as Texas Governor Rick Perry told his supporters last month he'd deal with Bernanke if he "printed more money" between now and the election.

But the threat was there. "It is not clear that the recent round of quantitative easing undertaken by the Federal Reserve has facilitated economic growth or reduced the unemployment rate."

Translated: You try this, and we rake you over the coals publicly, and make the Fed into an even bigger scapegoat than we've already made it.

Top Republicans believe they can block all or most of Obama's jobs bill. That leaves only the Fed as the last potential player to boost the economy. So the GOP will do what it can to stop the Fed.

After all, as Republican Senate head Mitch McConnell stated, their "number one" goal is to get Obama out of the White House. And that's more likely to happen if the economy sucks on Election Day.

To say it's unusual for a political party to try to influence the Fed is an understatement.

When I was Secretary of Labor in the Clinton Administration, it was considered a serious breach of etiquette -- not to say potentially economically disastrous -- even to comment publicly about the Fed. Everyone understood how important it is to shield the nation's central bank from politics.

If global investors suspect the Fed is responding to political pressure of any kind, investors will lose confidence in the independence of the Fed and its monetary policies. Even if the pressure is to tighten the money supply and keep interest rates high, it's still politics. And once politics intrudes, lenders of all stripes worry that it will continue to intrude in all sorts of ways. Lending to the United States becomes a tad riskier. As a result, lenders charge us more.

The Republican letter puts Bernanke and his colleagues in a bind. If they decide against another round of so-called "quantitative easing" to lower long-term rates and boost the economy, they may look like they're caving to congressional Republicans. If they decide to go ahead notwithstanding, they're bucking the Republicans and siding with Democrats. Either way, they're open to the charge they're playing politics.

Congressional Republicans evidently don't care. They want Obama out, whatever the cost. Besides, they've never met a government institution they don't mind trashing.

Shares