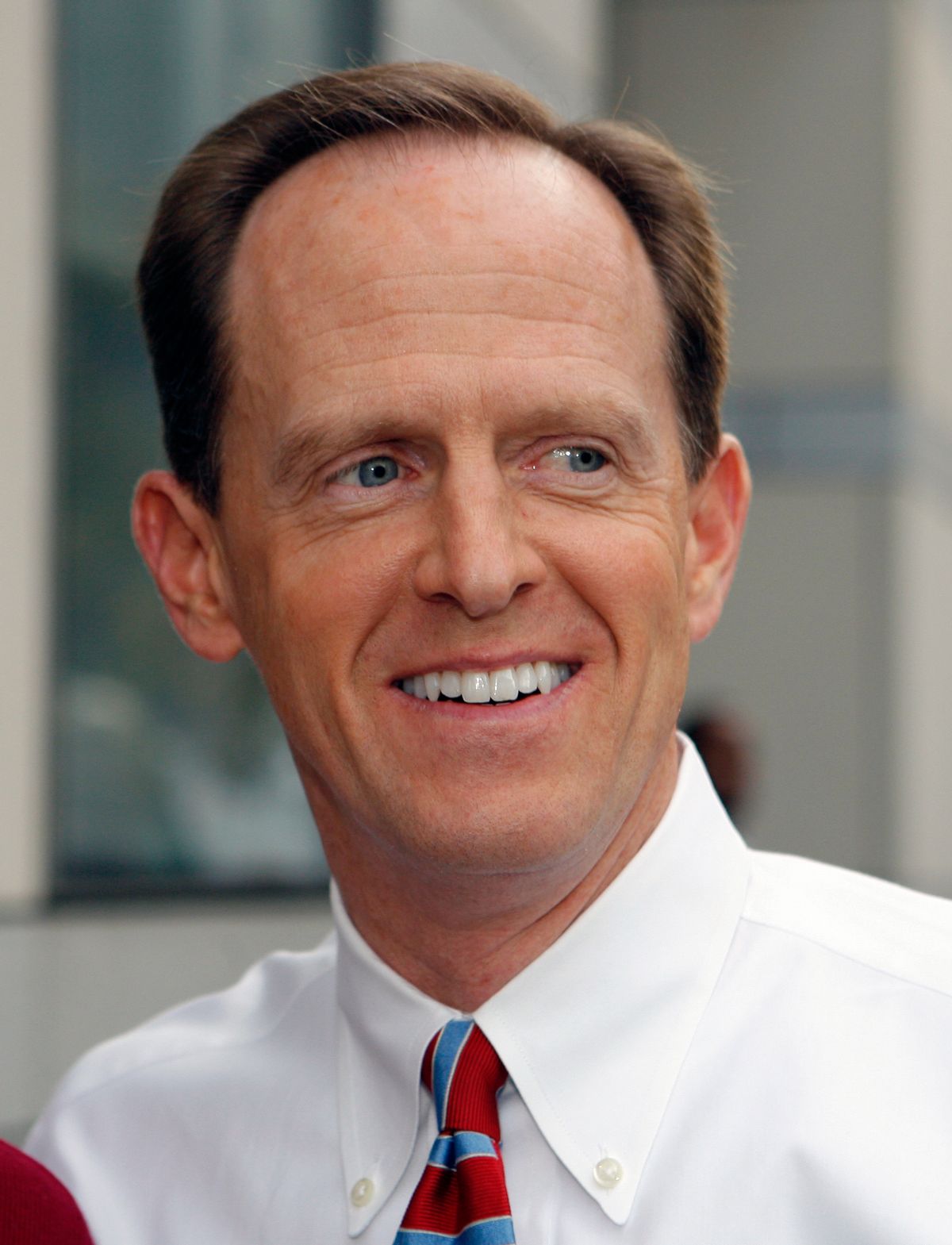

Republicans have a nutty plan to get around the economic turmoil that could ensue if Congress fails to raise the debt ceiling. Fearing that a revolt by bond investors would cause an economic disaster if the U.S. can't stand by its Treasury obligations, they intend to pass a law making interest payments on government debt the "first priority." As outlined by Pat Toomey, the new Republican Senator from Pennsylvania, in a Wall Street Journal op ed on Friday, the scheme "would not only ensure the continued confidence of investors at home and abroad, but would enable us to have an honest debate about the consequences of our eventual decision about the debt ceiling."

At Talking Points Memo, Brian Beutler covers the news with the unfortunate headline "'Pay China First' -- Republicans' Wild Plan To Avoid U.S. Debt Default."

The quote is from Kent Conrad, D-N.D:

"I think it is a dreadful idea," Sen. Kent Conrad (D-ND) told National Journal. "Basically what they are saying is, pay China first. Are we going to forget about the American public and the things that they need? Somehow they are secondary? And paying the Chinese and the Japanese is the first priority of this country? I don't even know how to describe that idea; it's just a very, very bad one."

It is true that China and Japan own a lot of U.S. debt.. According to an analysis conducted by CNBC, China and Japan place third ($895.6 billion) and fourth ($877.2 billion) on a list of the top 15 holders of U.S. debt.

But the rest of the top ten lives much closer to home: Pension funds ($706.5 billion), mutual funds ($637.7 billion) and state and local governments ($511.8 billion) rank 5th, 6th, and 7th. Banks and insurance companies also own a considerable stake. At the very top is the Federal Reserve, which owns an amazing 5 trillion worth of government debt, while in second place is a catchall category covering "other investors and savings bonds" that rolls in at $1.4 trillion.

Large swathes of the American public are owners of government debt, and would be hurt by a debt default. It's completely fair to argue that they are likely to be richer Americans than those who would be hammered if the government stopped making Social Security payments or paying unemployment benefits or covering Medicaid expenses. That alone should (and will) likely be enough to scuttle Toomey's plan. But making this all about China -- or any other foreign country, like Canada, or the UK, that owns a significant amount of U.S. government debt -- injects an unnecessary strain of xenophobia into the story.

Republicans are understandably anxious about how bond investors would react to a debt default. It would be hard to devise a more reckless way to manage the U.S. economy than simply refusing to raise the debt ceiling. So they're trying to finesse the situation. But as the U.S. Treasury has been to quick to observe, merely prioritizing one form of debt as more important than another is unlikely to assuage the bond markets if the U.S. government meanwhile fails to meet its other legal obligations. If the U.S. can't pay its bills, markets will react negatively.

The politics and economics of this move are bad enough for Republicans that it doesn't stand a chance of becoming law. There's no need to China bash.

Shares