A few years ago, in the heat of the battle over the Affordable Care Act, Daniel J. Mitchell of the libertarian Cato Institute posted a blog entry with the provocative title: “Why Is Obama Trying to Make America More Like Sweden when Swedes Are Trying to Be Less Like Sweden?”

Good question! When you put it that way, it does seem pretty perverse. Why, Mr. President, are we swimming against the current of history, while social welfare states around the world—even rich little Sweden!—are cutting back on expensive benefits and high taxes? “If Swedes have learned from their mistakes and are now trying to reduce the size and scope of government,” Mitchell writes, “why are American politicians determined to repeat those mistakes?”

Answering this question will require an extremely scientific chart. Here’s what the world looks like to the Cato Institute:

The x-axis represents Swedishness, and the y-axis is some measure of prosperity. Don’t worry about exactly how we’re quantifying these things. The point is just this: according to the chart, the more Swedish you are, the worse off your country is. The Swedes, no fools, have figured this out and are launching their northwestward climb toward free-market prosperity. But Obama’s sliding in the wrong direction.

Let me draw the same picture from the point of view of people whose economic views are closer to President Obama’s than to those of the Cato Institute:

This picture gives very different advice about how Swedish we should be. Where do we find peak prosperity? At a point more Swedish than America, but less Swedish than Sweden. If this picture is right, it makes perfect sense for Obama to beef up our welfare state while the Swedes trim theirs down.

The difference between the two pictures is the difference between linearity and nonlinearity, one of the central distinctions in mathematics. The Cato curve is a line; the non-Cato curve, the one with the hump in the middle, is not. A line is one kind of curve, but not the only kind, and lines enjoy all kinds of special properties that curves in general may not. The highest point on a line segment—the maximum prosperity, in this example—has to be on one end or the other. That’s just how lines are. If lowering taxes is good for prosperity, then lowering taxes even more is even better. And if Sweden wants to de-Swede, so should we. Of course, an anti-Cato think tank might posit that the line slopes in the other direction, going southwest to northeast. And if that’s what the line looks like, then no amount of social spending is too much. The optimal policy is Maximum Swede.

Usually, when someone announces they’re a “nonlinear thinker” they’re about to apologize for losing something you lent them. But nonlinearity is a real thing! And in this context, thinking nonlinearly is crucial, because not all curves are lines. A moment of reflection will tell you that the real curves of economics look like the second picture, not the first. They’re nonlinear. Mitchell’s reasoning is an example of false linearity—he’s assuming, without coming right out and saying so, that the course of prosperity is described by the line segment in the first picture, in which case Sweden stripping down its social infrastructure means we should do the same.

But as long as you believe there’s such a thing as too much welfare state and such a thing as too little, you know the linear picture is wrong. Some principle more complicated than “More government bad, less government good” is in effect. The generals who consulted Abraham Wald faced the same kind of situation: too little armor meant planes got shot down, too much meant the planes couldn’t fly. It’s not a question of whether adding more armor is good or bad; it could be either, depending on how heavily armored the planes are to start with. If there’s an optimal answer, it’s somewhere in the middle, and deviating from it in either direction is bad news.

Nonlinear thinking means which way you should go depends on where you already are.

This insight isn’t new. Already in Roman times we find Horace’s famous remark “Est modus in rebus, sunt certi denique fines, quos ultra citraque nequit consistere rectum” (“There is a proper measure in things. There are, finally, certain boundaries short of and beyond which what is right cannot exist”). And further back still, in the Nicomachean Ethics, Aristotle observes that eating either too much or too little is troubling to the constitution. The optimum is somewhere in between; because the relation between eating and health isn’t linear, but curved, with bad outcomes on both ends.

Something-doo economics

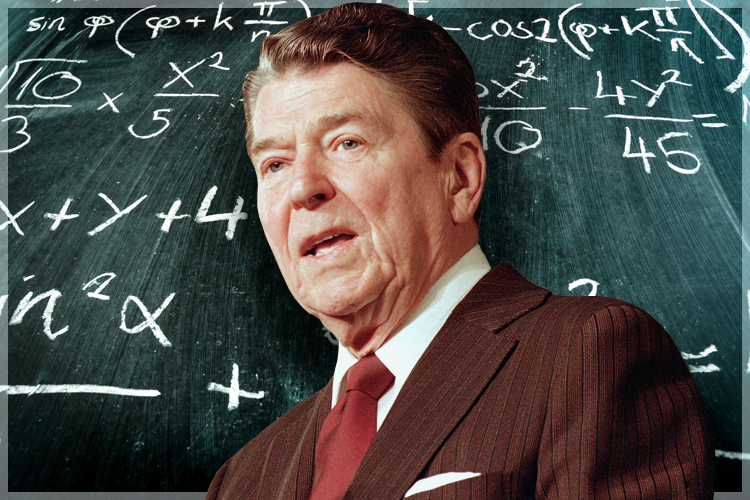

The irony is that economic conservatives like the folks at Cato used to understand this better than anybody. That second picture I drew up there? The extremely scientific one with the hump in the middle? I am not the first person to draw it. It’s called the Laffer curve, and it’s played a central role in Republican economics for almost forty years. By the middle of the Reagan administration, the curve had become such a commonplace of economic discourse that Ben Stein ad-libbed it into his famous soul-killing lecture in “Ferris Bueller’s Day Off”:

Anyone know what this is? Class? Anyone? . . . Anyone? Anyone seen this before? The Laffer Curve. Anyone know what this says? It says that at this point on the revenue curve, you will get exactly the same amount of revenue as at this point. This is very controversial. Does anyone know what Vice President Bush called this in 1980? Anyone? Something-doo economics. “Voodoo” economics.

The legend of the Laffer curve goes like this: Arthur Laffer, then an economics professor at the University of Chicago, had dinner one night in 1974 with Dick Cheney, Donald Rumsfeld, and Wall Street Journal editor Jude Wanniski at an upscale hotel restaurant in Washington, DC. They were tussling over President Ford’s tax plan, and eventually, as intellectuals do when the tussling gets heavy, Laffer commandeered a napkin and drew a picture. The picture looked like this:

The horizontal axis here is level of taxation, and the vertical axis represents the amount of revenue the government takes in from taxpayers. On the left edge of the graph, the tax rate is 0%; in that case, by definition, the government gets no tax revenue. On the right, the tax rate is 100%; whatever income you have, whether from a business you run or a salary you’re paid, goes straight into Uncle Sam’s bag.

Which is empty. Because if the government vacuums up every cent of the wage you’re paid to show up and teach school, or sell hardware, or middle-manage, why bother doing it? Over on the right edge of the graph, people don’t work at all. Or, if they work, they do so in informal economic niches where the tax collector’s hand can’t reach. The government’s revenue is zero once again.

In the intermediate range in the middle of the curve, where the government charges us somewhere between none of our income and all of it—in other words, in the real world—the government does take in some amount of revenue.

That means the curve recording the relationship between tax rate and government revenue cannot be a straight line. If it were, revenue would be maximized at either the left or right edge of the graph; but it’s zero both places. If the current income tax is really close to zero, so that you’re on the left-hand side of the graph, then raising taxes increases the amount of money the government has available to fund services and programs, just as you might intuitively expect. But if the rate is close to 100%, raising taxes actually decreases government revenue. If you’re to the right of the Laffer peak, and you want to decrease the deficit without cutting spending, there’s a simple and politically peachy solution: lower the tax rate, and thereby increase the amount of taxes you take in. Which way you should go depends on where you are.

So where are we? That’s where things get sticky. In 1974, the top income tax rate was 70%, and the idea that America was on the right-hand down slope of the Laffer curve held a certain appeal—especially for the few people lucky enough to pay tax at that rate, which only applied to income beyond the first $200,000. And the Laffer curve had a potent advocate in Wanniski, who brought his theory into the public consciousness in a 1978 book rather self-assuredly titled “The Way the World Works.” Wanniski was a true believer, with the right mix of zeal and political canniness to get people to listen to an idea considered fringy even by tax-cut advocates. He was untroubled by being called a nut. “Now, what does ‘nut’ mean?” he asked an interviewer. “Thomas Edison was a nut, Leibniz was a nut, Galileo was a nut, so forth and so on. Everybody who comes with a new idea to the conventional wisdom, comes with an idea that’s so far outside the mainstream, that’s considered nutty.”

(Aside: it’s important to point out here that people with out-of-the-mainstream ideas who compare themselves to Edison and Galileo are never actually right. I get letters with this kind of language at least once a month, usually from people who have “proofs” of mathematical statements that have been known for hundreds of years to be false. I can guarantee you Einstein did not go around telling people, “Look, I know this theory of general relativity sounds wacky, but that’s what they said about Galileo!”)

The Laffer curve, with its compact visual representation and its agreeably counterintuitive sting, turned out to be an easy sell for politicians with a preexisting hunger for tax cuts. As economist Hal Varian put it, “You can explain it to a Congressman in six minutes and he can talk about it for six months.” Wanniski became an advisor first to Jack Kemp, then to Ronald Reagan, whose experiences as a wealthy movie star in the 1940s formed the template for his view of the economy four decades later. His budget director, David Stockman, recalls:

I came into the Big Money making pictures during World War II,” [Reagan] would always say. At that time the wartime income surtax hit 90 percent. “You could only make four pictures and then you were in the top bracket,” he would continue. “So we all quit working after about four pictures and went off to the country.” High tax rates caused less work. Low tax rates caused more. His experience proved it.

These days it’s hard to find a reputable economist who thinks we’re on the downslope of the Laffer curve. Maybe that’s not surprising, considering top incomes are currently taxed at just 35%, a rate that would have seemed absurdly low for most of the twentieth century. But even in Reagan’s day, we were probably on the left-hand side of the curve. Greg Mankiw, an economist at Harvard and a Republican who chaired the Council of Economic Advisors under the second President Bush, writes in his microeconomics textbook:

Subsequent history failed to confirm Laffer’s conjecture that lower tax rates would raise tax revenue. When Reagan cut taxes after he was elected, the result was less tax revenue, not more. Revenue from personal income taxes (per person, adjusted for inflation) fell by 9 percent from 1980 to 1984, even though average income (per person, adjusted for inflation) grew by 4 percent over this period. Yet once the policy was in place, it was hard to reverse.

Some sympathy for the supply-siders is now in order. First of all, maximizing government revenue needn’t be the goal of tax policy. Milton Friedman, whom we last met during World War II doing classified military work for the Statistical Research Group, went on to become a Nobel-winning economist and advisor to presidents, and a powerful advocate for low taxes and libertarian philosophy. Friedman’s famous slogan on taxation is “I am in favor of cutting taxes under any circumstances and for any excuse, for any reason, whenever it’s possible.” He didn’t think we should be aiming for the top of the Laffer curve, where government tax revenue is as high as it can be. For Friedman, money obtained by the government would eventually be money spent by the government, and that money, he felt, was more often spent badly than well.

More moderate supply-side thinkers, like Mankiw, argue that lower taxes can increase the motivation to work hard and launch businesses, leading eventually to a bigger, stronger economy, even if the immediate effect of the tax cut is decreased government revenue and bigger deficits. An economist with more redistributionist sympathies would observe that this cuts both ways; maybe the government’s diminished ability to spend means it constructs less infrastructure, regulates fraud less stringently, and generally does less of the work that enables free enterprise to thrive.

Mankiw also points out that that the very richest people—the ones who’d been paying 70% on the top tranche of their income—did contribute more tax revenue after Reagan’s tax cuts. That leads to the somewhat vexing possibility that the way to maximize government revenue is to jack up taxes on the middle class, who have no choice but to keep on working, while slashing rates on the rich; those guys have enough stockpiled wealth to make credible threats to withhold or offshore their economic activity, should their government charge them a rate they deem too high. If that story’s right, a lot of liberals will uncomfortably climb in the boat with Milton Friedman: maybe maximizing tax revenue isn’t so great after all.

Mankiw’s final assessment is a rather polite, “Laffer’s argument is not completely without merit.” I would give Laffer more credit than that! His drawing made the fundamental and incontrovertible mathematical point that the relationship between taxation and revenue is necessarily nonlinear. It doesn’t, of course, have to be a single smooth hill like the one Laffer sketched; it could look like a trapezoid

or a dromedary’s back

or a wildly oscillating free-for-all

but if it slopes upward in one place, it has to slope downward somewhere else. There is such a thing as being too Swedish. That’s a statement no economist would disagree with. It’s also, as Laffer himself pointed out, something that was understood by many social scientists before him. But to most people, it’s not at all obvious—at least, not until you see the picture on the napkin. Laffer understood perfectly well that his curve didn’t have the power to tell you whether or not any given economy at any given time was overtaxed or not. That’s why he didn’t draw any numbers on the picture. Questioned during congressional testimony about the precise location of the optimal tax rate, he conceded, “I cannot measure it frankly, but I can tell you what the characteristics of it are; yes, sir.” All the Laffer curve says is that lower taxes could, under some circumstances, increase tax revenue; but figuring out what those circumstances are requires deep, difficult, empirical work, the kind of work that doesn’t fit on a napkin.

There’s nothing wrong with the Laffer curve—only with the uses people put it to. Wanniski and the politicians who followed his panpipe fell prey to the oldest false syllogism in the book:

It could be the case that lowering taxes will increase government revenue;

I want it to be the case that lowering taxes will increase government revenue;

Therefore, it is the case that lowering taxes will increase government revenue.

Excerpted from “How Not to Be Wrong: The Power of Mathematical Thinking” by Jordan Ellenberg. Copyright © 2014 by Jordan Ellenberg. Reprinted by arrangement with The Penguin Press. All rights reserved.