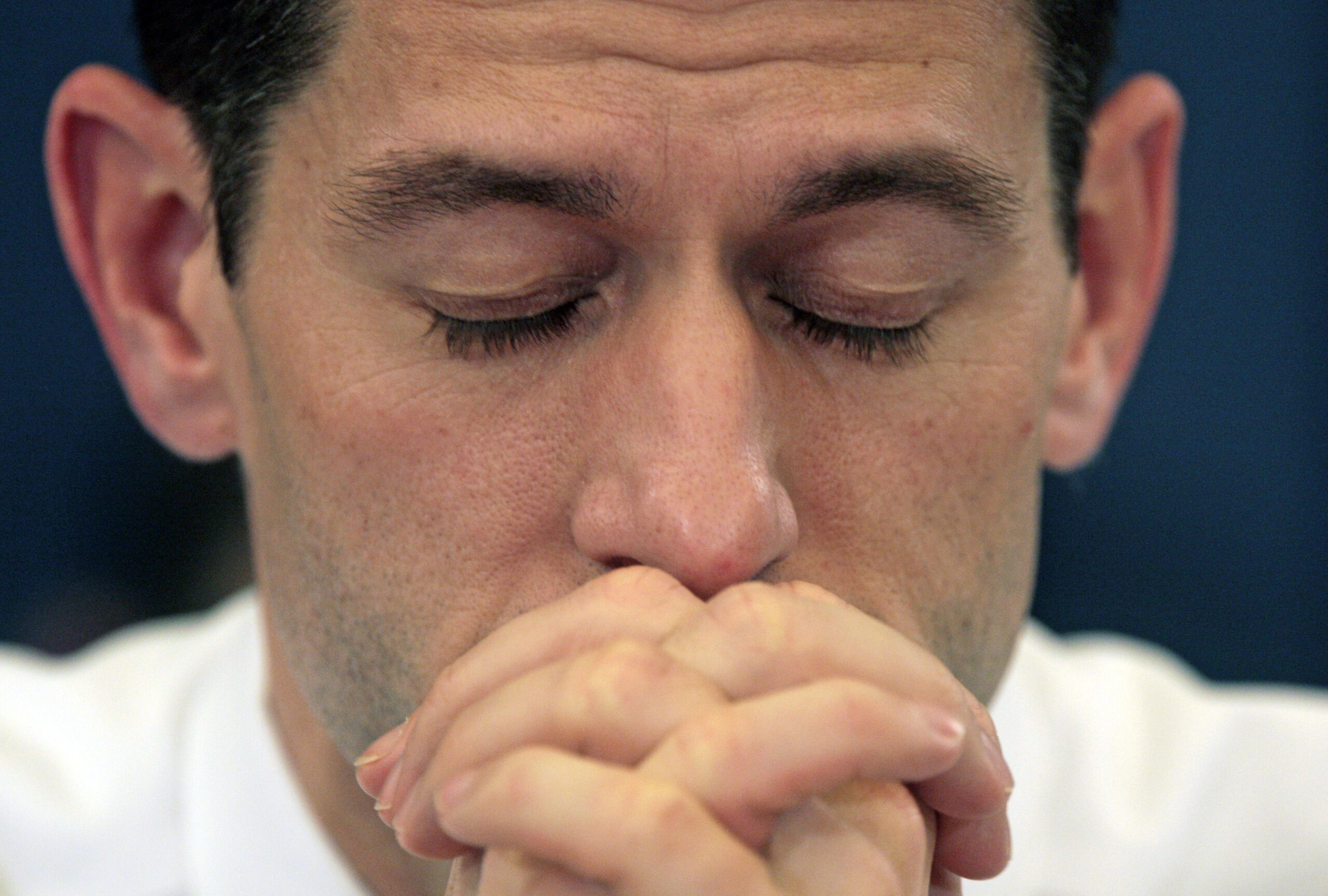

From the editorial pages of major newspapers to “Hardball’s” Chris Matthews to President Obama himself, nearly everyone in public life seems to feel obliged to praise Rep. Paul Ryan for his tough-minded, cost-slashing budget “road map” that even his own party isn’t quite bold enough to fully adopt. In the mainstream media, the Wisconsin Republican is often presented as a straight-shooting prophet whose prescriptions for privatizing Social Security and eviscerating Medicare can only be ignored if we want to jeopardize America’s future, and so on.

Fortunately, the Center on Budget and Policy Priorities has studied Ryan’s proposals with its usual perspicacity and issued a clear warning that his road map would only lead us — after a series of hard-right turns — to the same old plutocratic dead end. Like so many Republican speeches about fiscal responsibility, the Ryan promise to balance the budget is a scam whose real purpose has more to do with redistributing taxes downward and wealth upward — that is, more of the same.

The CBPP report is bracing in its candor about what we might actually expect from enacting Ryan’s plan — as opposed to its advertised effects. The middle-class tea party types who believe the Republicans will save them from high taxes and big deficits should know that Ryan’s plan will not lead to fiscal balance someday, but in fact is more likely to balloon both deficits and debt until well after 2070.

What should be even more disturbing, from the tea party perspective, is that the Ryan plan sharply raises federal taxes on the middle class by imposing a value-added or sales tax. It raises taxes on the consumption of items like tea, quite literally. By definition such taxes are regressive, falling much more heavily on working- and middle-income families than on the rich, unless they include specific features to make them more equitable (which the Ryan version does not).

The fiscal analysis used by the CBPP found that three out of four Americans, with incomes between $20,000 and $200,000, would see their taxes go up, not down, if Ryan’s plan replaced current law.

Indeed, the reason that Ryan’s plan cannot balance the budget is quite simple. (And as CBPP points out in responding to Ryan’s whiny complaints, the only way he can claim it would is to quote a wildly skewed revenue estimate conjured up by his own research staff.)

While raising the taxes of middle-class families via the sales tax, it reduces taxes on the richest 1 percent of Americans — those with incomes over $633,000 — by half. The wealthiest taxpayers would receive larger and larger tax cuts going up the income scale, with the richest one-tenth of 1 percent, with annual incomes above $2.9 million, receiving an average tax cut of $1.7 million per year. And these generous cuts would be in addition to the benefits that the nation’s very wealthiest households would get from making permanent the Bush tax cuts, which are supposed to expire at the end of this year.

As a result of these changes, middle-class taxpayers would end up paying a larger percentage of their annual income to the government than now, while the wealthiest taxpayers would pay a smaller percentage. According to the CBPP — which many conservatives acknowledge for its tradition of honesty and accuracy — Ryan’s plan would damage health coverage for most Americans and endanger if not destroy the safety net for the elderly, whose rise from mass poverty began with Social Security and Medicare.

This is what passes for “populism” on the Republican right.