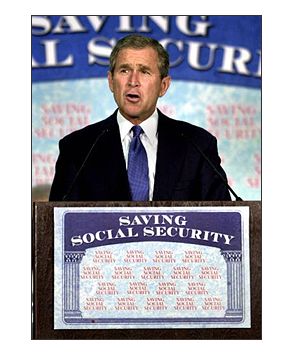

For those Americans who are worried that the Social Security system will prove to be as reliable a source of income as the latest McDonald’s Monopoly Sweepstakes, last week’s interim meeting of the 15-member President’s Commission to Strengthen Social Security should be of interest. The meeting’s agenda is “a review of historical experience in administering portable personal accounts,” but the group’s larger purpose is to recommend to President George W. Bush sweeping changes to the Social Security system.

The meeting had potential for drama. Nonpartisan experts believe Bush’s budget would have dipped into the Social Security surplus had it not been for some last-minute budgetary chicanery. Democrats insist it still might. And there was some more sleight of hand when it came to federal open meeting laws; the General Services Administration’s new interpretation of the 1972 Federal Advisory Committee Act open meeting law took effect just two days before the commission was to meet, allowing its members to meet privately Wednesday morning as long as they bifurcated into two “subcommittees,” exploiting a loophole in the federal sunshine laws. Good government groups — still angry over the closed-door Energy Task Force meetings headed by Vice President Dick Cheney — insist that by holding closed meetings in the morning the commission is, in the words of Common Cause president Scott Harshbarger, “skirting the spirit of our open meeting laws.”

When I show up for the commission meeting at the Loews L’Enfant Plaza Hotel in Washington, there doesn’t appear to be too much public outrage, though. Or even interest. In the lobby, a few colorless men speak in hushed tones of “solvency,” but the meeting machinations are hardly Ludlum-esque. I don’t see any other reporters trying to peek into the closed-door meetings, certainly none outside the solarium where one of the meetings began to convene over breakfast.

Clearly visible as it is, right off the Grand Ballroom where the public meeting will later take place, the private gathering doesn’t seem remotely dark and foreboding. A projector has been placed near the table, no doubt ready for all sorts of visuals about how the system’s going to start paying out more in benefits than it’s receiving in payroll taxes in 2016, and how the system itself, without reform, is going to go bust in 2038.

The makeup of the commission is a stacked deck, with every one of the 15 members generally supporting Bush’s plan for partial privatization of Social Security accounts. Many Social Security reformers worry that may hurt any chance for a constructive, bipartisan plan to save Social Security.

“I’m very supportive of the commission, but it’s been discredited,” former Sen. Bob Kerrey, D-Neb., will later tell me, having worked closely in the Senate on the issue with former Sen. Daniel Patrick Moynihan, D-N.Y., the commission co-chairman. “It lacks credibility when all of the members favor some modification of what Bush campaigned on. It needs some dissenters. It needs some skeptics. But they’re a bunch of smart people. Regardless, its composition is nowhere near as important as what Bush does with its recommendations.”

Commission member Tim Penny, a former Democratic representative from Minnesota, says the commission will present its report to Bush at either the end of November or beginning of December. Having pursued the unenviable task of fiscal responsibility in the Democratically controlled U.S. House from 1982 to 1994, Penny thinks of himself as a realist when it comes to tackling tough political matters. He’s more than aware that many pols who somehow get distracted along the path to bold and meaningful reform excuse themselves to get some popcorn never to return.

Penny, however, says that when he was asked to join the panel last spring he “was assured that the president was serious about this.” And he became convinced. In a subsequent meeting with the president, Bush told Penny that reforming the current system is “a leadership issue” designed for the presidency, a “leadership issue” he would meet head-on.

While Penny acknowledges that Bush’s campaign-trail pronouncements about Social Security “were a little vague,” he does point out that it was on the trail that Bush began not only making the case for partial privatization of Social Security accounts, but also alluding to some of the tough choices ahead. Promising that he would “preserve the benefits of all current retirees and those nearing retirement,” Bush would say nothing about those of us who expect to collect Social Security down the road. It’s an implicit acknowledgment of “some restriction of benefits,” as Penny puts it.

Those are the “hard choices,” as the deficit hawks at the Concord Coalition put it in a report this month. Those choices consist of either increasing contributions to the system — read: higher Social Security taxes; securing a higher return on current investments, presumably through partial privatization; reducing benefits, or staggering them based on other income; increasing the age at which Americans can collect Social Security; or increasing the system’s financing from general revenue as opposed to relying solely on payroll taxes.

“Simply counting on robust stock market returns, or presumed fiscal dividends from reform itself, is not a realistic solution,” the Concord Coalition report states. “There is no free lunch solution. Each reform option involves trade-offs and each comes with a fiscal and political price, regardless of whether it aims to prop up the existing pay-as-you-go system or aims at transitioning to a partially pre-funded system.”

Commission officials — none of whom have to face voters — today seem willing to at least discuss hard choices, specifically reducing benefits by tying future benefits to the index of inflation instead of wage growth. They discuss this behind closed doors but it leaks out, of course, since this is Washington and since the point of this commission is in part to float trial balloons. At a press conference, however, Moynihan says that none of us should read too much into their talk.

“I wish you wouldn’t get too preoccupied with the day-to-day events,” he says. “We’re trying to think the way — well, it would be presumptuous to compare ourselves to Edmund Witte, who was the staff director of the Committee on Economic Security that Francis Perkins chaired” — during the Roosevelt administration, forming Social Security. “But they were thinking in terms of 75 years, and they did it pretty well, didn’t they? And here we are about the time to sort of think of the next 75.”

“Have we made any conclusions?” asks Richard Parsons, co-chief operating officer of AOL Time Warner and Moynihan’s co-chair. “Not at this point in time.”

The Democratic National Committee already has begun running an ad slamming Bush for “using gimmicks to hide a raid on Social Security.” But where are the Democrats? Circling like a school of sharks at a Florida surf-a-thon, they sense a winning issue. The Bush plan will raise the retirement age, they say. It will cut benefits, it will put the whole system at risk, it’s unworkable, it will reward big Bush campaign contributors on Wall Street.

But are the Democrats’ counter-claims responsible? How are we supposed to react when the Democratic congressional leadership feigns outrage that Bush would dare to use an accounting gimmick to hide his dip into the Social Security trust fund, when most of those same Democrats have been voting to dip into the trust fund for so long that all that’s in there is a bunch of government IOUs?

And what of their current tactic, the charge that the GOP has created a crisis so as to justify partial privatization? Partial privatization may be the worst idea since New Coke, but the pending crisis is not invented. The current pay-as-you-go approach cannot be sustained. A couple weeks ago, while touring Massachusetts, Sen. John Kerry, D-Mass., called the Democratic Policy Committee’s talking points on Social Security “disingenuous,” and seemed to take issue with how his party was acting as if nothing was wrong with the system.

Penny is quick to point out that the commission’s report is just Step 1 of the process. After all, none of the members of the commission are current lawmakers. After their report, Penny says, the next step might be for Bush to convene a panel of members of Congress to figure out how to enact some of the recommended reforms.

What of a report in the Wall Street Journal that Bush’s senior advisor, Karl Rove, assured GOP lawmakers that nothing would be enacted before the 2002 elections? Penny shrugs. “That may be,” he says.

Kerrey says that in the end he fears Bush, urged by GOP congressional leaders, will opt out of leadership on this issue just as President Clinton did. “My guess is Bush will pretend to do something with it but will do nothing and break one of his campaign promises. And the reason is, the Republican leadership will tell him the same thing Clinton heard from Congress: ‘Hey, we don’t want to fix the damn thing.’

“He challenged Al Gore’s character on this issue,” Kerrey recounts. “He said ‘Gore lacks the character to do anything about it, and I won’t lack the character, I won’t look at political polling data.’ And God bless him if he does. But he’s gonna get a wake-up call from the Hill. They’re gonna tell him, ‘You talked, but don’t do anything. Otherwise we’ll lose the House.”

Not long ago, Kerrey wrote a letter to his old pal Moynihan, urging him to begin describing politicians who haven’t signed onto any proposal to fix Social Security as supporting the “do nothing plan.” While proposals like the one offered by Moynihan and Kerrey on their way out of the Senate — and the pending one from the commission — will be picked to death by opponents, this fight is often uneven since the critics frequently have no counter-plan of their own to defend.

“Five hundred members of Congress support the do-nothing plan,” Kerrey says. “We should make them justify it. Right now, they don’t have to explain it; instead it’s Moynihan who’s trying to fix the problem. I’m suggesting that we don’t let anybody who is not supporting some specific plan off the hook. If they say, ‘I haven’t figured out what to do,’ you say, ‘Well, you must lack the intelligence to be a member of Congress.’ I mean, it’s a very simple thing to figure out. You either raise taxes or increase the amount of income being taxed or you decrease benefits.”

Both Democrats and Republicans have historically been in favor of the do-nothing plan, but the Democrats appear to be leading the charge right now as they oppose Bush’s commission every step of the way.

“Social Security is running a surplus of more than $150 billion, and these surpluses are growing and projected to last for 24 years,” Sen. Paul Wellstone, D-Minn., said in the Democrats’ weekly radio address on Aug. 18. While briefly acknowledging that “the system does face real but manageable long-term financial challenges,” Wellstone went on to say that all was OK in the world of our fading retirement account savings. “Social Security is not in crisis,” Wellstone said. “It is not broken. It is not facing bankruptcy.”

All of those assertions, of course, depend on what your definition of the word “is” is. The Social Security benefits of Wellstone, who turned 57 last month, are indeed guaranteed, not in crisis, not broken, not facing bankruptcy. But by the time Wellstone’s three children, David, Marcia and Mark, and his six grandchildren, Cari, Keith, Joshua, Acacia, Sydney and Matt, try to collect, the system will indeed be broken unless there are major reforms soon. When Wellstone was born, there were approximately 16 workers for every one beneficiary; today that ratio is about 3-to-1. And it’s shrinking as baby boomers reach retirement age. Facing what promises to be a tough reelection contest next year, Wellstone has long opposed raising the retirement age or reducing benefits so as to solve the problem facing his progeny. “The greatest danger facing Social Security today is the Wall Street campaign to privatize it,” he has said.

Bush is to be lauded for even addressing this issue seriously, but one has to wonder how square he’s being with us. Since the transition costs of partial privatization have been estimated to cost as much as $1 trillion, where is that cash going to come from? He has yet to address that question, either as a candidate or a president.

Last year, hectored for weeks by the campaign of Vice President Al Gore about how he would fund the privatization plan, Bush finally said during the third presidential debate that “we need to take a trillion dollars out of that $2.4 trillion surplus.” But a funny thing happened to that $2.4 trillion: It was spent on the tax cut. Last week’s International Monetary Fund report indicated that the price tag of the $1.35 trillion cut will be at least $2.5 trillion.

“The recently enacted tax cut considerably weakens the chances that the President’s Commission will succeed in designing a credible plan to restore long-term Social Security solvency,” said Robert Greenstein, executive director of the Center on Budget and Policy Priorities, and Peter Orszag, a senior fellow at Brookings Institution, in a joint statement. “In a fundamental sense, the tax cut has undermined the opportunity that the nation had to use the projected budget surpluses as a substantial down payment on the longer-term budgetary pressures facing the nation.”

Tellingly, the Bush administration doesn’t seem to actually be preparing for any major Social Security reforms. In a July 23 letter to Sen. Max Baucus, D-Mont., Stephen C. Goss — chief actuary for the Social Security Administration and a technical advisor to the President’s Commission — acknowledged that while the payroll tax revenues for Social Security are scheduled to exceed costs only until 2016, if the president’s proposed partial privatization plan were to be enacted that date would be moved to 2007.

Moreover, at a press conference on Wednesday, Mitchell Daniels, director of the Office of Management and Budget, acted as if the major reform measures the President’s Commission is currently preparing to propose can be added to the budget with no problem.

As Daniels announces $1 trillion in future budget surpluses — a fairly rosy scenario, it should be noted — he’s asked if the administration is willing to commit that trillion to the costs of partially privatizing Social Security.

“With regard to Social Security reform, no one knows what the transition costs may be,” Daniels responds. “I’ve heard numbers as high as the $1 trillion you used, but I don’t think anybody knows that yet, and I think the president wants to await the report of the commission and work that’s going on within the administration before we can really cost out a plan.”

But optimists — notably those who no longer hold elected office — say Congress may yet take action. “I have a sense that both sides recognize they’re going to have do something soon and it’s going to have to be responsible,” former Sen. Warren Rudman, R-N.H, a deficit hawk and one of the founders of the Concord Coalition, says. “The numbers over the long term are very discouraging for young people paying into the system today. It’s no wonder they have no confidence in the system.”

But it’s not just the system some of us don’t have confidence in.