One of the guiding principles of Tea Party-era Republicanism — if Barack Obama’s for it, we’re against it — is on a collision course with a hard deadline, and GOP leaders are apparently getting nervous.

At issue is the expiration of payroll tax cuts that Obama insisted on when he cut a deal with congressional Republicans last year to extend the Bush tax cuts. The 4.2 percent rate that workers have been paying will revert to the old level of 6.2 percent unless Congress and the White House can reach a deal before the end of the year. For most of this year, Republicans have been signaling strong opposition to extending the cuts. Over the summer, Rep. Paul Ryan belittled the payroll tax cut as “sugar-high economics,” while just this past Sunday Sen. Jon Kyl argued that it “has not stimulated job creation. We don’t think that is a good way to do it.”

This reflexive opposition seems to come from two places. One is philosophical: It’s hard to argue at this point that today’s conservatives aren’t a lot more interested in lowering the tax burden on the wealthy — “job-creators,” in the right’s parlance — than on workers. The other is political: The payroll tax cut is essentially Obama’s idea, and the conservative movement has shown a tendency since 2009 to turn against ideas it once embraced if Obama takes them up.

But with Democrats from Obama down loudly calling for the tax holiday to be extended, Republicans, if they dig their heels in, run the very real risk of being blamed for an election year tax squeeze that millions of voters will feel. If the cuts expire, the average family will face a tax increase of $1,000 in 2012.

So Democrats are turning up the heat. On the Senate side, they are set to force a vote this week on a plan that would further reduce the rate to 3.1 percent for 2012, paying for it by applying a 3.25 percent income surcharge on millionaires. The plan would also apply the 3.1 percent rate to employers for the first $5 million of their payrolls, and exempt them outright from the payroll tax for the first $50 million of their payroll for new new hires.

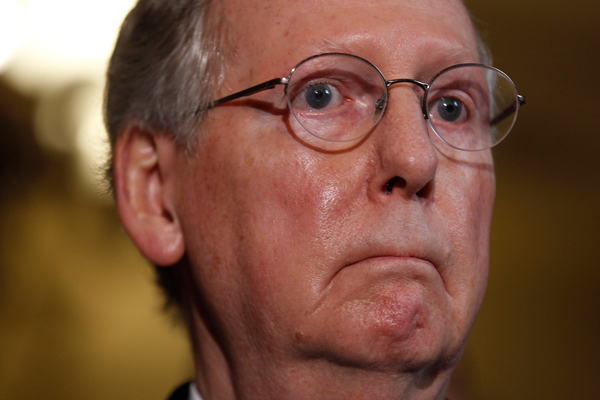

And Republicans are starting to sweat. On Tuesday, just 48 hours after Kyl, the second-ranking Republican in the Senate, seemed to sniff at the idea of an extension, Minority Leader Mitch McConnell sent a very different message, saying that there is now a “majority sentiment” within the GOP for an extension and vowing to present an alternative plan to achieve it. “In all likelihood we will agree to continue the current payroll tax relief for another year,” McConnell said.

Clearly, McConnell recognizes that the political risk for the GOP in blocking an extension. His party’s image has already suffered terribly this year, as Republican leaders have felt compelled by Tea Party pressure to use the new power they won in the 2010 midterms to pursue a confrontational and ideologically polarizing agenda, one that has forced congressional Republicans into a series of politically draining showdowns with the White House. This has helped bring the GOP’s favorable rating to a modern low and created a potential opening for Obama to survive the ’12 election simply by running against the Republican label — and for Democrats to retain control of the Senate and maybe even win back the House by doing the same. Shouldering the blame for a sizable tax increase on the middle class won’t help the GOP’s problems at all.

The signals that some Republican senators are sending suggest a workable compromise could actually be possible. Both Sens. Susan Collins and Pat Roberts actually suggested on Tuesday that they might be OK with paying for a payroll tax extension with increased taxes on the wealthy if some kind of exemption could be included to protect small business owners from any hikes. According to Suzy Khimm, only two percent of small business owners would be affected by the plan that Democrats are now offering, so that demand may not be impossible for Democrats to accommodate, if other Republicans are willing to take the same posture.

But that would still leave a potential problem: the House, where Tea Party influence is much more pronounced and where Speaker John Boehner lived in fear of an intraparty mutiny since the 112th Congress began. Boehner has said he’s ready to discuss an extension with the White House, but it remains to be seen what the majority of his members can live with. For instance, it’s hard to see the House’s true believer conservatives favoring any kind of a tax increase, even in the name of extending a tax cut that benefits millions of Americans.

And while modern conservative dogma generally holds that tax cuts pay for themselves by spurring growth and increasing revenue, that logic may not apply to the payroll tax situation — which explains why Ryan, the face of Tea Party economics in the House, claimed over the summer that extending the holiday “would simply exacerbate our debt problems.” In other words, the idea of simply extending the cuts without offsets — something Sen. Scott Brown suggested on Tuesday — may be a nonstarter too.

McConnell’s sudden announcement on Tuesday suggests that Republican leaders are quickly waking up to the danger that this debate poses to their party’s 2012 prospects. The question is whether the GOP’s Tea Party wing will end up seeing things the same way.