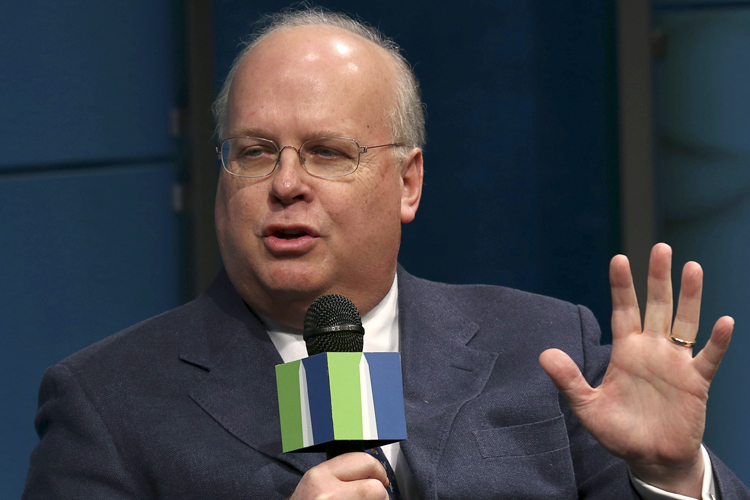

Since the diabolical pairing of federal court cases decided in Citizens United and Speechnow, donors looking to spend unlimited amounts of funds to sway the political process — but keep their precious names undisclosed — have been parking their largesses in so-called dark money groups, organized under section 501(c)(4) of the tax code. Perhaps the two most famous of these “nonprofits” you may have heard of are Karl Rove’s Crossroads GPS, the sister organization to the super PAC American Crossroads, and the Koch brothers-backed Americans for Prosperity, seen recently pounding the hell out of vulnerable Senate Democrats everywhere. These two very obviously political vehicles, like others, receive a tax exemption under the guise of “social welfare,” which allows them to shield their donors from public scrutiny.

A lot of people believe that this arrangement is a complete joke that needs to be fixed. And that’s because it’s quite obviously a complete joke that needs to be fixed.

But as the IRS, over the past year, has been trying to fix it by clarifying the rules for 501(c)(4) exemption, something interesting has happened: everyone, from across the spectrum, has complained about the new, proposed language; the general tenor has been that the new language would essentially destroy all activism in the United States. The IRS received a record 150,000 comments in the months following the release of the proposed fix. The commissioner of the IRS said this week that the agency is preparing to issue a rewrite that addresses some of these concerns. But at this point, it’s unlikely that the howling will disappear no matter what they come up with, and the abuse will continue unfettered.

This trying, tediously bureaucratic episode demonstrates a tough lesson: Once campaign finance rules are relaxed and all sorts of predictable, expensive abuse occurs, it’s extremely difficult to repair that without damaging everything else.

The rise of (c)(4)s as the shady donor’s electioneering vehicle of choice served as the background to last year’s “IRS scandal,” which in turn led to the current interminable rule-fixing process. The period following Citizens United coincided with the rise of the Tea Party, and applications for such tax-exempt status soared. The IRS, lacking proportionate manpower, used various search terms to sift through the files for potentially shady applications. (Some huckster wants tax-exempt status to solicit donations for his nonprofit, and that money in turn can be converted into highly political posters with Obama in devil horns and/or a comfortable salary for oneself, for example.) Among these search terms were things like “Tea Party” — oops! And so the IRS was dragged into a year-long (so far) investigation into its standards for applying special scrutiny.

The IRS has complained, reasonably, that it could do a more judicious job screening applications with more funding (instead, it’s gotten less) and a clarification of tax-exemption rules. The agency is trying to weed out groups that are political organizations: where political activity is, effectively, the “primary” purpose of these groups.

And so began the process that led to this proposed change (via the LA Times):

The draft rules would replace the current definition of political activity — “direct or indirect participation or intervention in political campaigns on behalf of or in opposition to any candidate for public office” — with this language: “direct or indirect candidate-related political activity.” That term is further defined to include “any public communication that is made within 60 days before a general election or 30 days before a primary election and that clearly identifies a candidate for public office (or, in the case of a general election, refers to a political party represented in that election).” This language is similar to that in federal law governing “electioneering communications” about federal candidates, but it also would include candidates for state and local office.

If it were up to us — and probably for the best, it’s not — we’d change the current definition of “political activity” to “where you’re obviously just trying to help one political party win elections.” And … poof! There would go tax-exempt status and donor-shielding for Crossroads GPS and Americans for Prosperity.

What the IRS is finding, though, is that once an avalanche of new cash has been released and such groups have popped up to launder it into elections, it’s extremely difficult then to find the right wording that doesn’t affect even the non-controversial nonprofit work. As the New York Times wrote in February, near the end of the comment period:

With time running short, both progressive and conservative advocacy groups are raising serious objections to new rules proposed by the Obama administration to rein in political activity by nonprofit organizations that are not required to disclose sources of their funding.

In a rare agreement between Tea Party and liberal activists, organizations across the political spectrum say new regulations drafted by the Internal Revenue Service to curb a surge in political spending and activity by nonprofits are far too broad. They fear that enforcement of the regulations would chill more neutral civic initiatives such as voter registration efforts and candidate forums.

So, the IRS is going to give this another go.

Think for a second: Is there any way that the rule can be rewritten, in an effective way, that won’t lead to howls from the entirety of the nonprofit world? The sad truth is that abuse by the likes of Karl Rove and the Koch brothers since Citizens United has made it so that a serious clampdown may spread collateral damage all around. So once again: Thanks, Supreme Court. No corruption to see here, just more and more glorious (undisclosed) freedom of speech.