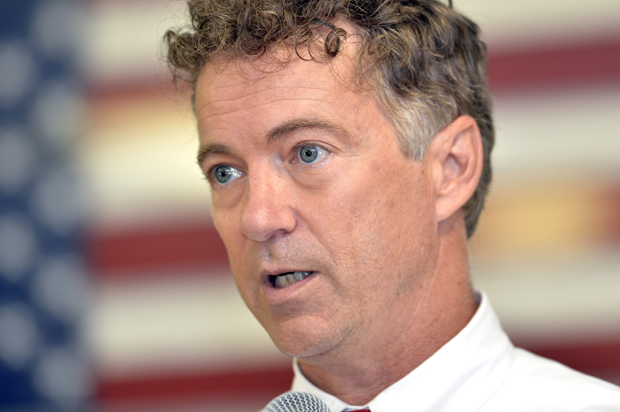

As some of you may have heard, Sen. Rand Paul provided us with some of his famous libertarian insight the other day. When asked about whether his flat tax plan, which would make all incomes over $50,000 taxable by an equal 14.5 percent, would increase income inequality, which is already at record highs, he responded:

“The thing is, income inequality is due to some people working harder and selling more things. If people voluntarily buy more of your stuff, you’ll have more money….It’s a fallacious notion to say, ‘Oh, rich people get more money back in a tax cut,’ if you cut taxes 10 percent, 10 percent of a million is more than 10 percent of a thousand dollars. So, obviously, people who pay more in taxes will get more back.”

At a time when the top 1 percent’s share of income has just about tripled over the past four decades, and is now at similar heights as just before the Great Depression in 1928, it is interesting to hear a presidential candidate shrug it off as if it were a minor issue. Paul’s notion that income inequality is because of “some people working harder” is wonderfully dumb, and it causes me to wonder what Sen. Paul imagines hard work to be. Is a CEO or a politician’s job harder than, say, a coal miner or fisherman’s — which, by the way, are considered by many to be the “hardest” jobs in America. Paul seems to assume that everyone is “selling things” rather than selling (renting) their labor to capitalists or the state.

This is a very libertarian way of thinking — looking at every working person as a small businessperson selling whatever good they produce with the sweat of their brow. This is what I have previously called lemonade-stand capitalism. Before economies became industrialized during the 18th and 19th centuries, this model of labor was true for a certain class of working individuals, called artisans. These workers were somewhat like small businessmen, crafting various goods or providing services that required a certain degree of skill in towns and cities. As capitalism and industrialization grew, the need for artisans decreased, as goods that had previously been crafted by artisans began to be mass produced much more efficiently through the division of labor.

But enough history; today, the majority of people in America do not sell anything other than their labor value — whether they work for a multinational corporation, a small business or the state. There are about 28 million small businesses in America — ranging from self-employed therapists to businesses with hundreds of employees. In the case of small businesses, what Paul said makes logical sense — owners who sell more goods (or services) have more money.

However, like it or not, the majority of Americans are not small business owners. There are nearly 320 million citizens in the United States, and most of them sell their labor to the business owners who employ them. For these individuals, whether they are coal miners or computer scientists, they produce a certain amount of value, and receive a fraction of this value in income. Now, when looking at actual workers who sell their labor to capitalists, it is clear that working harder or being more productive has done little to make them wealthier.

Since the 1980s, these workers have been paid less and less for their labor. As productivity increased with technology, capitalists have managed to get even more out of the workers’ labor. Moreover, our income-tax system was completely overhauled with the Tax Reform Act of 1986, which cut many loopholes, but also slashed the top marginal rate from 70 percent in 1981 to 28 percent in 1988. Since then, executives have become increasingly well paid, while everyone else has seen their pay stagnate. No doubt, there are many reasons for the rise in income inequality, but creating a less progressive tax system is a big one.

It seems quite obvious that when the top tax rate is slashed, top earners become much wealthier — especially because they can demand outrageously high wages without worrying about it being taxed at a higher rate. Imagine you are a CEO discussing your pay package with the board, for example. If you know that your income will be taxed at a higher rate the more you earn, there is less incentive to demand outrageous sums. If you know that you will be taxed at the same rate of 14 percent regardless of what you make, you will reach for the sky. There is no doubt that income inequality will only increase with Rand’s radical plan.

When income inequality has reached record highs, it is not wise to move toward a plan that will only increase this inequality. Paul’s beliefs are based largely on the false notion that every single person sells something, and that if they work harder, they will make more. This is a childish and utopian view of the economy. The truth is that Paul does not care about income inequality, and neither do any of the other GOP candidates. This idea that some people are lazy and others are hard workers is sacred in Republican circles. As with many other issues, the “just-world bias” kicks in whenever inequalities or injustices are discussed, and explained away with this notion that people get what they deserve. By now Paul should understand how false this notion is. He is, after all, competing with Donald Trump.