Somewhere in the middle of the Long March that was Wednesday night’s Republican debate, Donald Trump said something sensible about taxes.

You could be forgiven for missing the moment amid the blizzard of grade-school insults and flat-out lying coming from the stage at the Ronald Reagan Library. Heck, you could be forgiven for skipping the debate because you found that re-watching the Sharknado trilogy was a better use of your time. But considering the unquestioned assumptions that formed the foundation for the candidates’ views – that the Iran deal is a terrible one that weakens America, that the Planned Parenthood videos show a baby being murdered to harvest its brain, that vaccines cause autism – it’s interesting that the current GOP frontrunner once again challenged standing Republican orthodoxy on income taxes, and hardly anyone seems to have noticed.

I wrote about this a couple of weeks ago. Trump had just told Bloomberg TV that he found the low taxes paid by millionaires “outrageous” and would happily raise their rates if he’s elected. It was an electric moment for a party that has spent much of the Obama administration shrieking about the president raising the marginal rates on incomes over $400,000 as if he had wired the additional revenue directly into Vladimir Putin’s personal bank account.

Remarkably, Trump’s nod towards semi-sensible tax reform (I’d give him more credit if this wasn’t the only sensible part of his plan) didn’t seem to hurt his poll numbers. So when Jake Tapper turned the discussion to the candidates’ tax plans Wednesday night, he kept at it.

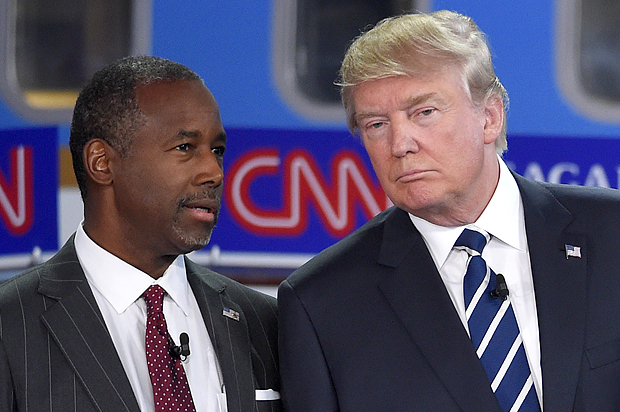

TAPPER: Dr. Carson, you support scrapping the entire tax code and replacing it with a flat tax based on the principal on tithing from the Bible. If you make $10 billion, you pay $1 billion in taxes, if you make $10, you pay $1 in taxes.

Donald Trump believes in progressive taxation. He says it’s not right that rich people pay the same as the poor. Tell Donald Trump why his ideas on taxes are wrong.

BEN CARSON: You know, the people who say the guy who paid a billion dollars because he had 10, he has still got $9 billion left, that’s not fair, we need to take more of his money. That’s called socialism. That doesn’t work so well.

As Tapper said, Carson’s proposal is to tax everyone’s income at the rate of 10 percent, which is actually one point higher than what Herman Cain proposed in his infamous “9-9-9 Plan” in 2012, because come on, nine percent is just irresponsible. But the funniest part of Carson’s answer is his contention that taxing the wealthy at a higher rate is socialism. It’s the kind of dumb talking point you find across the right wing. Trump immediately smacked it down.

One thing I’ll say to Ben is that we’ve had a graduated tax system for many years, so it’s not a socialistic thing. What I’d like to do, and I’ll be putting in the plan in about two weeks, and I think people are going to like it, it’s a major reduction in taxes. It’s a major reduction for the middle class. The hedge fund guys won’t like me as much as they like me right now. I know them all, but they’ll pay more. I know people that are making a tremendous amount of money and paying virtually no tax, and I think it’s unfair.

What struck me most about this moment was that, though the candidates had shown a willingness all night to jump on each other’s comments and talk out of turn, not one of them stepped up to defend Ben Carson or tell Donald Trump that nuh-uh, we are too laboring under socialism and punishing society’s makers with higher taxes. And all of these candidates are wealthy people whose effective tax rates would go up if President Trump managed to push through his plan to raise marginal rates while closing the carried-interest loophole that spares more of their investment income from the government’s clutches.

What’s more, the debate audience did not react. And these were presumably California Republicans, a people who have a history of supporting utterly absurd tax proposals. Perhaps some of them have noticed that while they might have benefitted personally from Proposition 13, their state has suffered.

There are three possibilities for why Trump went unchallenged here. The first is that the other candidates were picking their battles carefully and none felt this one was worth fighting. After all, Tapper gave Mike Huckabee and Rand Paul a chance to talk about their own beliefs in the flat tax, so it got its moment in the sun.

The second possibility is that none of them were actually listening to Trump.

The third possibility is the most tantalizing. Four years after Obama clobbered Mitt Romney and his Ayn Rand fanboy vice-presidential nominee, Paul Ryan, and given the poll numbers Trump has maintained with his populist tax plan, is it possible that at least some in the GOP realize that the “don’t tax society’s makers” argument is a loser? Is it possible that at least some of these candidates have long known it’s a scam and recognize that the American people have finally caught on? Is there any chance at all that the anti-tax fever that has gripped the GOP for generations has finally moderated a tiny bit and will eventually – pardon the pun – trickle down to others in the party?

Personally, I’m betting on number two. But I would love to be wrong.