The only thing wrong with the U.S. economy is the failure of the Republican Party to play Santa Claus.

-Jude Wanniski, March 6, 1976

The Republican Party has been running a long con on America since Reagan’s inauguration, and somehow our nation’s media has missed it – even though it was announced in The Wall Street Journal in the 1970s and the GOP has clung tenaciously to it ever since.

In fact, Republican strategist Jude Wanniski’s 1974 “Two Santa Clauses Theory” has been the main reason why the GOP has succeeded in producing our last two Republican presidents, Bush and Trump (despite losing the popular vote both times). It’s also why Reagan’s economy seemed to be “good.”

Here’s how it works, laid it out in simple summary:

First, when Republicans control the federal government, and particularly the White House, spend money like a drunken sailor and run up the US debt as far and as fast as possible. This produces three results – it stimulates the economy thus making people think that the GOP can produce a good economy, it raises the debt dramatically, and it makes people think that Republicans are the “tax-cut Santa Claus.”

Second, when a Democrat is in the White House, scream about the national debt as loudly and frantically as possible, freaking out about how “our children will have to pay for it!” and “we have to cut spending to solve the crisis!” This will force the Democrats in power to cut their own social safety net programs, thus shooting their welfare-of-the-American-people Santa Claus.

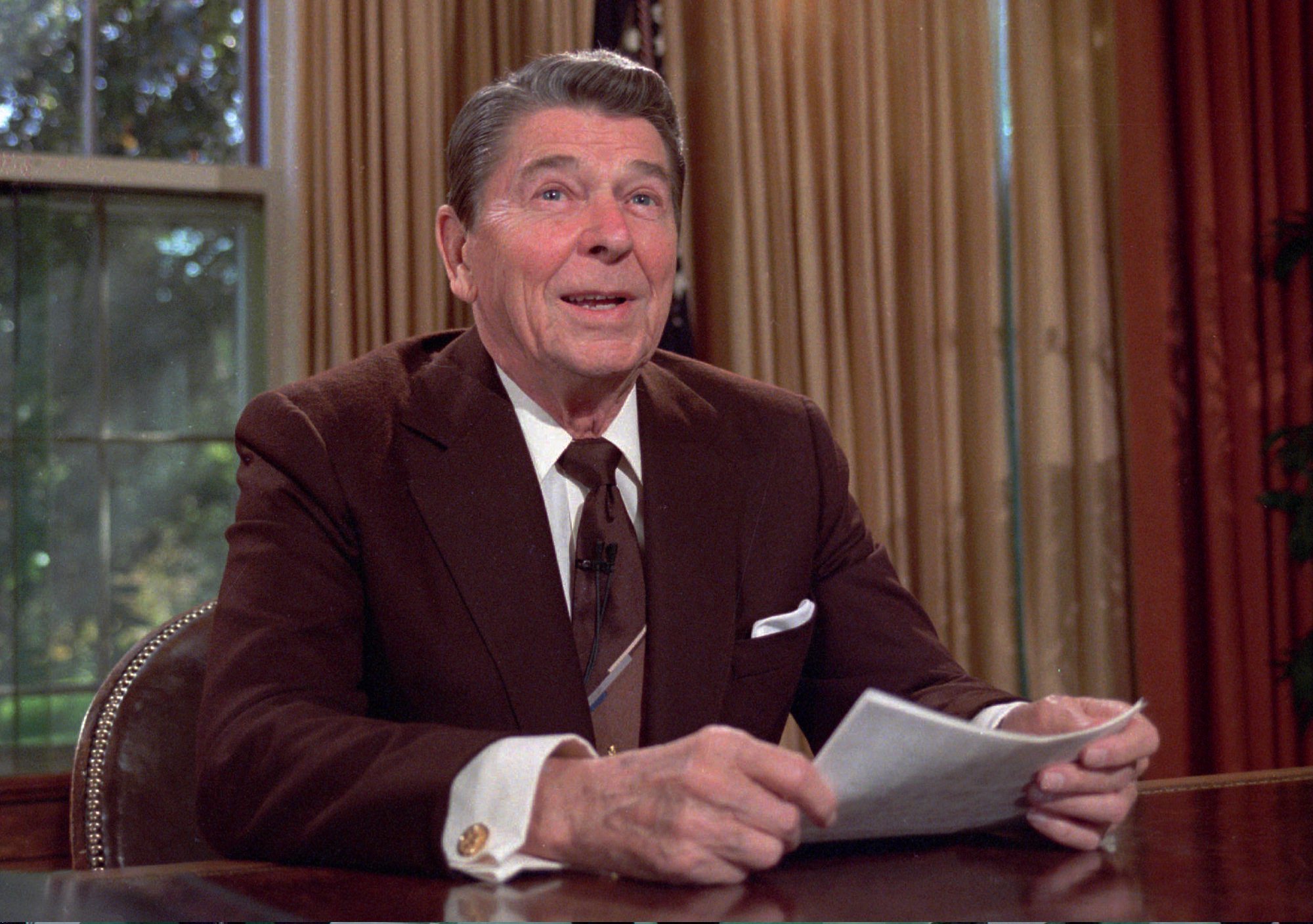

Think back to Ronald Reagan, who more than tripled the US debt from a mere $800 billion to $2.6 trillion in his 8 years. That spending produced a massive stimulus to the economy, and the biggest non-wartime increase in the debt in history. Nary a peep from Republicans about that 218% increase in our debt; they were just fine with it.

And then along came Bill Clinton. The screams and squeals from the GOP about the “unsustainable debt” of nearly $3 trillion were loud, constant, and echoed incessantly by media from CBS to NPR. Newt Gingrich rode the wave of “unsustainable debt” hysteria into power, as the GOP took control of the House for the first time lasting more than a term since 1930, even though the increase in our national debt under Clinton was only about 37%.

The GOP “debt freakout” was so widely and effectively amplified by the media that Clinton himself bought into it and began to cut spending, taking the axe to numerous welfare programs (“It’s the end of welfare as we know it” he famously said, and “The era of big government is over”). Clinton also did something no Republican has done in our lifetimes: he supported several balanced budgets and handed a budget surplus to George W. Bush.

When George W. Bush was given the White House by the Supreme Court (Gore won the popular vote by over a half-million votes) he reverted to Reagan’s strategy and again nearly doubled the national debt, adding a trillion in borrowed money to pay for his tax cut for GOP-funding billionaires, and tossing in two unfunded wars for good measure, which also added at least (long term) another $5 to $7 trillion.

There was not a peep about the debt from any high-profile in-the-know Republicans then; in fact, Dick Cheney famously said, essentially ratifying Wanniski’s strategy, “Reagan proved deficits don’t matter. We won the midterms [because of those tax cuts]. This is our due.” Bush and Cheney raised the debt by 86% to over $10 trillion (although the war debt wasn’t put on the books until Obama entered office).

Then comes Democratic President Barack Obama, and suddenly the GOP is hysterical about the debt again. So much so that they convinced a sitting Democratic president to propose a cut to Social Security (the “chained CPI”). Obama nearly shot the Democrats biggest Santa Claus program. And, Republican squeals notwithstanding, Obama only raised the debt by 34%.

Now we’re back to a Republican president, and once again deficits be damned. Between their tax cut and the nearly-trillion dollar spending increase passed on February 8th, in the first year-and-a-month of Trump’s administration they’ve spent more stimulating the economy (and driving up debt by more than $2 trillion, when you include interest) than the entire Obama presidency.

Consider the amazing story of where this strategy came from, and how the GOP has successfully kept their strategy from getting into the news; even generally well-informed writers for media like the Times and the Post – and producers, pundits and reporters for TV news – don’t know the history of what’s been happening right in front of us all for 37 years.

Republican strategist Jude Wanniski first proposed his Two Santa Clauses strategy in 1974, when Richard Nixon resigned in disgrace and the future of the Republican Party was so dim that books and articles were widely suggesting the GOP was about to go the way of the Whigs. There was genuine despair across the Party, particularly when Jerry Ford began stumbling as he climbed the steps to Air Force One and couldn’t even beat an unknown peanut farmer from rural Georgia for the presidency.

Wanniski was tired of the GOP failing to win elections. And, he reasoned, it was happening because the Democrats had been viewed since the New Deal as the Santa Claus party (taking care of people’s needs and the General Welfare), while the GOP, opposing everything from Social Security to Medicare to unemployment insurance, was widely seen as the party of Scrooge.

The Democrats, he noted, got to play Santa Claus when they passed out Social Security and Unemployment checks – both programs of the New Deal – as well as when their “big government” projects like roads, bridges, and highways were built, giving a healthy union paycheck to construction workers and making our country shine.

Democrats kept raising taxes on businesses and rich people to pay for things, which didn’t seem to have much effect at all on working people (wages were steadily going up, in fact), and that added to the perception that the Democrats were a party of Robin Hoods, taking from the rich to fund programs for the poor and the working class.

Americans loved the Democrats back then. And every time Republicans railed against these programs, they lost elections.

Wanniski decided that the GOP had to become a Santa Claus party, too. But because the Republicans hated the idea of helping working people, they had to figure out a way to convince people that they, too, could have the Santa spirit. But what?

“Tax cuts!” said Wanniski.

To make this work, the Republicans would first have to turn the classical world of economics — which had operated on a simple demand-driven equation for seven thousand years — on its head. (Everybody understood that demand — aka “wages” — drove economies because working people spent most of their money in the marketplace, producing demand for factory output and services.)

In 1974 Wanniski invented a new phrase — “supply side economics” — and suggested that the reason economies grew wasn’t because people had money and wanted to buy things with it but, instead, because things were available for sale, thus tantalizing people to part with their money.

The more things there were, he said, the faster the economy would grow. And the more money we gave rich people and their corporations (via tax cuts) the more stuff they’d generously produce for us to think about buying.

At a glance, this move by the Republicans seems irrational, cynical and counterproductive. It certainly defies classic understandings of economics. But if you consider Jude Wanniski’s playbook, it makes complete sense.

To help, Arthur Laffer took that equation a step further with his famous napkin scribble. Not only was supply-side a rational concept, Laffer suggested, but as taxes went down, revenue to the government would go up! Neither concept made any sense – and time has proven both to be colossal idiocies – but together they offered the Republican Party a way out of the wilderness.

Ronald Reagan was the first national Republican politician to fully embrace the Two Santa Clauses strategy. He said straight out that if he could cut taxes on rich people and businesses, those tax cuts would cause them to take their surplus money and build factories, and that the more stuff there was supplying the economy the faster it would grow.

George Herbert Walker Bush – like most Republicans in 1980 who hadn’t read Wanniski’s piece in The Wall Street Journal – was horrified. Ronald Reagan was suggesting “Voodoo Economics,” said Bush in the primary campaign, and Wanniski’s supply-side and Laffer’s tax-cut theories would throw the nation into such deep debt that, he believed, we’d ultimately crash into another Republican Great Depression.

But Wanniski had been doing his homework on how to sell “voodoo” supply-side economics.

In 1976, he rolled out to the hard-right insiders in the Republican Party his “Two Santa Clauses” theory, which would enable the Republicans to take power in America for the next forty years.

Democrats, he said, had been able to be “Santa Clauses” by giving people things from the largesse of the federal government. From food stamps to new schools to sending a man to the moon, the people loved the “toys” the Democrats brought every year.

Republicans could do that, too, the theory went – spending could actually increase without negative repurcussions. Plus, Republicans could be double Santa Clauses by cutting people’s taxes!

For working people it would only be a small token – a few hundred dollars a year on average – but would be heavily marketed. And for the rich, which wasn’t to be discussed in public, it would amount to hundreds of billions of dollars in tax cuts.

The rich, Reagan, Bush, and Trump told us, would then use that money to import or build more stuff to market, thus stimulating the economy and making average working people richer. (And, of course, they’d pass some of that money back to the GOP, like the Kochs giving Paul Ryan $500,000.00 right after he passed the last tax cut that gave them billions.)

There was no way, Wanniski said, that the Democrats could ever win again. They’d be forced into the role of Santa-killers by raising taxes, or anti-Santas by cutting spending. Either one would lose them elections.

When Reagan rolled out Supply Side Economics in the early 80s, dramatically cutting taxes while exploding spending, there was a moment when it seemed to Wanniski and Laffer that all was lost. The budget deficit exploded and the country fell into a deep recession — the worst since the Great Depression — and Republicans nationwide held their collective breath.

But David Stockman came up with a great new theory about what was going on — they were “starving the beast” of government by running up such huge deficits that Democrats would never, ever in the future be able to talk again about national health care or improving Social Security.

And this so pleased Alan Greenspan, the Fed Chairman, that he opened the spigots of the Fed, dropping interest rates and buying government bonds, producing a nice, healthy goose to the economy.

Greenspan further counseled Reagan to dramatically increase taxes on people earning under $37,800 a year by doubling the Social Security (FICA/payroll) tax, and then let the government borrow those newfound hundreds of billions of dollars off-the-books to make the deficit look better than it was.

Reagan, Greenspan, Winniski, and Laffer took the federal budget deficit from under a trillion dollars in 1980 to almost three trillion by 1988, and back then a dollar could buy far more than it buys today. They and George HW Bush ran up more debt in eight years than every president in history, from George Washington to Jimmy Carter, combined.

Surely this would both starve the beast and force the Democrats to make the politically suicidal move of becoming deficit hawks. And that’s just how it turned out.

Bill Clinton, who had run on an FDR-like platform of a “New Covenant” with the American people that would strengthen the institutions of the New Deal, strengthen labor, and institute a national health care system, found himself in a box.

A few weeks before his inauguration, Alan Greenspan and Robert Rubin sat him down and told him the facts of life: he was going to have to raise taxes and cut the size of government. Clinton took their advice to heart, raised taxes, balanced the budget, and cut numerous programs, declaring an “end to welfare as we know it” and, in his second inaugural address, an “end to the era of big government.”

Clinton was the anti-Santa Claus, and the result was an explosion of Republican wins across the country as Republican politicians campaigned on a platform of supply-side tax cuts and pork-rich spending increases. State after state turned red, and the Republican Party rose to take over, ultimately, every single lever of power in the federal government, from the Supreme Court to the White House.

Looking at the wreckage of the Democratic Party all around Clinton by 1999, Winniski wrote a gloating memo that said, in part: “We of course should be indebted to Art Laffer for all time for his Curve… But as the primary political theoretician of the supply-side camp, I began arguing for the ‘Two Santa Claus Theory’ in 1974. If the Democrats are going to play Santa Claus by promoting more spending, the Republicans can never beat them by promoting less spending. They have to promise tax cuts…”

Ed Crane, then-president of the Koch-funded Libertarian CATO Institute, noted in a memo that year: “When Jack Kemp, Newt Gingich, Vin Weber, Connie Mack and the rest discovered Jude Wanniski and Art Laffer, they thought they’d died and gone to heaven. In supply-side economics they found a philosophy that gave them a free pass out of the debate over the proper role of government. Just cut taxes and grow the economy: government will shrink as a percentage of GDP, even if you don’t cut spending. That’s why you rarely, if ever, heard Kemp or Gingrich call for spending cuts, much less the elimination of programs and departments.”

Two Santa Clauses had gone mainstream. Never again would Republicans worry about the debt or deficit when they were in office; and they knew well how to scream hysterically about it as soon as Democrats took power.

George W. Bush embraced the Two Santa Claus Theory with gusto, ramming through huge tax cuts – particularly a cut to the capital gains tax rate on people like himself who made their principle income from sitting around the mailbox waiting for their dividend or capital gains checks to arrive – and blew out federal spending.

Bush, with his wars, even out-spent Reagan, which nobody had ever thought would again be possible. And it all seemed to be going so well, just as it did in the early 1920s when a series of three consecutive Republican presidents cut income taxes on the uber-rich from over 70 percent to under 30 percent.

In 1929, pretty much everybody realized that instead of building factories with all that extra money, the rich had been pouring it into the stock market, inflating a bubble that – like an inexorable law of nature – would have to burst.

But the people who remembered that lesson were mostly all dead by 2005, when Jude Wanniski died and George Gilder celebrated the Reagan/Bush supply-side-created bubble economies in a Wall Street Journal eulogy:

“…Jude’s charismatic focus on the tax on capital gains redeemed the fiscal policies of four administrations. … Unbound by zero-sum economics, Jude forged the golden gift of a profound and passionate argument that the establishments of the mold must finally give way to the powers of the mind. … He audaciously defied all the Buffetteers of the trade gap, the moldy figs of the Phillips Curve, the chic traders in money and principle, even the stultifying pillows of the Nobel Prize.”

In reality, his tax cuts did what they have always done over the past 100 years – they initiated a bubble economy that would let the very rich skim the cream off the top just before the ceiling crashed in on working people. Just like today.

The Republicans got what they wanted from Wanniski’s work. They held power for thirty years, made themselves trillions of dollars, and cut organized labor’s representation in the workplace from around 25 percent when Reagan came into office to around 6 of the non-governmental workforce today.

Over time, and without raising the cap, Social Security will face an easily-solved crisis, and the GOP’s plan is for force Democrats to become the anti-Santa, yet again. If the GOP-controlled Congress continues to refuse to require rich people to pay into Social Security (any income over $128,000 is SS-tax-free), either benefits will be cut or the retirement age will have to be raised to over 70.

The GOP plan is to use this unnecessary, manufactured crisis as an opening to “reform” Social Security – translated: cut and privatize. Thus, forcing Democrats to become the Social Security anti-Santa a different way.

When this happens, Democrats must remember Jude Wanniski, and accept neither the cut to disability payments nor the entree to Social Security “reform.” They must demand the “cap” be raised, as Bernie Sanders proposed and the Democratic Party adopted in its 2016 platform.

And, hopefully, some of our media will begin to call the GOP out on the Two Santa Clauses program. It’s about time that Americans realized the details of the scam that’s been killing wages and enriching billionaires for nearly four decades.