Janet Yellen, the former head of the Federal Reserve who stepped down earlier this year, once declared that economic expansions don’t die of old age. Her remark has become a popular slogan among economists when they’re asked whether the U.S. is long overdue for a recession.

It’s not an absurd question. Since World War II, the average period of U.S. economic growth between recessions has been about five years, with the average recession lasting about 11 months. Nine years after the worst recession in 85 years ended, many watchers are wondering (some impatiently) how much longer this current long and slow expansionary period can continue.

All the indicators point to continued economic growth, at least for now. There’s a significant danger, however, that President Trump’s sustained trade bluster will generate headwinds offsetting any benefits realized by his corporate tax cuts.

On Thursday, the Department of Commerce announced the nation’s gross domestic product for the first three months of the year grew by 2 percent, a downgrade from earlier estimates but still higher than the same period in the previous two years. Wall Street firms are predicting the stimulus of GOP tax cuts that passed in December will boost second-quarter GDP by as much as 4.5 percent.

The question is this: How much life is left in the current economic expansion, and will President Donald Trump’s hostile attitude toward trading partners cause the U.S. economy to contract?

Trade Wars Are Bad for Business

The Trump administration has lashed out at Mexico, Canada, China and the European Union by announcing a series of punitive trade measures it says are aimed at punishing countries for exploiting the U.S., but these threats have also rattled U.S. manufacturers and agricultural exporter who either depend on a supply of imported materials or access to foreign markets.

In addition to steel and aluminum tariffs announced by the administration earlier this year, the president has floated a 20 percent import tax on European cars, has demanded a renegotiation of the North American Free Trade Agreement to position the U.S. more favorably, and has played tough with China in a way that could hurt the U.S. farm belt. Countries have responded with a raft of retaliatory tariffs against U.S. exports, especially agricultural products.

“A trade war is really the only cloud I see on the horizon, but it’s a big one,” Joseph E. Gagnon, senior fellow at Peterson Institute for International Economics, told Salon. “If you think Donald Trump is going to raise tariffs on $400 billion in Chinese imports and the Chinese retaliate then I think there will be a recession. But I don’t know how likely that is.”

So far, economists are saying the situation hasn’t escalated into a full-blown trade war, but business owners and executives despise uncertainty. Even a threat to their supply chains and exports can cause them to pull back on investment when they can’t discern the noise from the signals of where trade policy is headed. (And Trump produces a lot of noise.)

“The Trump administration’s dealing with trade policy could erode confidence in the American economy and, more importantly, created a great deal of uncertainty,” Paul Wachtel, professor of economics at the New York University Leonard N. Stern School of Business, told Salon. “Why would any business invest domestically or invest abroad when it doesn’t know what the rules of the game with regard to trade are going to be?”

The threat of an escalating trade war on multiple fronts is coming just as confidence in the longer-term economic growth in the U.S. economy seems to be waning. The GOP tax cuts, which among other measures reduced the corporate tax rate from 35 percent to 21 percent, has been described as a “sugar high” that won’t stop slower growth in 2020 and beyond.

Bond Buyers Are Getting Nervous

One of the most reliable signals the U.S. economy may be headed toward a recession is showing up in government bonds, where the interest rates on longer-term Treasury bonds have been falling.

“What low long-term interest rates tell you is that nobody thinks there’s going to be inflation, and also nobody thinks there’s going to be a lot of growth,” Steven Kyle, associate professor of economics at the Charles H. Dyson School of Applied Economics and Management at Cornell University, told Salon.

Longer-term Treasury bonds typically pay higher interest rates than shorter-term bonds because longer-term bonds are riskier investments. To compensate for this higher risk, longer-term bonds tend to yield higher interest payments than shorter-term bonds when the economy appears to be in good health.

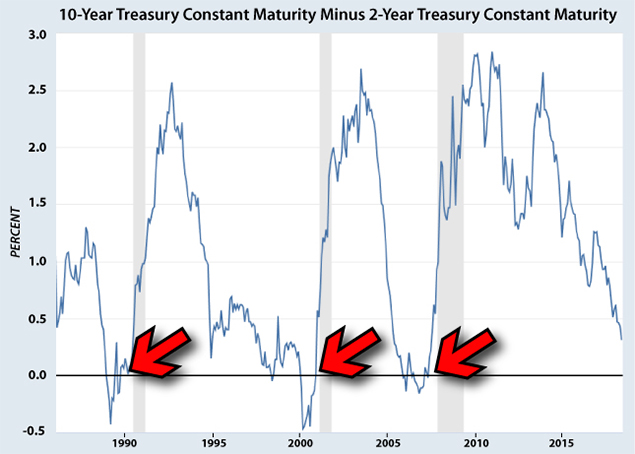

A closely watched measure of where the economy is headed is known as the yield curve, or the difference between the interest rate on shorter-term bonds, like two-year Treasury notes, compared to longer-term bonds, like 10-year notes.

When the gap between the interest rates paid on longer-term bonds and the shorter-term ones narrows, the yield curve is considered to be “flattening,” which indicates growing concern over the health of the economy in the years to come.

The yield curve can also “invert,” meaning that shorter-term bonds are paying higher rates than longer-term ones. Historically, every time this has happened a recession has occurred roughly between six months and two years from when the yield curve first inverts.

“If there’s any signal in the last 50 years that has been reliably connected to economic downturns it’s the inversion of the yield curve,” Wachtel said.

For example, prior to the 2001 recession following the bursting of the speculative dot-com bubble, the yield curve inverted in February 2000 and remained inverted for the rest of the year; the eight-month recession struck in March 2001. A similar thing happened prior to the Great Recession that began at the end of 2007; the yield curve inverted in June 2006 and remained in negative territory for most of the following year.

Today, the yield curve is well on its way to zero, in part because of the Fed’s current effort to bring historically low borrowing costs back to normal levels by raising short-term interest rates. On Wednesday, the interest rate on the two-year note closed at 2.52 percent while the 10-year note hit 2.83 percent, a difference of 0.31 points. In the spring of last year, the yield curve was over a percentage point and it has been trending lower ever since.

The flattening of the yield curve suggests a recession is on the way, but it doesn’t mean it’s imminent, and many economists seem to think that economic expansion is likely to continue for a while. But if history is any measure, once the yield curve inversion occurs, a recession could happen within two years — just in time for the 2020 presidential election.

“If I were running Trump’s 2020 campaign I would be worried that we would be distinctly on the down side by the time the election rolls around,” Kyle said. “And if that’s true, that’s not good news for the incumbent.”

Economic expansions might not die of old age, but Trump’s time in office might end if the economy falters before his re-election bid.