I mostly write about cryptocurrency. I’ve written about “Why Crypto’s A Growing Threat To FAMGA (a.k.a. Facebook, Apple, Microsoft, Google and Amazon).” But that’s in the future. This is a post about how Facebook is in decline today, even before crypto has an impact.

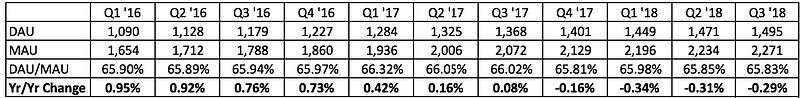

I became the original Facebook bull after I published the first Wall Street style research report on Facebook in March of 2010. My 2014 revenue forecast was off by just one percent, because I focused on one thing: engagement. I remained a Facebook bull for eight years, as they continued to increase user engagement, defined by Facebook as the ratio of Daily Active Users to Monthly Active Users, or DAUs/MAUs, once the company started reporting results). I’ve long believed that sites are growing engagement, or they’re dying, and for eight years, Facebook was growing user engagement.

But when the company reported Q4 ’17 earnings on January 31st, 2018, for the first time in it’s history, Facebook’s user engagement declined, and I turned bearish, penning this blog post to note the occasion. On April 25th, Facebook reported Q1 ’18 earnings, and Wall Street applauded the results, sending the shares up 10 percent, adding $45 billion in market cap, as Facebook’s revenue surged 49 percent, year-over-year, to $12 billion. While Wall Street cheered, I saw another signpost of Facebook’s decline. Humorously, Wall Street, even after all those years, still didn’t understand Facebook. Wall Street has never understood Facebook, because they don’t appreciate engagement. Now, even after a mixed Q3 report issued on Tuesday, October 30, another quarter is being cheered, when all I see is further signs of decline.

The One Graph Facebook Investors Don’t Appreciate

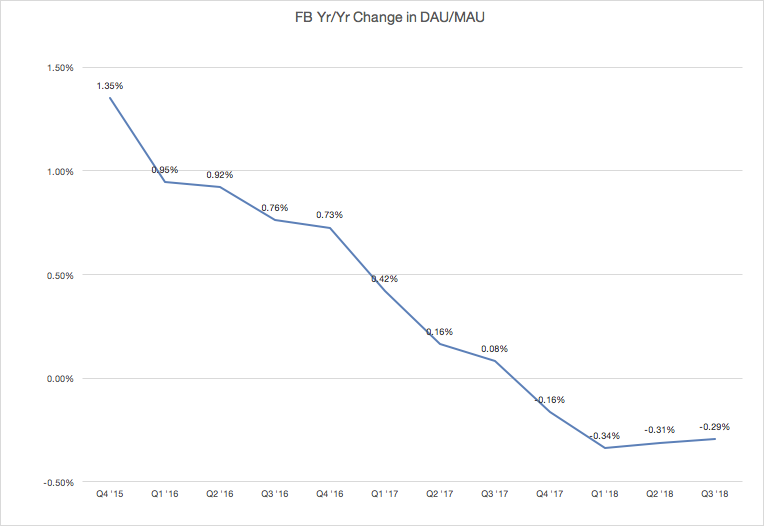

While Facebook presented 18 slides on their conference call yesterday, they didn’t present the one below, which, in my opinion, is the most important graph of all. It shows the year-over-year change in user engagement, Daily Active Users/Monthly Active Users (DAU/MAU). It is not a pretty picture:

Facebook is dying. At the moment, it’s a slow death, but at some point, it will accelerate. That’s what social networks do. They grow engagement, until they don’t. Interestingly, Facebook blames the drop on engagement on the fact that they are trying to stop people from being able to do the thing people like to do most on Facebook . . . read fake news.

What Wall Street Misses

The main thing that Wall Street misses is that revenue is a lagging indicator of engagement. So revenue is still climbing dramatically (up 33 percent year-over-year), catching up to engagement growth of years past. When revenue starts slowing dramatically in 2019, which it will, Wall Street will be caught off guard.

But What About Instagram and WhatsApp

Both are insanely great products that have attracted massive audiences. That said, there are two reason I don’t care. The first is, the properties monetize at a fraction of Facebook today. That could change, but, my second points is . . . if things are going so great, why don’t we get more metrics on those properties? I rarely write negative pieces. But I did write a piece before SNAP came public when I said, buyer beware, because they didn’t release the relevant numbers, because, I assumed, they were bad. And they were.

This story first appeared on the CryptoOracle page on Medium. It has been reprinted with the author's permission.

Shares