President Joe Biden wants a $1.9 trillion pandemic relief package; Senate Republicans only a third that much. Both proposals are too little for too short a time. Even more important, both propose too little for where help is needed most.

The Republicans say America just can’t afford more relief. Their skimpy plan would provide nothing for renters facing eviction, just the latest sign of how since Trump the Republicans have chosen to become the party of white skin privilege since it’s Black and Latino renters most at risk of eviction.

The GOP would do little for small business, offering only 10 cents on the Biden dollar; to reopen schools, 12 cents; for the jobless, 34 cents.

Complaints that America can’t afford the Biden relief package ring hollow. The Trump-Radical Republican tax cuts—passed in December 2017 without a single vote from a Democrat—used borrowed money to bestow $2.4 trillion in tax savings to large corporations and rich individuals. The 99% got crumbs.

Biden’s tax plan would raise $2.1 trillion over 10 years, taking back much of the savings from large companies and individuals making more than $400,000 per year.

Welfare for the Rich

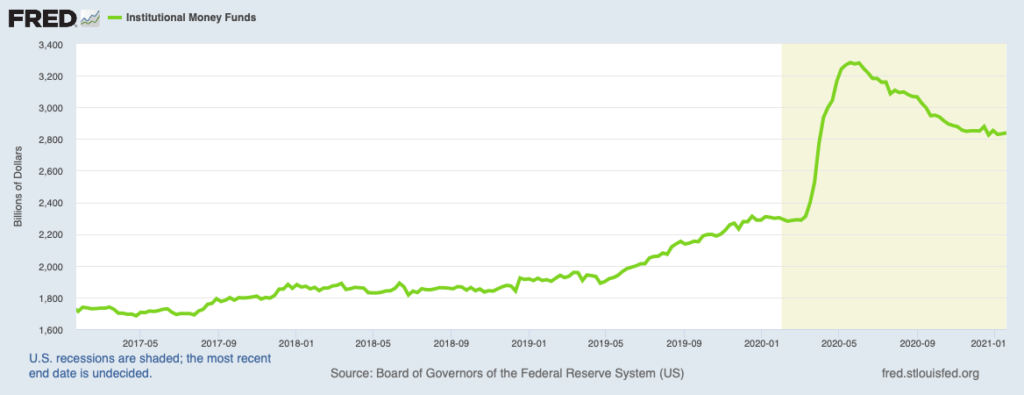

The COVID-19 relief package Trump signed into law last spring was heavily weighted to those who didn’t need help. As the graphic below shows, such excess cash nearly doubled from when Trump assumed office and last May. Only a little of that money has been withdrawn, an indication that federal aid included a lot of welfare for the rich.

Cash parked in institutional money market funds used by corporations almost doubled between Trump becoming president and soon after.

During the pandemic, many millions of American households have reduced their debts and increased their savings because they had continued to be employed while their spending dropped. They don’t need relief.

Since your spending is my income, and vice versa, the people suffering because of the drop in spending do need help. Think of restaurant workers, barbers, gym trainers, and retail store clerks.

Invisible Suffering

In a nation whose political and economic power structure is largely white and in which large numbers of Americans have few to no minorities as neighbors, it’s easy for those suffering the most to be invisible.

One of the striking patterns I’ve noticed in print and broadcast interviews with COVID-19 deniers, the people who reject masks and social distancing, is that they are overwhelmingly white and often say they don’t know anyone who died from the virus. These people let their anecdotal experience trump what the data show.

It’s easy to never notice the depth and breadth of American poverty because it’s highly concentrated in neighborhoods with aging houses and apartments, little bus service, and often far from good jobs. There’s plenty of rural poverty, too, which is even less likely to be noticed by the majority culture.

The data show the tremendous suffering in places like Rochester, N.Y., a once fabulously rich city. These days every sixth Rochester resident subsists on less than half the income needed to escape poverty.

For a family of four, that’s $1,000 per month or less, hardly enough for a single person to pay bills. Rochester is far from alone among once rich cities turned poor.

$25,000 a Year

The official federal poverty measure, created when Lyndon Johnson was president, is badly outdated. It assumes that an income of about $500 per week or about $25,000 per year is enough for a family of four to escape poverty. That’s not even true in rural areas where housing is dirt cheap.

A newer and much more reliable poverty measure called ALICE should guide Congress.

ALICE is an acronym for Asset Limited, Income Constrained, Employed – people who work but don’t have savings and find it hard to make ends meet. The concept was developed by the nonprofit United Way. Think of the majority of American households who have less than $1,000 in savings and often nothing at all.

ALICE indicates that to meet basic needs a family of four in most urban areas needs about $1,200 per week—more than $62,000 per year. That’s not much less than the median household income these days of about $68,000.

$10 Million a Year

For perspective, a third of American households make less than $25,000; 90% make less than $134,000. The fastest growth is among the $10 million-and-up class that now has more than 24,000 households.

The economic carnage from Trump’s incompetent and malicious response to the coronavirus has been concentrated in poor and minority neighborhoods. In large part, that’s because close to two-thirds of higher-income Americans have jobs they can do from home, only about 9% of lower-paid workers enjoy that privilege.

And many of these lower-paid workers are deemed essential, risking their health and sometimes dying so we have clean floors in hospitals, food on grocery store shelves, and other fundamental services.

Many of those hardest hit are workers who show up and do their jobs but have had their hours cut or their jobs eliminated. That’s where relief needs to be concentrated – extending jobless benefits and making sure people aren’t evicted, which can make them homeless and set them back financially for years.

Families Facing Eviction

As many as 40 million families are at risk of eviction because they can’t pay the rent. Miles long lines of cars at food giveaways shown in television news reports attest to the depth of the income problem from those made jobless by the pandemic.

Relief needs to help both renters and their landlords.

Black and Hispanic renters are “twice as likely as white renter households to be behind on housing payments and twice as likely to report being at risk of eviction,” said Sophia Wedeen of Harvard University’s Joint Center for Housing Studies.

Giving poor renters cash grants to cover their rent would be the cleanest way to help landlords avoid foreclosure. That would also save on the social costs of dealing with people who become homeless, lose their household furniture, and may not recover for years.

Loan Thieves

That first round of help also attracted hordes of thieves. The suspected thefts exceed $4 billion. A rapidly growing list of borrowers is now charged with making up vast numbers of employees so they could get Payroll Protection Plan loans that don’t have to be paid back. One North Carolina man was indicted for fraudulently collecting $5.5 million using 12 companies with wildly inflated payroll numbers.

One of the greatest needs is for more and longer-lasting jobless benefits including an expansion of eligibility. I’ve talked to small business owners whose operations are seasonal and failed before the pandemic or otherwise fell between the cracks in qualifying for the $400 per week in jobless benefits and the $600 per week that was in the initial relief bill.

Congress should make the $400 per week of federal jobless benefits open-ended just like the pandemic’s effects are open-ended. Otherwise, as the pandemic drags on because the Trump administration failed to plan for distributing vaccines there will have to be another vote in Congress on extending relief. Take care of it all. Now.