As I watched the Super Tuesday returns last night I was struck by exit polls that showed the economy is the most important issue to many Republican voters. They believe Donald Trump will be better for them financially than President Biden. Considering how successfully Biden has managed a swift recovery from the economic catastrophe he inherited, I find that disturbing. Yet, according to the New York Times, a majority of the electorate is suffering from "collective amnesia" and don't remember why they ousted Trump back in 2020. Apparently, they are nostalgic for the golden days of a Trump administration that never existed.

I don't know if that amnesia will be cured by facts and statistics, but even Fox News has to admit that the Biden economy is doing very well.

seen on Fox News. pretty pretty good! pic.twitter.com/Ta6P0JRyyj

— Aaron Rupar (@atrupar) March 6, 2024

Nonetheless, Trump and all of his various henchmen spend their days insisting that the economy is on the verge of collapse. Last night, during his low-energy victory speech, Trump said it once again and as he told Lou Dobbs in an interview in January, he hopes the economy will crash within the next 12 months so that he won't be like Herbert Hoover. (Joe Biden correctly pointed out to Evan Osnos in the New Yorker, "He’s already Herbert Hoover. He’s the only President that ever lost jobs in a four-year period—other than Hoover.”)

Despite the fact that inflation has stopped rising at the same pace as a couple of years ago, people yearn for prices to go back down to where they were before the pandemic. And just as he promised back in 2016, Trump says that only he can fix it. But he's short on details about how he's going to do that except for some vague promises to dramatically raise tariffs and deport millions of undocumented workers which will actually ignite inflation. And he has said that he will fully fund Social Security and Medicare through "growth" and selling oil leases in Alaska which might as well be a promise to pay for it with diamond mines on Mars.

He does have one other plan that he doesn't talk about quite as much, however. Here he is sharing it with a group of wealthy donors at Mar-a-Lago back in December. "You're all people that have a lot of money. You're rich as hell. We're gonna give you tax cuts," he told them.

Trump: You’re all people that have a lot of money. You’re rich as hell. We’re gonna give you tax cuts pic.twitter.com/50Iy9ddag9

— Kamala HQ (@KamalaHQ) December 14, 2023

Of course he is. And he's planning to cut corporate taxes too. He's a Republican and that's what they do.

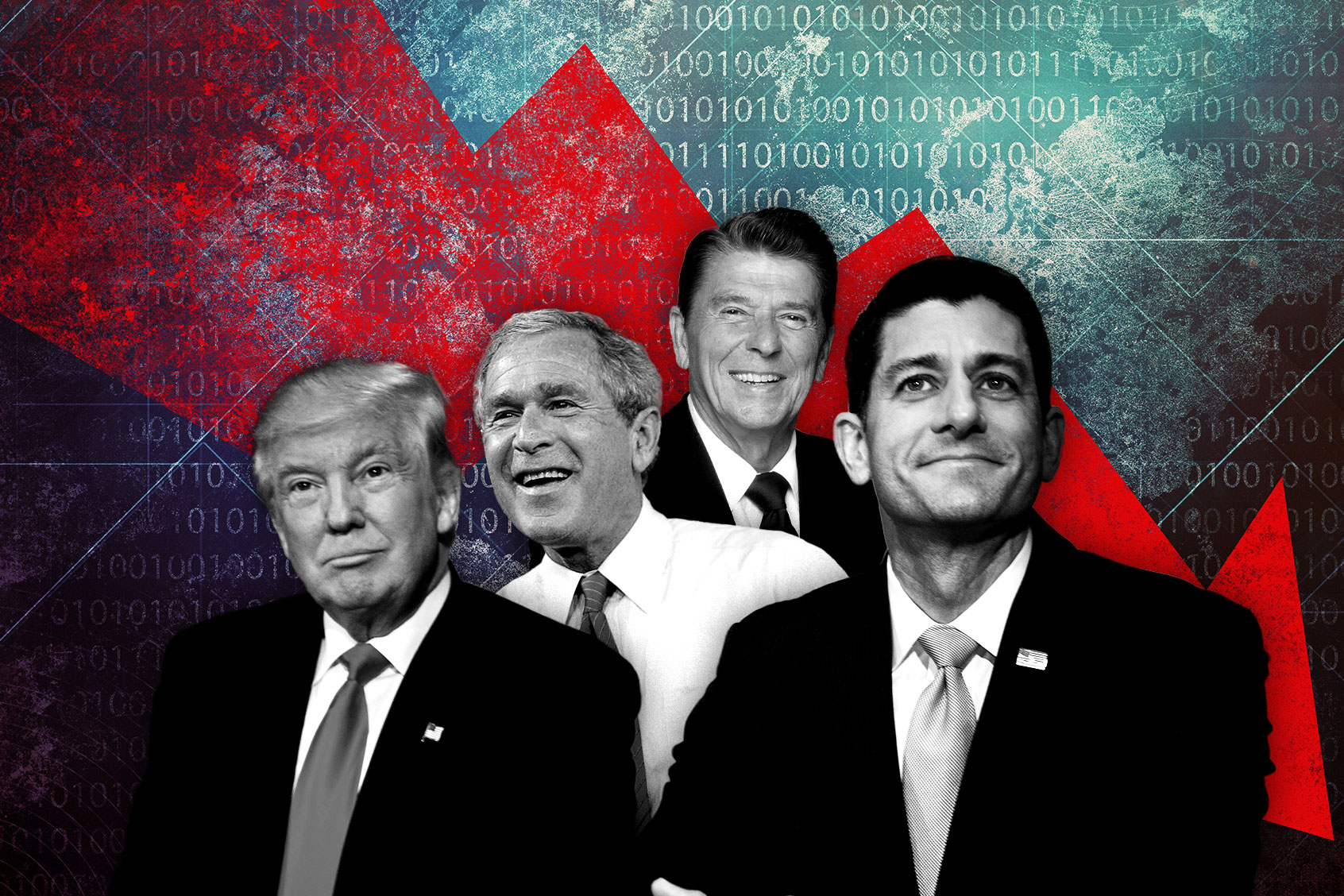

Donald Trump's only legislative accomplishment in his first term was a massive tax cut bill for the rich. But that wasn't really his accomplishment, was it? That was the evergreen policy goal of the Republican Party, especially the blue-eyed dream boat Speaker of the House Paul Ryan, the Ayn Rand devotee who believed that rich men were heroes who needed to be allowed to run free and unencumbered by civic responsibility so that capitalism might save humanity. That the Republican tax cut personally benefited the new, wealthy president made it all the sweeter.

Trump's determination to lower taxes for the rich is a given. Everything he does is first and foremost for himself and he won't even try to rationalize it. It's unlikely that the rest of the party can get away with that, so they'll no doubt return to their perennial excuse — the federal budget deficit as a reason to lower taxes, even though that makes no sense.

We need your help to stay independent

That tired old saw goes back to the Reagan administration which popularized a quack theory called "supply side economics" championed by economist Arthur Laffer. He claimed that the more you cut taxes the greater the revenue to the government. Even then everyone knew it was ridiculous. Reagan's budget director, David Stockman, actually spilled the beans to journalist William Greider, telling him, "It's kind of hard to sell 'trickle down, so the supply-side formula was the only way to get a tax policy that was really 'trickle down.' Supply-side is 'trickle-down' theory." Trump gave Arthur Laffer the Presidential Medal of Freedom in 2019.

Today another supply side guru, Stephen Moore, formerly of the Club for Growth, has co-authored the Project 2025 economic plan to completely "reform" the U.S. Treasury. He's pushing to privatize Social Security which Trump has never explicitly ruled out and told The Guardian, “Yes, I am strongly in favor of cutting tax rates to make [the] American economy No 1.” And this would presumably be in addition to extending the Trump tax cuts from 2017 which are up for renewal next year.

Just this week, we've received some important data on the effect of those tax cuts and I'm sure you won't be surprised to learn that they did not pay for themselves or deliver the thousands of dollars in increased wages to workers as promised. The New York Times reports:

Instead, they are adding more than $100 billion a year to America’s $34 trillion-and-growing national debt, according to the quartet of researchers from Princeton University, the University of Chicago, Harvard University and the Treasury Department.

The researchers found the cuts delivered wage gains that were “an order of magnitude below” what Trump officials predicted: about $750 per worker per year on average over the long run, compared to promises of $4,000 to $9,000 per worker.

Want a daily wrap-up of all the news and commentary Salon has to offer? Subscribe to our morning newsletter, Crash Course.

That trickle never seems to make it down from the wealthy's palatial palaces, as CBS News outlines further:

The new paper, by David Hope of the London School of Economics and Julian Limberg of King's College London, examines 18 developed countries — from Australia to the United States — over a 50-year period from 1965 to 2015. The study compared countries that passed tax cuts in a specific year, such as the U.S. in 1982 when President Ronald Reagan slashed taxes on the wealthy, with those that didn't, and then examined their economic outcomes.

Per capita gross domestic product and unemployment rates were nearly identical after five years in countries that slashed taxes on the rich and in those that didn't, the study found.

But the analysis discovered one major change: The incomes of the rich grew much faster in countries where tax rates were lowered. Instead of trickling down to the middle class, tax cuts for the rich may not accomplish much more than help the rich keep more of their riches and exacerbate income inequality, the research indicates.

This is nothing but a giveaway to their rich benefactors. It's a con that's been working beautifully for 50 years.

Apparently, Trump just welcomed one of the two richest men in the world, Elon Musk, a major government contractor and social media influencer, to Mar-a-Lago to beg for money. Considering the batshit lunacy that Musk is posting to his X account these days, Trump can probably count on him for a billion dollars or so. Both of these men are shallow thinkers who have adopted the personas of populist demagogues speaking for the working man against the elites but in the end, they're just a couple of rich guys looking out for number one. Underneath all the MAGA bluster and BS, it's still the Republican Party — and the politicians will always cater to them that brung 'em.