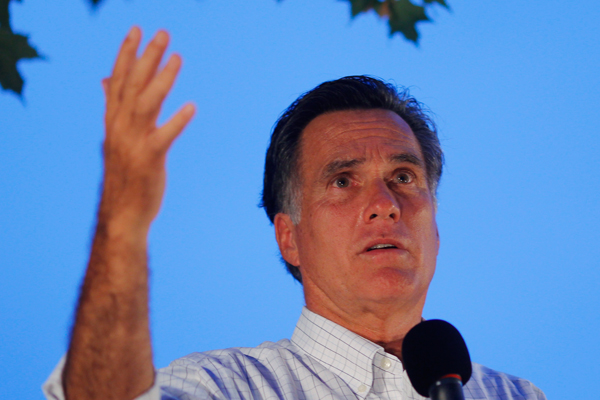

I poured through Mitt Romney’s jobs plan last night — it’s a comprehensive piece of work, worth a look. Unfortunately, Mr. Romney offers no solutions for our most pressing short-term problem: high unemployment and the weak job growth. And his long-term strategy is based on supply-side measures that have long been associated more with budget deficits and upward wealth redistribution than with job creation.

Despite evidence to the contrary, part of his case is that stimulative measures haven’t worked, so he has to oppose such ideas in his plan.

That’s a big problem for someone running for president in a climate of highly elevated unemployment. He argues that since it’s fruitless to attack the short-run economy, the only way forward is to focus on longer-term reforms to the tax and regulatory structure, along with some trade deals.

In fact, his main short-term ideas are quite dangerous to the economy: an immediate “move to cut spending and cap it at 20 percent of GDP.” That’s actually worse than a punt on short-term; it’s a 3 percent cut in next year’s GDP and a touchdown for the team recession.

His longer-term measures consist of supply-side tax cuts to corporate rates, though without any loophole closing, and locking in the full range of the Bush tax cuts, so expect big revenue losses. Moreover, this supply-side, trickle-down stuff simply doesn’t generate job gains.

On this point, Republican candidates refuse to accept the lesson of the G.W. Bush years — a solid test, compared to the Clinton years, of trickle down. Annualized job growth in the Clinton years, under a more progressive tax structure, was about four times that of the Bush years.

One wrinkle here is interesting and noteworthy: While Mr. Romney proposes to eliminate capital gains taxes, he only does so for households with incomes below $200,000. I’ve argued that favorable treatment of cap gains is misguided, but Romney will probably get beat up by the other Republican candidates for not just zeroing out this tax for everyone.

I suspect Mr. Romney would argue that he differs from the most recent President Bush in that he’ll hold down spending. In fact, he argues for a balanced budget. Not only does this have the contractionary impact noted above, but it of course takes away the ability of the federal government to do counter-cyclical policies (here’s some CBPP analysis of the cuts associated with a balanced budget amendment). But, as I noted, he’s in a box where he has to argue that such policies don’t work.

There’s a bunch of other standard pablum about whacking the EPA and labor unions — none of that matters for job growth — just standard R candidate box-checking. He argues for achieving Social Security solvency with benefit cuts alone — no revenues from increasing the maximum taxable level of earnings. There’s the standard pledge to get rid of the Affordable Care Act, matched with turning Medicaid into a block grant and (sort of) embracing Rep. Ryan voucher’s plan on Medicare (“Romney’s own plan will differ, but it will share those objectives”).

Put these healthcare ideas all together and you have the classic R strategy to deal with rising federal healthcare costs: shifting them onto states and families. There’s no savings here, nothing that will begin to deal with the American problem — it’s not not just the government problem — of rising health costs. This is a very significant shortcoming of Mr. Romney’s plan, and I suspect of his colleagues’ as well. Just shifting the burden elsewhere doesn’t do anything to attack the growth of healthcare costs, and that, along with the radical budget cap, may be the most anti-growth part of Mr. Romney’s agenda.

There are two quite good ideas in the document: going after China on unfair trade practices and supporting more high-skilled immigration. The former is targeted at China’s currency management and is essentially a strategy to weaken the U.S. dollar in export markets (if China allowed the value of their currency to be set in markets, as opposed to managing it, the yuan would rise relative to the dollar), something that could get the former governor some bad press in conservative places but could potentially help boost manufacturing exports fairly quickly (note that liberal economist Dean Baker makes a similar argument here).

By locking in the Bush high-end cuts, cutting the corporate tax, capping spending at 20 percent (implying large entitlement cuts), shifting health costs, cutting Social Security benefits, and punting on short-term job creation, this is far from a jobs plan that could help the middle class. It’s more likely to prolong the downturn, hasten the growth of income inequality, and increase economic insecurity.