In his bestselling book "Capital in the 21st Century," economist Thomas Piketty alerted the world to the new aristocracy of wealth being formed by runaway inequality. We have only to look at the state of Illinois to see what this means for democracy.

The current Republican governor, Bruce Rauner, is a near billionaire. On the Democratic side, one candidate, J.B. Pritzker, is a multi-billionaire and another candidate, Chris Kennedy, is estimated to be worth only about $100 million.

All three earned or enhanced their fortunes in high finance as heads of small private equity and investment firms that move billions of dollars in and out of the economy. If you asked each one what their firms are all about, they would probably say that their financing provides the life blood for new startups and the wherewithal for established companies to become more innovative and efficient and more able to create good jobs. They see themselves as experts in unlocking and creating hidden value.

Unfortunately, they actually make their money through financial strip-mining, the process by which financial investment firms extract billions in wealth from productive facilities. They are in business for one and only one reason: to enrich themselves as quickly as possible—and it isn't always pretty.

The strip-mining process, while enormously complicated in detail, comes down to this: Financial firms buy up companies with borrowed money. They load the debt onto the purchased companies, pay themselves special dividends, and restructure the companies in order to squeeze as much cash flow out of them as possible. That cash, and more borrowed money, is then used to buy back the company's stock, thereby jacking up the stock price so that the investors can make a killing.

To get that cash they often demand that the company downsize, ship production abroad, abandon less profitable products, cut wages and benefits, and reduce R&D.

Before a Securities and Exchange deregulatory rule change in 1982, massive stock buybacks were considered stock manipulation and therefore largely prohibited. Only 2% of all corporate profits went to stock buybacks in 1980. By the time of the crash in 2008, nearly 75% of all corporate profits went to stock buybacks. (Hundreds of companies even pour more than 100% of their profits into these buybacks by using more borrowed money for the repurchases.) It is not an exaggeration to say the driving force of American business is stock buybacks. And this driving force is one of the primary causes of wage stagnation and runaway inequality. (See "Profits Without Prosperity," by William Lazonick.)

Some version of this financial strategy is the preferred path to great riches for small financial firms and is likely to have contributed mightily to the wealth of these three Illinois gubernatorial candidates.

The Strip-Miners

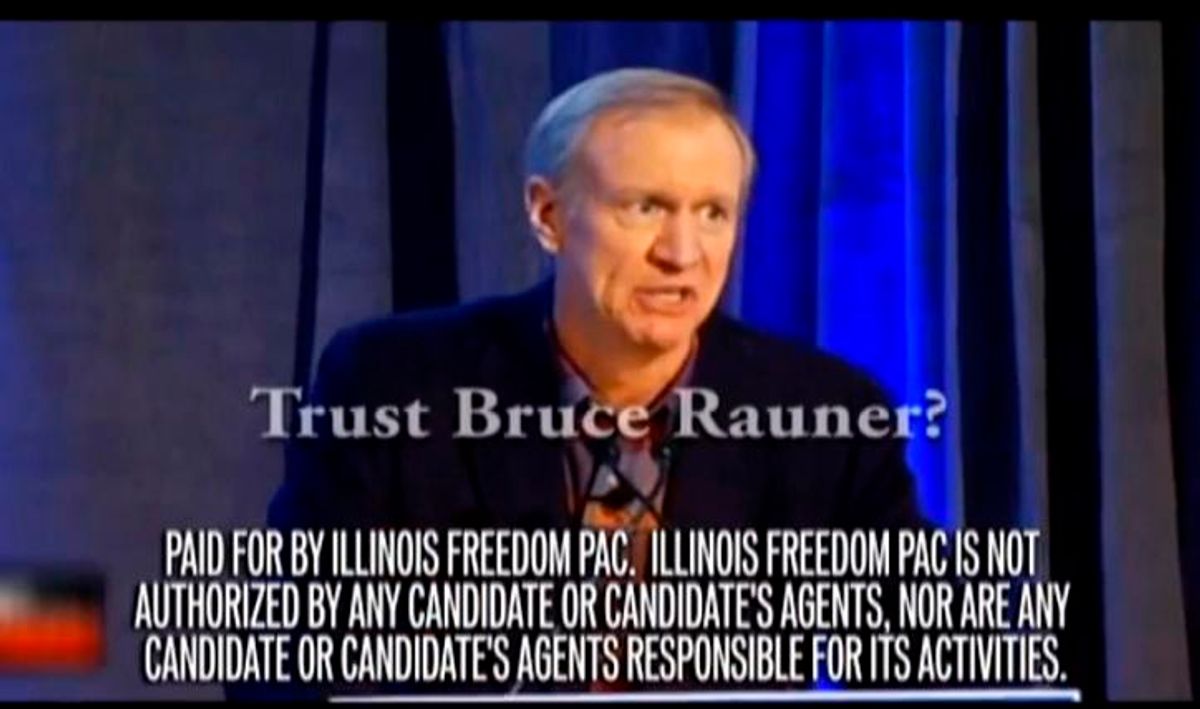

Governor Bruce Rauner (R): Made his fortune at GTCR, an $11 billion private equity fund based in Chicago with only 80 employees. For much of his term as governor, he has been unable even to pass a state budget. The messy give-and-take of productive politics may be utterly foreign to someone who is so accustomed to top-down control within his financial firm. No one yet has shown that running a private equity company leads to good governing. The opposite is more likely to be the case.

J.B. Pritzker (D): His father was co-founder and president of Hyatt Hotels and left him over a billion dollars. To build upon it, he founded Pritzker Group Venture Capital, yet another small investment firm that extracts wealth from the enterprises it finances. He believes his liberal values and business acumen are just what Illinois needs after what he calls the "failure" of the Rauner administration.

Chris Kennedy (D): This son of the late Robert F. Kennedy runs the family's investment business. We don't have much information about his financial strategies, but it would be shocking if he didn't participate in the financial strip-mining game.

What Do These Elite Financiers Bring to Politics?

1. Hypocrisy

Every Illinois candidate claims to have the ability to make the hard choices needed to balance the state budget and bring fiscal sanity to the cash-strapped state. But these financial elites are one of the main reasons why the state is cash-strapped in the first place. Private equity managers are the beneficiaries of enormous tax breaks as well as having the ability to park their money offshore, far from American state, local and federal tax collectors. One of the most egregious tax breaks they profit from is the "carried interest" loophole which allows them to declare their income at the lower capital gains rate. The net effect is that they are likely to be paying a lower tax rate than their secretaries.

This loophole costs the federal government billions each year and no doubt costs Illinois tens of millions of dollars as well. Why should the richest of the rich get such a tax break? Because they have been able to buy the silence of both political parties.

2. Cluelessness About How We Live

In modern-day America it is impossible for a multi-millionaires and billionaires to understand how the rest of us live, just as it is impossible for us to imagine how we would think and act if we didn't have to worry about money. The wealthiest few live in their own rarified world. They have their own schools, their own clubs, their own shopping venues, their own healthcare and even their own transportation systems. They can sound empathetic, and can even mean it, but the chances of really feeling our deep-seated economic insecurities are slim to none. They are the great beneficiaries of runaway inequality and we are its victims. Their financial firms are the predators. We are the prey.

3. Entitlement

When you are super-rich and successful in finance, you truly believe you understand the world better than anyone else. This becomes reinforced on a daily basis by all those around you. Your subordinates are deferential. Naturally, they let you know in countless ways, large and small, that you are truly gifted and smart. You rarely experience an egalitarian situation where your voice is given no preference. And unless you are prosecuted, you never experience someone else having more power than you have.

4. Fallacy of Skill Transference

As a financial strip-miner you do indeed know a lot about how to extract wealth from your investments. But because you are super-rich, you assume that your skill set applies to everything. You know about how to cut costs in the enterprises you own, so you believe you also know how to run a school system. In fact many financiers have gone all-in on charter schools because they are dead certain that they know all there is to know about improving education, especially for the poor, whom they rarely encounter except as housekeepers and gardeners. But, in our complex modern world, skill sets are honed within specific areas of expertise and sectors. Financial strip-mining qualifies you to be an expert in only that. Running a state government involves an entirely different set of skills, which have virtually nothing to do with elite finance.

5. Harming of Democratic Participation

The original Constitution left voter eligibility up to the states, and for the first century or so, most of the states chose to limit the franchise to white male property owners. By 1920 the property restrictions were eliminated and women won the right to vote. The 1964 Voting Rights Act eliminated legal restrictions on black voters, and today the fight centers on reducing the impact of gerrymandering and tactics designed to discourage voting. But these political contests among multi-millionaires hearken back to the days of property restrictions. Now your chances of success are reduced unless you also are super-rich, or have one or more billionaires willing to finance you. The average person faces the enormous struggle of raising large sums of money in order to compete with the new political aristocracy of wealth.

Hope in Illinois!

Fortunately, there is one serious candidate in the Democratic primary. Daniel Biss is a former math professor and current state senator, who is not wealthy and, more importantly, wants to counter financial strip-mining and runaway inequality. He is a co-sponsor of a state financial transaction tax on the Chicago Mercantile Exchange on LaSalle Street. The proposed tax is small enough to be hardly noticed by any small to medium-sized investor, but large enough to raise significant sums for the cash-strapped state.

A financial transaction tax, sometimes called a Robin Hood Tax, is one of the most efficient and powerful ways to move money from Wall Street/LaSalle to Main Street. It is not for the faint of heart. Financiers cry that they exchanges will runaway to no-tax jurisdictions, (even though moving their vast array of servers would be nearly impossible). And they provide ample campaign cash and advertising to make sure it never becomes law. So Biss will have his hands full.

To further back up his pro-Main Street policies, Biss has selected Leticia Wallace, a state representative from Rockford to serve as his running mate for lieutenant governor. Wallace won her seat in a district with only 15% black voters. She is committed to doing all she can to reverse runaway inequality. She wants to help others understand how financial strip-mining is undermining our economy and democracy, and how we can reverse it.

The Biss/Wallace ticket faces an uphill battle. Already Pritzker, the former chair of the Hillary Clinton campaign, has inherited much of the formidable Clinton/Obama political machine in Illinois. But as we now know, the inevitable is no longer a sure thing. No one expected Sanders, an avowed democratic socialist, to raise more money than Hillary and nearly defeat her in the primaries. And no one expected Trump to upend the entire Republican establishment, and defeat Clinton as well.

For Biss/Wallace to have a chance, they will need to make reversing runaway inequality the centerpiece of their campaign. They need to show the same guts Sanders displayed when he railed against the billionaire class and called for free higher education and Medicare for All, funded largely through taxes on Wall Street and the super-rich. They will need to help Illinois residents understand that the crisis of the public sector is not about teachers' pensions or too many services. Rather it is about a public sector that has been starved for funds due to enormous tax breaks for the super-rich and large corporations. The richest country in the world can afford a decent public sector. It can afford a $15 minimum wage. It can afford to lift every child out of poverty. But it can only do so when the rich again pay their fair share.

In a very real way, the fabric of our democracy is on the ballot in Illinois, starting with the March Democratic primary. Let's hope that we-the-people break through.

Shares