Despite his boasting about supposedly invigorating the economy, President Donald Trump has alienated many on Wall Street and in the financial industry with his erratic leadership, his trade wars, and his opposition to immigration.

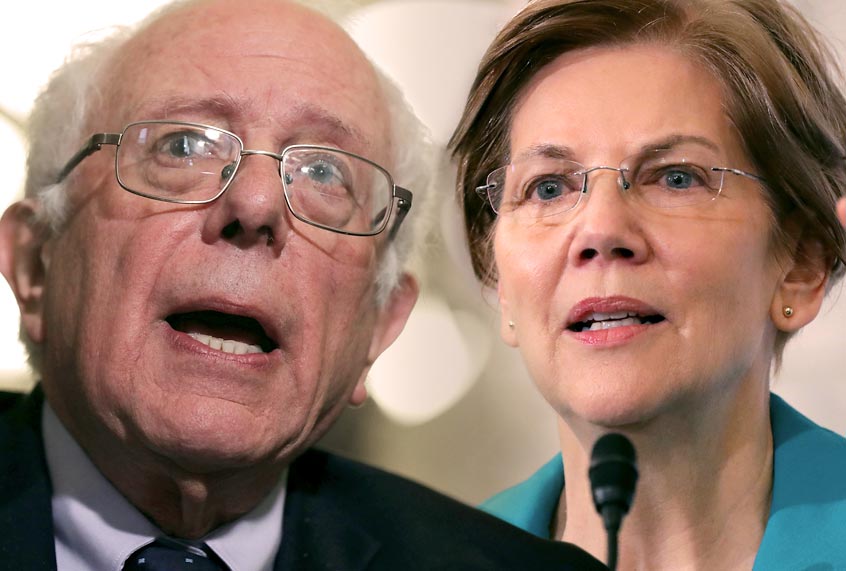

This leaves many on Wall Street clamoring for a strong Democratic challenger in 2020. But according to new reports published Monday morning, insiders are particularly terrified of two potential nominees: Sen. Elizabeth Warren, D-MA., and Sen. Bernie Sanders, I-VT. Terrified, that is, that if either of them is elected, the financial industry might face serious regulation and oversight.

“She has this sort of applause line that we are all crooks, which is scary that you may hear that for a year and a half,” one anonymous bank executive told the Wall Street Journal of Warren.

“It can’t be Warren and it can’t be Sanders,” another top executive at a large bank told Politico. “It has to be someone centrist and someone who can win.”

The Politico report said that Wall Street has a clear favorite: former New York Mayor Michael Bloomberg. The billionaire has indicated his interest in running before, but it’s never been clear how he could gather the necessary coalition. And one banker acknowledged to Politico that Bloomberg seems unlikely to win.

The feat sparked by Sanders and Warren is reasonable; they really would challenge Wall Street’s power and influence. Both see themselves as enemies to the entrenched financial interests in the country, criticizing banks and accumulated wealth. Sanders frequently bemoans the power of “millionaires and billionaires” in the United States — Warren just proposed a wealth tax on fortunes over $50 million. They also favor greater regulation of the financial industry.

What’s not reasonable, though, is the apparent belief in among some financial bigwigs that the Democratic Party presidential nominee ought to be up to them.

“There is a lot of excitement about where the party is going, and we will all have friends running, and it’s hard to decide who to support,” said Robert Wolf, an investment banker and former fundraiser for President Barack Obama, to Politico. “Our party likes the aspirational, exciting candidate, but we also have to find someone who can do well in the swing states.”

There’s no reason, of course, to think that a candidate that takes on financial interests would alienate swing states. Trump himself ran — falsely, as was clear then, but passionately — as a candidate who was supposedly against the influence of entities like Goldman Sachs. Opposing the financial industry is likely to be a big political winner for Democrats, and this fact, at least, shouldn’t hurt them at all in Trump country.

Meanwhile, Richard Hunt, the president of Consumer Bankers Association, criticized Warren’s post-financial crisis politics to the Journal, saying, “The banking industry is a lot different than it was in 2008 . . . Most people know that but she still seems to be living in 2008-land.”

But while some of the problems of 2008 have been addressed, the power for the financial industry to run out of control and drive us back into recession remains, requiring strong oversight of the kind of Warren promises.

Politico also mentions another candidate who, somewhat surprisingly, could make Wall Street nervous: Sen. Kirsten Gillibrand, D-NY. As a senator from New York, she has natural ties to the financial industry, and she has already been criticized as supposedly being too friendly to Wall Street.

But the report notes that this characterization may be an exaggeration:

After CNBC reported earlier this month on Gillibrand making calls to bankers to gauge potential support for a 2020 bid, the senator tweeted a list of her progressive credentials on the banking industry including support for a financial transactions tax, reinstating a wall between retail and investment banking and opposing the bank bailouts of 2008.

In several interviews, Wall Street executives cited these positions as reasons they were skeptical of Gillibrand as a candidate and unlikely to support her unless she catches fire and emerges from the field. “It will be an interesting test to see if people actually step up and support her,” one senior executive at a large bank said. “There is not a lot of trust there.”

But Gillibrand does have Wall Street backers who view her as pragmatic, a centrist and preferable to Warren or Sanders.

In the Democratic primary, closeness to Wall Street will almost certainly be seen as a liability rather than an asset for many voters. Contrary to the fantasies of some bankers, the devastation of the 2008 financial crisis — and the fact that so many of those who shared in the responsibility faced no real penalty — remain fresh in the minds of many voters. They’ll be happy to support someone who doesn’t care about alienating bank executives — and a candidate who strikes fear into the heart of Wall Street may even be more electable.