Welfare’s virtual extinction has gone all but unnoticed by the American public and the press. But also unnoticed by many has been the expansion of other types of help for the poor. Thanks in part to changes made by the George W. Bush administration, more poor individuals claim SNAP than ever before. The State Children’s Health Insurance Program (now called CHIP, minus the “State”) was created in 1997 to expand the availability of public health insurance to millions of lower-income children. More recently, the Affordable Care Act has made health care coverage even more accessible to lower-income adults with and without children.

Perhaps most important, a system of tax credits aimed at the working poor, especially those with dependent children, has grown considerably. The most important of these is the Earned Income Tax Credit (EITC). The EITC is refundable, which means that if the amount for which low-income workers are eligible is more than they owe in taxes, they will get a refund for the difference. Low-income working parents often get tax refunds that are far greater than the income taxes withheld from their paychecks during the year. These tax credits provide a significant income boost to low-income parents working a formal job (parents are not eligible if they’re working off the books). Because tax credits like the EITC are viewed by many as being pro-work, they have long enjoyed support from Democrats and Republicans alike. But here’s the catch: only those who are working can claim them.

These expansions of aid for the working poor mean that even after a watershed welfare reform, we, as a country, aren’t spending less on poor families than we once did. In fact, we now spend much more. Yet for all this spending, these programs, except for SNAP, have offered little to help two people like Modonna and Brianna during their roughest spells, when Modonna has had no work.

To see clearly who the winners and losers are in the new regime, compare Modonna’s situation before and after she lost her job. In 2009, the last year she was employed, her cashier’s salary was probably about $17,500. After taxes, her monthly paycheck would have totaled around $1,325. While she would not have qualified for a penny of welfare, at tax time she could have claimed a refund of about $3,800, all due to refundable tax credits (of course, her employer still would have withheld FICA taxes for Social Security and Medicare, so her income wasn’t totally tax-free). She also would have been entitled to around $160 each month in SNAP benefits. Taken together, the cash and food aid she could have claimed, even when working full-time, would have been in the range of $5,700 per year. The federal government was providing Modonna with a 36 percent pay raise to supplement her low earnings.

Now, having lost her job and exhausted her unemployment insurance, Modonna gets nothing from the government at tax time. Despite her dire situation, she can’t get any help with housing costs. So many people are on the waiting list for housing assistance in Chicago that no new applications are being accepted. The only safety net program available to her at present is SNAP, which went from about $160 to $367 a month when her earnings fell to zero. But that difference doesn’t make up for Modonna’s lost wages. Not to mention the fact that SNAP is meant to be used only to purchase food, not to pay the rent, keep the utility company happy, or purchase school supplies. Thus, as Modonna’s earnings fell from $17,500 to nothing, the annual cash and food stamps she could claim from the government also fell, from $5,700 to $4,400.

Welfare pre-1996 style might have provided a lifeline for Modonna as she frantically searched for another job. A welfare check might have kept her and her daughter in their little studio apartment, where they could keep their things, sleep in their own beds, take showers, and prepare meals. It might have made looking for a job easier —paying for a bus pass or a new outfit or hairdo that could help her compete with the many others applying for the same job.

But welfare is dead. They just aren’t giving it out anymore.

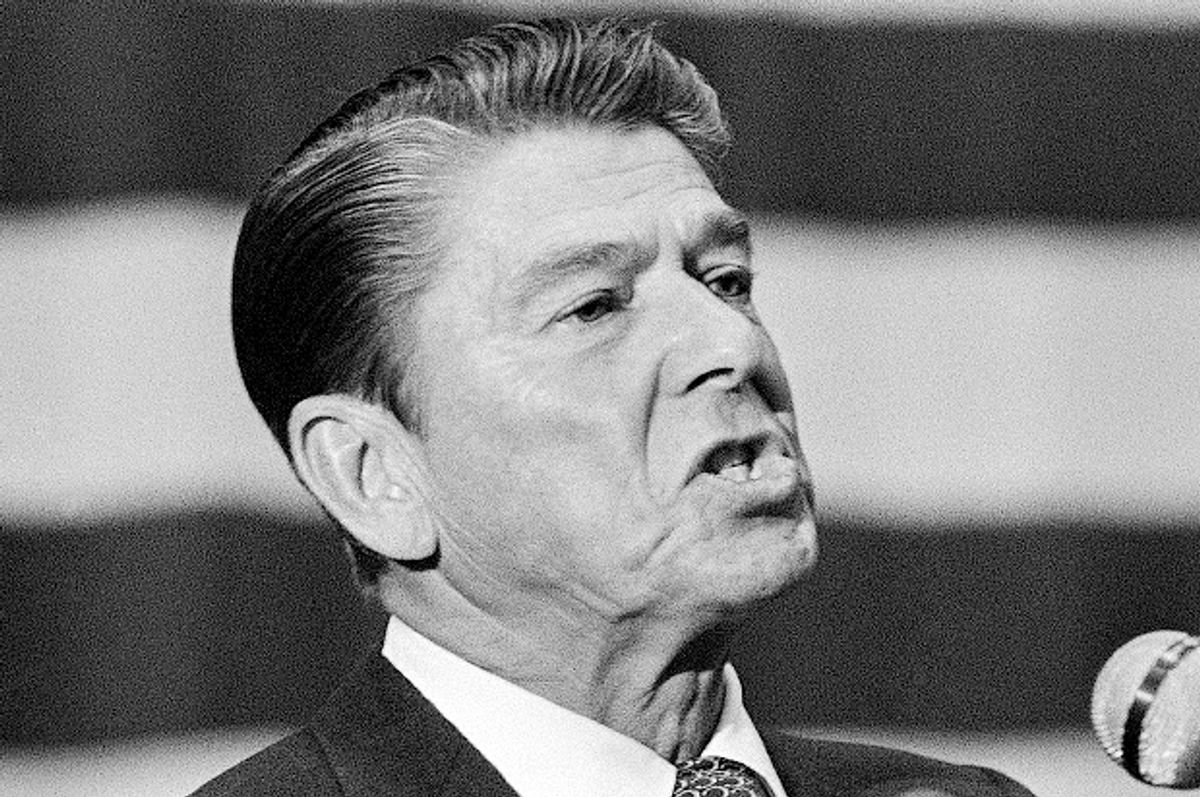

Who killed welfare? You might say that it all started with a charismatic presidential candidate hailing from a state far from Washington, D.C., running during a time of immense change for the country. There was no doubt he had a way with people. It was in the smoothness of his voice and the way he could lock on to someone, even over the TV. Still, he needed an issue that would capture people’s attention. He needed something with curb appeal.

In 1976, Ronald Reagan was trying to oust a sitting president in his own party, a none-too-easy task. As he refined his stump speech, he tested out a theme that had worked well when he ran for governor of California and found that it resonated with audiences all across the country: It was time to reform welfare. Over the years, America had expanded its hodgepodge system of programs for the poor again and again. In Reagan’s time, the system was built around Aid to Families with Dependent Children (AFDC), the cash assistance program that was first authorized in 1935, during the depths of the Great Depression. This program offered cash to those who could prove their economic need and demanded little in return. It had no time limits and no mandate that recipients get a job or prove that they were unable to work. As its caseload grew over the years, AFDC came to be viewed by many as a program that rewarded indolence. And by supporting single mothers, it seemed to condone nonmarital childbearing. Perhaps the real question is not why welfare died, but why a program at such odds with American values had lasted as long as it did.

In fact, welfare’s birth was a bit of a historical accident. After the Civil War, which had produced a generation of young widowed mothers, many states stepped in with “mother’s aid” programs, which helped widows care for their children in their own homes rather than placing them in orphanages. But during the Great Depression, state coffers ran dry. Aid to Dependent Children (ADC), as the program was first called, was the federal government’s solution to the crisis. Like the earlier state programs, it was based on the assumption that it was best for a widowed mother to raise her children at home. In the grand scheme of things, ADC was a minor footnote in America’s big bang of social welfare legislation in 1935 that created Social Security for the elderly, unemployment insurance for those who lost their jobs through no fault of their own, and other programs to support the needy aged and blind. Its architects saw ADC as a stopgap measure, believing that once male breadwinners began paying in to Social Security, their widows would later be able to claim their deceased husbands’ benefits.

Yet ADC didn’t shrink over the years; it grew. The federal government slowly began to loosen eligibility restrictions, and a caseload of a few hundred thousand recipients in the late 1930s had expanded to 3.6 million by 1962. Widowed mothers did move on to Social Security. But other single mothers —divorcées and women who had never been married —began to use the program at greater rates. There was wide variation in the amount of support offered across the states. In those with large black populations, such as Mississippi and Alabama, single mothers got nickels and dimes on the dollar of what was provided in largely white states, such as Massachusetts and Minnesota. And since the American public deemed divorced or never-married mothers less deserving than widows, many states initiated practices intended to keep them off the rolls.

Poverty rose to the top of the public agenda in the 1960s, in part spurred by the publication of Michael Harrington’s The Other America: Poverty in the United States. Harrington’s 1962 book made a claim that shocked the nation at a time when it was experiencing a period of unprecedented affluence: based on the best available evidence, between 40 million and 50 million Americans—20 to 25 percent of the nation’s population—still lived in poverty, suffering from “inadequate housing, medicine, food, and opportunity.” Shedding light on the lives of the poor from New York to Appalachia to the Deep South, Harrington’s book asked how it was possible that so much poverty existed in a land of such prosperity. It challenged the country to ask what it was prepared to do about it.

Prompted in part by the strong public reaction to The Other America, and just weeks after President John F. Kennedy’s assassination, President Lyndon Johnson declared an “unconditional war on poverty in America.” In his 1964 State of the Union address, Johnson lamented that “many Americans live on the outskirts of hope —some because of their poverty, and some because of their color, and all too many because of both.” He charged the country with a new task: to uplift the poor, “to help replace their despair with opportunity.” This at a time when the federal government didn’t yet have an official way to measure whether someone was poor.

In his efforts to raise awareness about poverty in America, Johnson launched a series of “poverty tours” via Air Force One, heading to places such as Martin County, Kentucky, where he visited with struggling families and highlighted the plight of the Appalachian poor, whose jobs in the coal mines were rapidly disappearing. A few years later, as Robert F. Kennedy contemplated a run for the presidency, he toured California’s San Joaquin Valley, the Mississippi Delta, and Appalachia to see whether the initial rollout of the War on Poverty programs had made any difference in the human suffering felt there.

RFK’s tours were organized in part by his Harvard-educated aide Peter Edelman. (Edelman met his future wife, Marian Wright —later founder of the Children’s Defense Fund—on the Mississippi Delta tour. “She was really smart, and really good-looking,” he later wrote of the event.) Dressed in a dark suit and wearing thick, black-framed glasses, Edelman worked with others on Kennedy’s staff and local officials to schedule visits with families and organize community hearings. In eastern Kentucky, RFK held meetings in such small towns as Whitesburg and Fleming-Neon. Neither Edelman nor anyone else involved anticipated the keen interest in the eastern Kentucky trip among members of the press, who were waiting to hear whether Kennedy would run for president. Since the organizers had not secured a bus for the press pool, reporters covering the trip were forced to rent their own vehicles and formed a caravan that spanned thirty or forty cars. Edelman remembers that “by the end of the first day we were three hours behind schedule.”

Kennedy’s poverty activism was cut short by his assassination in June 1968. But Johnson’s call to action had fueled an explosion in policy making. More programs targeting poor families were passed as part of Johnson’s Great Society and its War on Poverty than at any other time in American history. Congress made the fledgling Food Stamp Program permanent (although the program grew dramatically during the 1970s under President Richard Nixon) and increased federal funds for school breakfasts and lunches, making them free to children from poor families. Social Security was expanded to better serve the poorest of its claimants, Head Start was born, and new health insurance programs for the poor (Medicaid) and elderly (Medicare) were created.

What the War on Poverty did not do was target the cash welfare system (by then renamed Aid to Families with Dependent Children, or AFDC) for expansion. Yet the late 1960s and early 1970s marked the greatest period of caseload growth in the program’s history. Between 1964 and 1976, the number of Americans getting cash assistance through AFDC nearly tripled, from 4.2 million to 11.3 million. This dramatic rise was driven in part by the efforts of the National Welfare Rights Organization (NWRO). A group led by welfare recipients and radical social workers, the NWRO brought poor families to welfare offices to demand aid and put pressure on program administrators to treat applicants fairly.

The NWRO was also the impetus behind a series of court decisions in the late 1960s and the 1970s that struck down discriminatory practices that had kept some families over the prior decades off the welfare rolls, particularly those headed by blacks, as well as divorced and never-married mothers. Through “man in the house” rules, state caseworkers had engaged in midnight raids to ensure that recipients had no adult males living in the home. In addition, “suitable home” requirements had enabled caseworkers to exclude applicants if a home visit revealed “disorder.” Some instituted “white glove tests” to ensure “good housekeeping.” An applicant could be denied if the caseworker’s white glove revealed dust on a windowsill or the fireplace mantel. When these practices were struck down, the caseloads grew bigger, and with rising caseloads came rising expenditures. No longer was cash welfare an inconsequential footnote among government programs. It was now a significant commitment of the federal and state governments in its own right. As costs increased, AFDC’s unpopularity only grew.

The largest, most representative survey of American attitudes, the General Social Survey, has consistently shown that between 60 and 70 percent of the American public believes that the government is “spending too little on assistance for the poor.” However, if Americans are asked about programs labeled “welfare” in particular, their support for assistance drops considerably. Even President Franklin D. Roosevelt claimed that “welfare is a narcotic, a subtle destroyer of the human spirit.” Although there is little evidence to support such a claim, welfare is widely believed to engender dependency. Providing more aid to poor single mothers during the 1960s and 1970s likely reduced their work effort somewhat. But it didn’t lead to the mass exodus from the workforce that the rhetoric of the time often suggested. Sometimes evidence, however, doesn’t stand a chance against a compelling narrative.

Americans were suspicious of welfare because they feared that it sapped the able-bodied of their desire to raise themselves up by their own bootstraps. By the mid-1970s, with the country grappling with what seemed like a fundamental societal shift, another reason for wariness toward welfare arose. In 1960, only about 5 percent of births were to unmarried women, consistent with the two previous decades. But then the percentage began to rise at an astonishing pace, doubling by the early 1970s and nearly doubling again over the next decade. A cascade of criticism blamed welfare for this trend. According to this narrative, supporting unwed mothers with public dollars made them more likely to trade in a husband for the dole.

Once again, no credible social scientist has ever found evidence that the sharp rise in nonmarital childbearing was driven by welfare. While welfare may have led to a small decrease in the rate of marriage among the poor during those years, it could not begin to explain the skyrocketing numbers of births to unwed women. Yet Americans were primed to buy the story that AFDC, a system that went so against the grain of the self-sufficiency they believed in, was the main culprit in causing the spread of single motherhood.

And so it was that Ronald Reagan, preparing his run for the presidency during a period when discontent with this stepchild of the welfare state was particularly high, found an issue with broad appeal and seized on it as a way to differentiate himself from his more moderate opponent. His stump speech soon began to feature the “welfare queen”—a villain who was duping the government in a grand style. Unlike the average American, she wasn’t expected to work or marry. The father or fathers of her offspring were given a pass on the responsibility of caring for the children they sired.

The campaign even found a woman who became the symbol of all that was wrong with welfare. In a speech in January 1976, Reagan announced that she “[has] used 80 names, 30 addresses, 15 telephone numbers to collect food stamps, Social Security, veterans benefits for four nonexistent, deceased veteran husbands, as well as welfare. Her tax-free cash income alone has been running $150,000 a year.” As he punctuated the dollar value with just the right intonation, audible gasps could be heard from the crowd.

Reagan’s claims were loosely based on a real person. Hailing from Chicago, Linda Taylor was a character as worthy of the big screen as Reagan himself. In a profile in Slate, Josh Levin wrote that in the 1970s alone, “Taylor was investigated for homicide, kidnapping, and baby trafficking.” She was implicated in multiple counts of insurance fraud and had numerous husbands, whom she used and discarded. Without a doubt, she was a real villain. But she was very far from a typical welfare recipient.

Although negative racial stereotypes had plagued welfare throughout its existence, the emphasis on race was more widespread and virulent after Reagan turned his focus to the system. His welfare queen soon became deeply ingrained in American culture. She was black, decked out in furs, and driving her Cadillac to the welfare office to pick up her check. None of these stereotypes even came close to reflecting reality, particularly in regard to race. It was true that as of the late 1960s and beyond, a disproportionate percentage of blacks participated in AFDC. But there was never a point at which blacks accounted for a majority of recipients. The typical AFDC recipient, even in Reagan’s day, was white.

Reagan lost the Republican primary to Ford in 1976 but defeated President Jimmy Carter in 1980. As president, Reagan took a somewhat softer tone, rhetorically portraying the welfare recipient as more of a victim of bad public policy than a villain. Like FDR, President Reagan viewed the poor as caught up in a system that acted like a narcotic. He was buoyed by the work of the libertarian social scientist Charles Murray, whose influential 1984 book Losing Ground argued that social welfare policies had increased long-term poverty. Murray’s logic was simple: Pay women to stay single and have babies, and more of them will do so. Pay them not to work, and you have a double disaster on your hands. Murray laid the blame for continuing high rates of poverty squarely at the feet of the welfare system.

By discouraging both work and marriage, the system was ensuring that millions of American women and children remained poor. In his second inaugural address, Reagan argued for Murray’s thesis; his call was to help the poor “escape the spider’s web of dependency.”

Despite this grand narrative and call to action, the changes Reagan was able to make to the welfare system were not extensive. The most notable legislative accomplishment of the 1980s was the Family Support Act, a bipartisan effort by conservatives and New Democrats who sought to distance themselves from the tax-and-spend image that was losing them seats in Congress. Arkansas governor Bill Clinton was a leader among the latter group. The act was the most significant attempt to date to put teeth into a work requirement for the welfare poor and to enhance child support enforcement. Those with new requirements imposed upon them were supposed to work at least part-time or to participate in a training program, but there were numerous exemptions. In the end, the program amounted to little more than an unfunded mandate. There was a jobs program with a catchy acronym (JOBS, standing for “job opportunities and basic skills”), but few states took their part seriously, and life changed for only a small fraction of welfare recipients.

President Reagan famously quipped that “we waged a war on poverty, and poverty won.” Judged by the size of the welfare rolls, Reagan’s campaign against welfare was at least as futile. By 1988, there were 10.9 million recipients on AFDC, about the same number as when he took office . Four years later, when Reagan’s successor, George H. W. Bush, left office , the welfare caseloads reached 13.8 million —4.5 million adults and their 9.3 million dependent children. How was it that welfare, an immensely unpopular program, could withstand such an offensive? If welfare’s chief nemesis, Ronald Reagan, had failed, who possibly stood a chance?

Excerpted from "$2 a Day: Living on Almost Nothing in America" by Kathryn J. Edin and H. Luke Shaefer. Published by Houghton Mifflin Harcourt. Copyright 2015 by Kathryn J. Edin and H. Luke Shaefer. Reprinted with permission of the publisher. All rights reserved.

Shares