The Republican tax overhaul plan would be very good for the millionaire and billionaires currently running the federal government. What about middle-income households? Not so much.

According to the New York Times, President Donald Trump would save more than $1 billion in taxes based on information from the president’s 2005 federal tax return, the only one the president has released to the public. Most of the savings would come from the estate tax repeal, which only affects about 5,000 households. But Trump would have saved about $47.5 million from other measures if the current tax proposal would have been applied to his 2005 tax return; those measure would be more widely available to the nation’s top-income earners.

The data contradicts comments made Thursday by White House economic adviser and former Goldman Sachs president Gary Cohn, who flat-out denied the wealthy would get tax cuts under the Republican plan.

On Wednesday, the Treasury Department released the United Framework outlining the GOP’s tax-overhaul plan.

According to the framework, the three areas that would benefit the rich — as well as Trump, Trump’s family and the millionaires and billionaires of the Cabinet and Congress — including a repeal of the alternative minimum tax (a kind of insurance that the rich can’t use loopholes to totally eliminate their tax burdens), savings from taxes on certain types of business income and, most notably, a repeal of the estate tax on the wealthiest households. While the United Framework does include closing some loopholes, there would be overall gains for wealthy households.

The top individual tax rate would also be reduced to 35 percent from 39.6 percent. A reduction in the corporate tax rate would also lead to higher company earnings (this is why the stock market has been so bullish lately) which disproportionately favors top income earners who are more likely to hold large amounts of stock.

Meanwhile, not only would wealthy household reap the biggest benefits from the tax cuts, but some households could see tax increases, according to Josh Barro at Business Insider.

“While there are still a lot of details to be filled in, the information we have available suggests the new Republican tax proposal would raise income taxes on many families who make just a bit more than the national average,” Barro wrote.

Barro’s conclusion: A family earning $120,000 a year with at least one child would wind up paying $587 more in annual federal income tax compared to the current law. While Cohn was hoodwinking the American public on national television this week by saying the wealthy wouldn’t get tax cuts, Steve Mnuchin’s Treasury Department was doing some of its own manipulations.

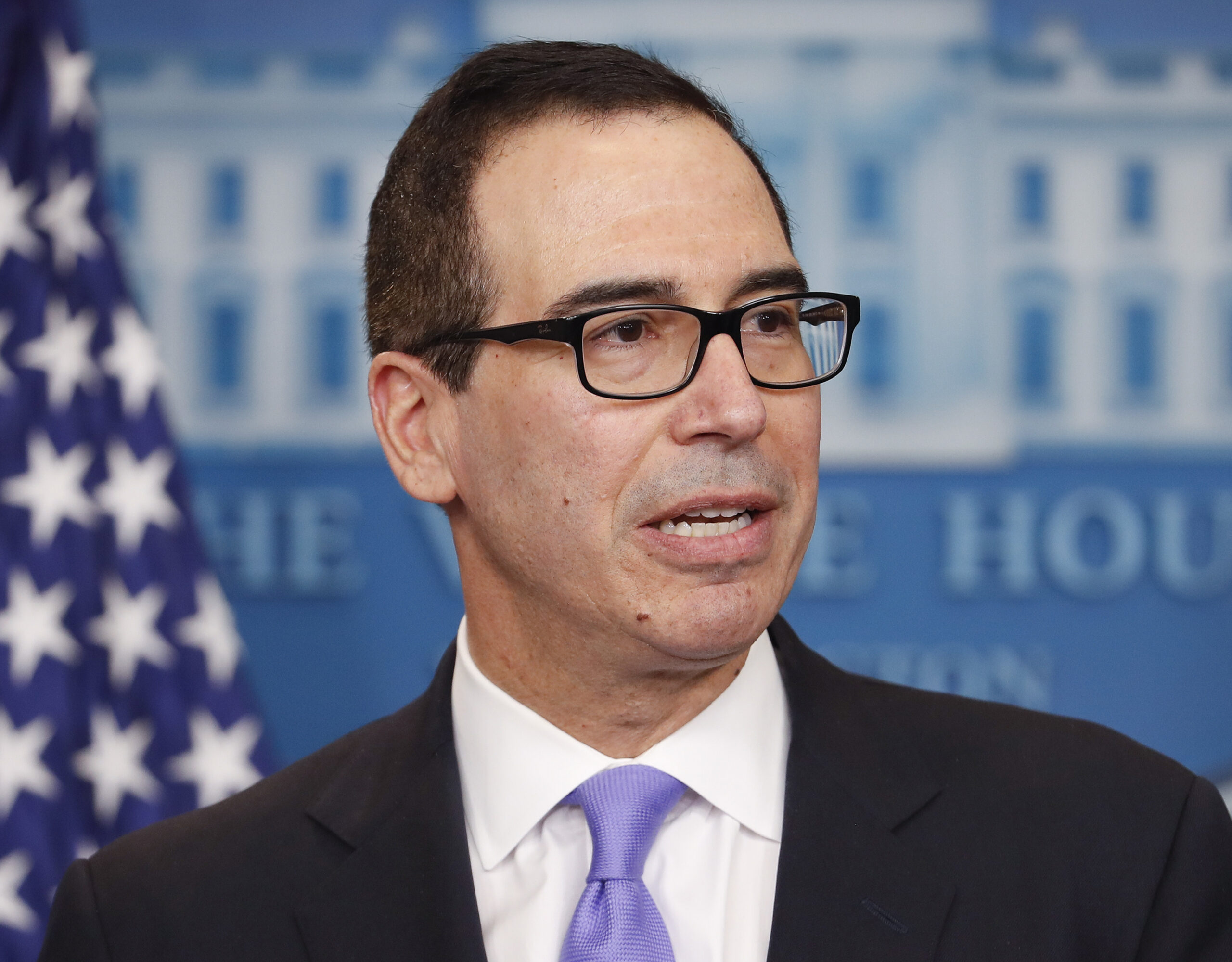

The Wall Street Journal reported Thursday the department took down a 2012 report contradicting Mnuchin’s statements that workers would benefit the most from the proposed corporate income tax cut to 20 percent from 35 percent.

According to the rescinded paper from the Office of Tax Analysis, workers pay 18 percent of the corporate income tax while the rest is paid by owners of capital (owners of stakes in businesses).

But a Treasury spokeswoman told the Journal that this paper “does not represent our current thinking and analysis.” Mnuchin’s Treasury department is claiming that workers bear 70 percent of the tax burden. So far, the Treasury Department has not release a paper to back up the claim.