“His money is twice tainted. ‘Taint yours and ‘taint mine.

— Mark Twain

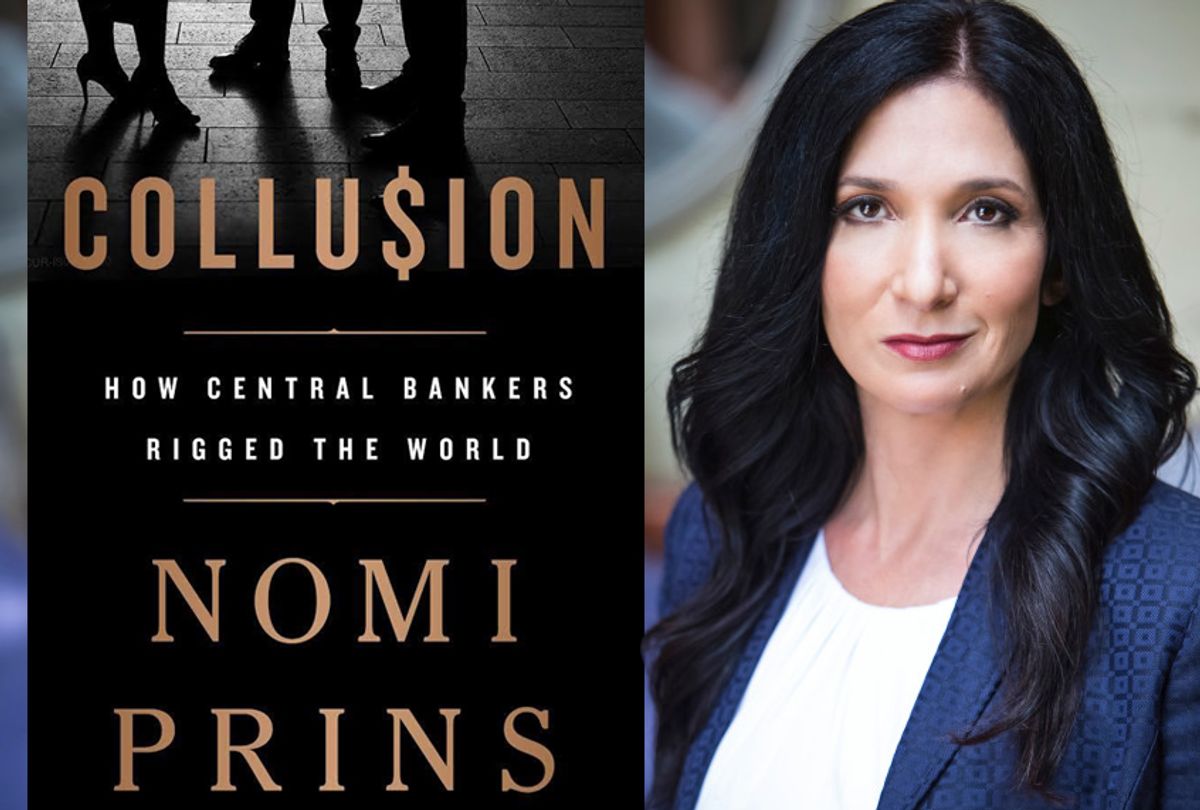

If there was one quote that adequately summed up former Goldman Sachs executive turned acclaimed financial journalist and critically acclaimed author Nomi Prins’ fascinating new book titled “Collusion: How Central Bankers Rigged The World” it would be Twain’s. No, this isn’t the “collusion” that has been dominating the news cycle over the last two years, rather, for financial, social and political matters on Wall Street, Main Street and around the world, it is something more perilous. Prins, who has a PhD in Statistics, as well as experience in the market, and whose previous work was the 2014 release “All The President’s Bankers”, demonstrates a keen eye for important and engaging stories about money, power and corruption.

Prins most recent work led her on what she called “a global expedition . . . to expose international relationships and the power grab of central bankers at the Fed, European Central Bank, Bank of Japan that have fabricated or ‘conjured’ money to fund banking activities at the people’s expense.” Despite all of the complexities surrounding money and its institutions, Prins asserts, it is the personal relationships between the players that matter and they really matter when it comes to the flow of money, the price of money and the access to money.

“Collusion” was selected as one of Amazon’s best business and management books in 2018 and Prins has served on Bernie Sanders’ Financial Reserve Advisory Council and is a frequent speaker at finance and monetary policy conferences. We recently caught up with Prins about her book and to get some perspective about some recent economic headlines.

You have written several books about monetary policy in the past and have received much acclaim for your work. What were you trying to achieve with this latest work?

Three of the last four books that I’ve written, including this new one "Collusion," all examine the juxtaposing of power and money. In all of them, I explore how elected leaders or those in positions of great unelected economic or political influence, use both of them to create or enforce policy. There is a time component as well, "It Takes a Pillage" examined the financial crisis and causes within the framework of a relatively tight temporal lens and I had a very short time to write it as well. "All the Presidents’ Bankers" was a much more expansive book from a historical sense, going back over a century to examine the relationships of key bankers and presidents, and the institutions with which they collaborated to fashion domestic and foreign policy.

"Collusion" is really a book about the future, though it spans the decade since the financial crisis from multiple geographical locations (traveling to which I amassed lots of air miles, and exploring which, I worked with a crack team of internal researchers). It delves into the global connectivity of a body of central banks that provide varying amounts of money to their respective local systems and by extension to the world, and examines how not all central banks are created equal.

READ MORE: How “public” is New York’s flagship public radio station? WNYC’s transition to corporate behemoth

In "Collusion," neither the Fed, nor the U.S. has its own chapter like the other countries or regions. This is by design. The Fed acts as the global influencer, directly and indirectly, as does the U.S. through all of what I call the “pivot regions” in the book that unfold in each chapter. I wanted to show how deeply co-dependent the entire world is on the US monetary policy decisions made since the financial crisis, in various ways, that we are still finding out about. All of my books though, are ultimately, about the people behind their roles of power, and the decisions they make out of ideology, necessity, ego or fear.

You cover several countries monetary systems such as China, Mexico and Brazil and give case studies for each. What are the central themes and/or commonalities that you found as you did a deep dive into these emerging markets?

When I considered the world, I realized there were several, what I call “pivot regions,” through which the story of epic monetary intervention from the main developed countries — who happened to be the ones colluding together — and the implications they had on the world, could be told. The common themes were that the leaders of the central banks in the developed world that followed the Fed tended to stay in power, or get power. Meanwhile, in the emerging countries, central bankers had a harder time deciding whether to adopt the Fed’s policies to attract or keep G7 capital in their countries at any given moment, or choose their own countries’ needs.

Mexico, our closest neighbor and one of our staunchest allies, was — because of the intricacy of the nature of its relationship with the US (which has shifted because of trade wars and Wall discussions since) — in a different position when the Fed cut rates to zero and then became a massive bond-buying or QE (quantitative easing) program. Indeed, before the financial crisis really exploded in the fall of 2008, the leader of Mexico's central bank, Guillermo Ortiz was publicly warning about it (So were other countries, but those warnings were ignored by our media). He went on to warn former Fed chair, Ben Bernanke, personally, what could happen if he subsidized the culprit banks and didn’t instill long-term confidence in the banking system amongst U.S. citizens. He was ignored. The Fed went on to conjure enough money to grow their book of assets from $800 billion before the crisis to $4.5 trillion afterwards (It is now about $4.25 trillion).

All told, the G7 central bankers conjured nearly $22 trillion worth of money with which to purchase financial assets from the system, but not to direct toward real infrastructure or development projects instead. His successor, Agustin Carstens, was selected, based largely on his more collegial relationships with the US and the Fed. He began to follow the Fed’s monetary policy lead, but this hurt Mexico’s economy, and so he changed course, and ultimately became a global critic about the negative ramifications of the Fed’s easy policy on emerging markets.

Brazil’s story was different, in that the government under former president " Lula" at first tried to ignore the US financial crisis's impact on Brazil. It was the finance minister of Brazil, Guido Mantega that coined the term "helicopter Ban" to connote the Fed chairman throwing money arbitrarily from a helicopter, promising it would reach the real economy. There were some major “wars” amongst the central bank leader and finance minister under Lula about whether to follow the US monetary policy or keep Brazil from entering a major inflationary period. One of the “last men standing” from that fight is Lula’s central bank head, Henrique Meirelles, is now running for president of Brazil.

As for China, for the first time ever, the PBOC head at the time, Zhou Xiaochuan began to warn the world, that the Fed’ s ultra easy monetary policy that the European Central Bank (ECB) and Bank of Japan (BOJ) were adopting, would create asset bubbles everywhere. He, more than China’s government, persuaded central bankers in the non G7 countries to take heed, and begin to consider a system in which the dollar, and thus, the monetary policy of the Fed and banking policy of the U.S. government policy, was not as much an impacting factor as it has been since Bretton Woods. Under his push, the IMF [International Monetary Fund], for instance, adopted China’s currency, the yuan, into what is called its Standard Drawing Rights Basket, which had been all G7 country based before that.

Can China really be considered an emerging market at this point?

In some ways, China’s financial market is still emerging, but it’s certainly not an emerging economic superpower. Not only has its speed of economic growth eclipsed that of the US and other classically considered “developed nations” during this decade, but the speed at which it was developed a trade and development oriented strategy to create new alliances the world over, has surpassed that of the US. China has championed the notion of funding development rather than capital speculation as a way to coin, as it were, new relationships throughout the world.

As I note in "Collusion," China has forged better economic and diplomatic relationship with its old adversary, Japan. It has been a leader among the BRICS (Brazil, Russian, India, China, South Africa) block of countries for financing new infrastructure projects, as well as doing the same throughout South-East Asia and Africa and other emerging countries, like most recently Argentina.

Where the US and Europe were once the main champions of forging these relationships, China has taken over that lead role and that has tremendous ramifications for the arch of the global hierarchy in the years to come. In "Collusion," I trace China’s rise as a 21st century power broker, back to its criticism of bank-coddling post-financial crisis Fed policy, and its ability to unearth similar fears and desires for alternatives to codependence on US Fed monetary policy.

I first traveled to China back in the early 1990s while I worked for Lehman Brothers, where I met with the People's Bank of China (its Central bank) and other banks. We were selling a product that combined selling US Treasury bonds with futures on interest rates, or Eurodollar, rates. At the time, China’s central bank, and government, was focused on keeping up with the US. Now, they are not trying to keep up, they are forging their own new world. Their money policy is not dissimilar to that of the Fed, but what’s different as "Collusion" notes, is that China’s new money benefited China’s development as well as that of its growing list of allies, and did not rely on the G7 monetary policy coordination exercises to dictate how it behaved.

One area I found fascinating about the book was that the "collusion" between the US, Europe and Japan is working toward a global system where other countries are trying to establish their own monetary policy, but are overpowered in doing so. Is that necessarily a bad thing that countries such as Mexico cannot be independent?

When a country has to follow the monetary policy of another country, it by definition, is not able to adhere to the needs of its own country. This was a problem, for example, when Mexico had high inflation but the US did not, so the Fed was able to keep rates very low, but Mexico simply couldn’t without severely damaging its economy and people. In the case of the US and Europe and Japan, the nature of their financial markets is such that they can more easily absorb trillions of dollars of fabricated money, in fact, they can inhale it, without there being a dent made on real sustainable economic or wage growth of those developed nations and regions.

In the case of Europe, the ECB not only fabricated money with which to buy the government bond, and later corporate bonds, of countries it deemed worthy (such as Germany) and specifically decide not to use that money to help struggling countries (such as Greece.) In doing that, they had a direct hand in propping up one country at the expense of another, with money that didn’t really come from either country anyway.

It’d be like if you could create a million dollars, and did, and then was walking some city streets and came upon two things, a billionaire having a sandwich at an upscale outdoor café for lunch and a homeless person having scraps by a fountain in the park opposite it, and you decided to give that million to the billionaire.

The undercurrent of nationalism in recent years with Brexit and the current administration's America First policy is spreading to other countries in Europe. With this dynamic, does that make the G7 pointless when it comes to the world bank and monetary policy?

Brexit, Trumpian nationalism, the move towards the same in Europe is all a direct result of the monetary policy adopted in the wake of the US financial crisis that fueled the banks and markets, and not the people, and was exported globally. This made people already economically challenged, more so. This created anger, fear and a need to blame. That blame came down upon people outside of borders, for the most part, but not through the understanding of how much inequality was produced central banks.

When a system favors the people or countries already benefiting the most from it, the fallout is inequality, an abundance of debt, financial system instability, shifts in voter preferences toward nationalism, and ultimately, a lack of economic growth and wages at the foundational level. Since currently, the G7 controls the lion’s share of unequal money creation, G7 central banks have become the financial markets.

If all the bonds they bought were sold tomorrow, it would wreck markets, economies, lives. That’s an unstable position, one in which the G7 central banks have insinuated themselves. Retaliation against or within the G7 countries should be against the central banks that have distorted the markets and economies, as well as the governments. But, governments are easier targets (and not exactly blameless).

In time however, non-G7 countries, will have more independent monetary policies and alliances for development projects and real economic growth that can displace those of the G7. This is now in flux. If we get to a point, where the ability of more countries to share the currency and monetary policy for the world in such a way that there is a widespread benefit, or at least, not a negative repercussion on some and not others, then the power of the Fed, etc. will dissipate.

Recently, President Trump was critical of Fed Chairman Jerome Powell in terms of raising rates in a CNBC interview. Politics and monetary policy by the Fed has not always aligned, but there has been a clear precedent of separation of the two where policy would not bow to political pressure. What concerns do you have with these recent comments and what impact might there be?

Trump’s recent pressuring of the Fed not to raise rates is a page out of another Republican president’s playbook — Richard Nixon. When the Fed began raising interest rates during Nixon’s term, as this article notes, he “wasn’t happy about it” either. However, Nixon’s intervention into the Fed’s policies didn't end well.

Back then, the US had been in the throes of a recession. To stimulate growth, the Fed had cut rates by more than a half of what they had been. There was no QE during that period, because there wasn’t a banking system liquidity crisis preceding that recession, so the level of Fed support wasn’t anywhere near as expansive as it has been this past decade. Fed Chairman Arthur Burns, believed that “awful problems” could occur if the Fed didn’t raise rates in tandem with the growing economy. But, Nixon didn’t want to risk the economy cooling off before the 1972 elections.

Subsequent conversations lead to a reversal of rate hikes during the fall of 1971. That inevitably led to one of the highest inflationary period in U.S. history. It is a bit different now. If Powell adheres to Trump’s wishes, it’ll be because the economy isn’t growing as fast as predicted and because banks remain addicted to cheap money. But, the idea that the president can sway the Fed adds to the general level of uncertainty around US policy now in general, from the standpoint of the world. That manifests tensions already being stoked for other geopolitical reasons.

What do you see as the possible consequences in a world of increased tariffs overall, a trade war with China and rising interest rates?

The biggest ramifications of President Trump’s trade wars are increased economic anxiety and deterioration of global trust, as the world experienced the last time the US adopted a swath of high tariff nationalism in the 1920s and the onset of the Great Depression. The lack of trust impinges upon diplomacy and international alliances.

In China, the main focal point of trade war actions and threats, is especially, anxious. That’s why, its central bank, the People’s Bank of China (PBOC) just cut the reserve requirements that certain Chinese banks must have in the case of emergencies. In addition, last week, the PBOC injected $74 billion into the system, though that money was set to flow to the small-business sector of China, whereas the Fed’s injections of money never had such directives. The Chinese government also announced a fresh $200 billion of infrastructure spending to boost infrastructure numbers. The US didn’t. As a result of its monetary policy moves, the Chinese yuan dropped to 6.8 vs. the dollar, giving the US the opportunity to cry currency manipulation. Yet, if the Fed is raising rates, it strengthens the dollar, the math means, that other currencies weaken in relation.

Trade wars aren’t only a matter of geopolitical economic sparring. They impact global stock markets. Under a full tariff scenario, for instance, according to UBS, “profits for S&P firms would take a 14.6 percent hit, with US and global growth being 245 and 108.5 basis points lower, respectively.” If Trump makes good on this threats to impose tariffs on China of between $200 and $500 billion, major losses would not be far behind.

“We are now at the 100-day mark before the midterm elections. Which economic issue do you think is the most pivotal for voters to pay attention to and why?”

There are several economic and financial areas to which voters should pay close attention regardless of whether they vote Republican, Democrat, third party, or independent. It’s imperative we all get on the same page about examining the impact of policies, not the rhetoric of them.

First, there is too much debt in the system, whether it be corporate, consumer or student loan debt as a result of cheap money on the corporate side and the lack of true economic and wage growth and prospects to make ends meet on the consumer and student loans side.

Wall Street is doing exactly what they did with mortgage loans before the US financial crisis, but with corporate ones. Now, “leveraged loans” or loans made to companies already deluged in debt are being re-packaged as “collateralized loan obligations” or CLOs. As Steve Pearlstein wrote, issuance of securities like “CLOs, leveraged lending and CLO” has risen by 38 percent during the first half of 2018 vs. last year’s near-record levels. When Wall Street packages with a vengeance, it’s because it wants to bank the fees before the loans start to default. I worked there. I know this.

We should be mindful that all talk of financial and bank deregulation being promoted by the administration and the Fed and the Treasury Department can and has, lead us on the path to banks packaging and dumping their risk on taxpayers.

We need a true Glass-Steagall Act to separate our deposits and loans from the speculative and trading and securities creation ability of the big banks. There is a connection. The crisis was worse than it had to be because independent banks could source loans, create assets and lend money to other banks and investors to buy those shady assets lines with defaulting loans that they knew were defaulting, because they get line-level data about it every single day, they just never admitted that.

We must be aware that trade wars don’t hurt politicians and financial elites (because they have more money) as much as real workers (who don’t). Nationalism and protectionism thwart growth at all levels of the real economy. We need a national or infrastructure and development bank and more public banks in the US to be able to deflect the debt already created to projects that have lasting benefit and job-creation abilities, and ensure that the money created to fuel QE is not used for the purpose of speculation, but production.

Shares