In a last-ditch bid to revive the expanded Child Tax Credit in some form by year's end, the White House has reportedly suggested to congressional Democrats that it is willing to accept a compromise deal that adds more stringent work requirements to the anti-poverty program—a reversal of President Joe Biden's previous opposition to such restrictions and a move that some progressives condemned.

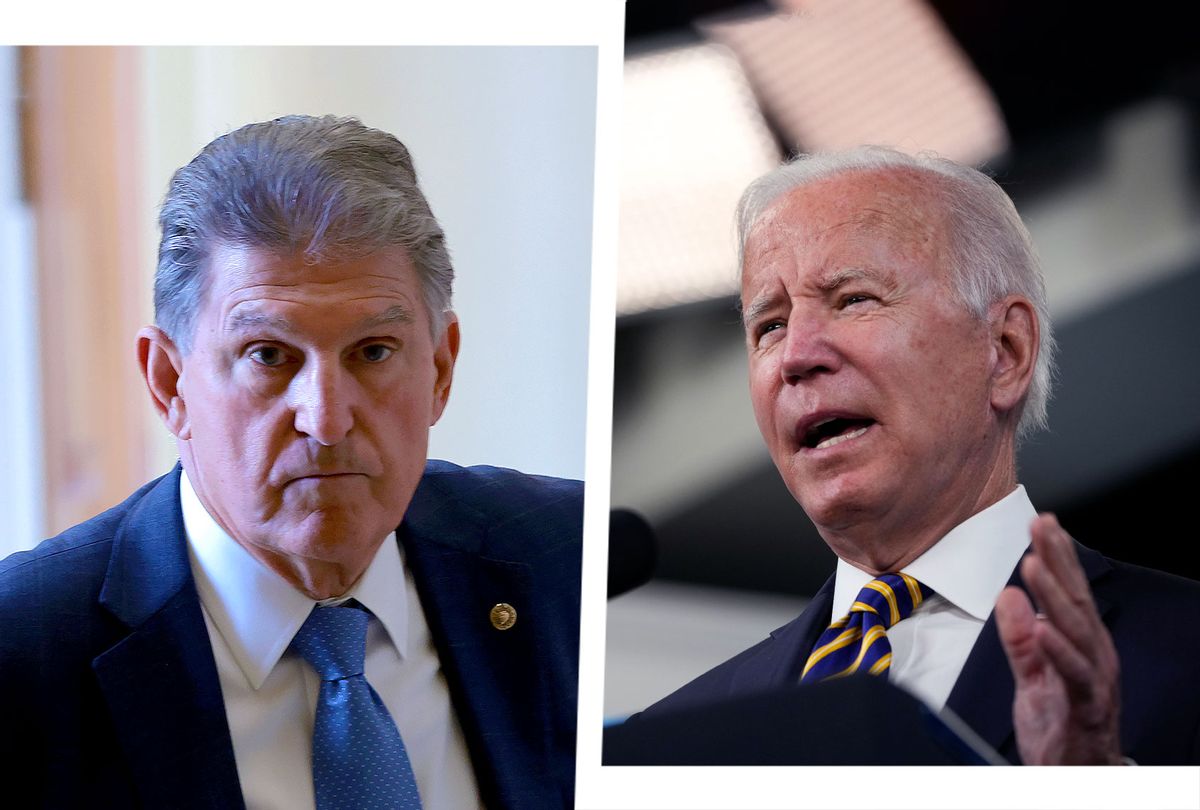

The Child Tax Credit (CTC) boost enacted in 2021 did not contain a work requirement, meaning the poorest families were eligible for the CTC for the first time. But the CTC enhancement, which brought about historic reductions in U.S. child poverty, expired at the end of last year due to the opposition of Republicans and Sen. Joe Manchin, D-W.Va., who refused to support a renewal of the expanded CTC unless a "firm work requirement" was added.

At the end of 2021, the CTC reverted to its previous form, which essentially already contains a work requirement given that only families with at least $2,500 in yearly earned income are eligible for the credit—a regressive design that excludes the very poorest from benefits.

Biden publicly opposed Manchin's 2021 push to add a work requirement to the boosted CTC, but Politico reported Monday that the White House has "privately signaled to Democrats that it would support a compromise deal to revive the expanded Child Tax Credit, even if it includes work requirements."

Research indicates that work requirements do little to boost employment, the purported goal of those who support adding them to social programs. However, work requirements do often succeed at denying benefits to vulnerable people, including many who are eligible.

"The evidence shows the red tape associated with work requirements can cause people to lose access to vital supports, even when they are working or should be exempt," Elaine Waxman and Heather Hahn of the Urban Institute observed last year. "Unfortunately, work requirements are not merely a mechanism for program integrity to prevent ineligible applicants from receiving services—they can also be an intentional mechanism to reduce program access for people who are eligible."

The Center on Budget and Policy Priorities has estimated around 80% of the child poverty-reducing impact of the boosted CTC was attributable to the provision that made families with zero or very little earned income eligible for the full credit of up to $3,600 annually per child. That money was paid out in monthly sums, helping families afford food and other necessities amid the pandemic and resulting economic turmoil.

"Just a complete disconnect from the reality of who benefitted from this policy and why," Rebekah Entralgo, managing editor of Inequality.org, tweeted in response to news of the Biden White House's about-face on work requirements. "The expanded CTC lifted millions of children out of poverty precisely because it was fully available to families too poor to pay income taxes."

Politico's reporting came amid growing pessimism that congressional Democrats—who hold a slim majority in both chambers until next month—will be able to secure a tax-related deal with Republicans before the end of the year. Republicans have been pushing for a batch of corporate tax cuts, which Democrats have said they're willing to entertain in exchange for a revival of the CTC enhancement, which the GOP has opposed.

"The package, which negotiators are hoping to slip into the omnibus, would be less substantial than the Child Tax Credit expansion Democrats passed in 2021, due to cost limitations and the need to win over 10 Senate Republicans," Politico reported Monday. "Whereas that 2021 version boosted payments across the board, for example, this time the focus is more on expanding the percentage of recipients who qualify for the current $2,000 yearly maximum, according to those involved in the process."

"The parents of roughly 19 million children don't receive that full amount as of now, either because they earn too little or aren't working at all," the outlet added.

Murshed Zaheed, a progressive strategist, argued Monday that "reviving an anti-poverty measure... shouldn't come at the expense of giving more corporate tax breaks and adding cruel work restrictions demanded by Manchin—especially after passing an $800B+ military bill."

"This would be a shameful cave by Biden and Democrats," Zaheed added.

Shares