Most people view Wall Street as less a geographical location than a kind of metaphor, like “the Beltway” and the “Rust Belt.” But it is an actual street, and the firms that surround it—and are spread across Manhattan—employ millions of fine, hardworking people.

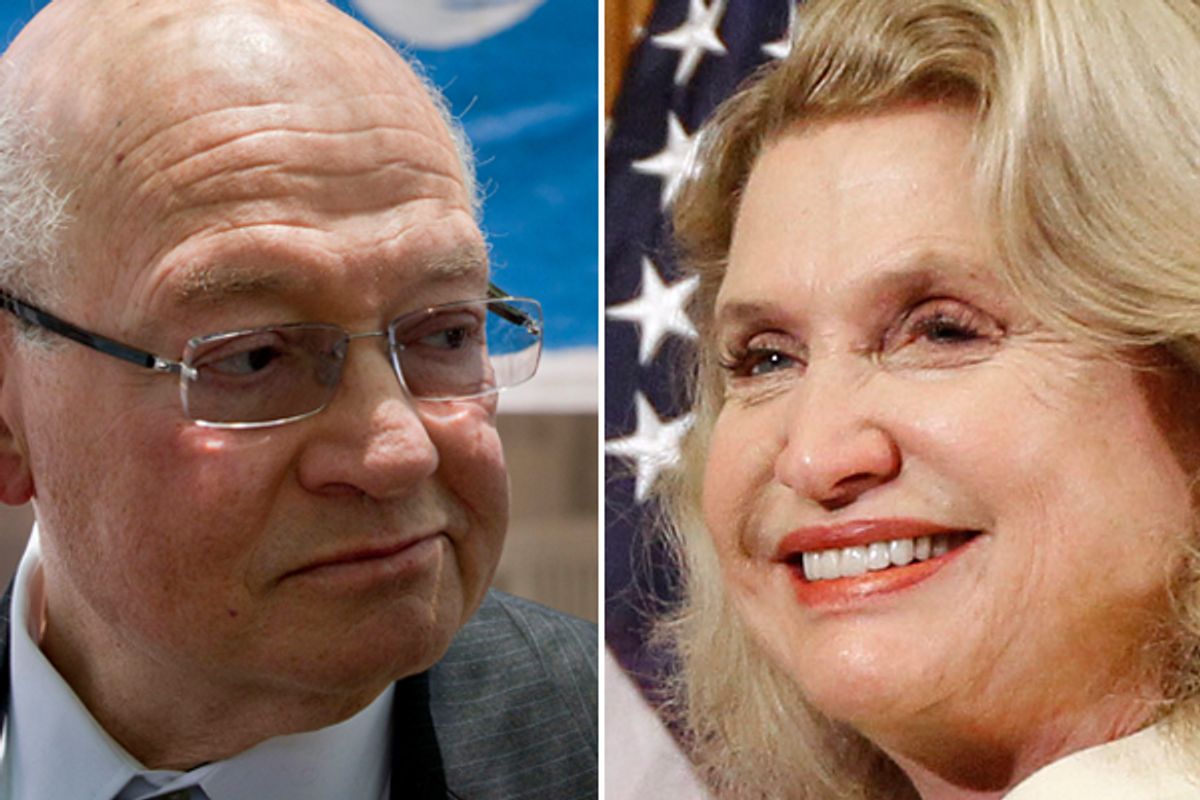

I make that point by way of pleading for mercy for a really good person who has strayed. Her name is Carolyn B. Maloney, and she is a Democratic member of Congress from New York City and sits on the House Financial Services Committee. Do not hate this woman, even though she has joined in the effort to slice away at the ineffectual Dodd-Frank non-market-reform “market reform” legislation, by co-sponsoring a bill that is gutting transparency in the swaps market. She knows not what she does. Well, OK, she knows perfectly well what she does, but she can’t help herself. She’s represents New York, you see.

It’s really that simple. As I say, she’s a good person, has a fine record, as does much of the city’s congressional delegation, but there’s something about representing a New York constituency that does something to one’s judgment when it comes to Wall Street. She is no shill for the banks. Maloney was among the toughest advocates of credit card reform legislation, and her Credit Card Bill of Rights, which she proposed in 2008, was something that would be unheard of today—progressive, pro-consumer legislation that was actually passed into law.

Then why, oh why, is she co-sponsoring a bill that would turn back the clock on swap contracts? Abusive swaps were the financial weapons of mass destruction that caused such misery in the run-up to the 2008 financial crisis. I say “abusive” because swaps are like radium—beneficial when not abused, but horrid in the hands of the wrong people, such as the executives of American International Group, which used them to wager on the housing market so ineptly that it required an $85 billion bailout from us taxpayers.

One of the many problems with swaps is that they have jet-age implications, but are traded the way cavemen used to trade arrowheads for bear carcasses—mano a mano, or “over-the-counter” as such trading is called. Except that unlike OTC stocks and bonds, there is no mechanism for the reporting of their prices. This is known as “opacity,” and it is universally decried as a bad thing. It also means that there are no safeguards in the event one party defaulted.

Dodd-Frank tried to tackle this problem by requiring that swap contracts be traded in the open, via “swap execution facilities,” with their prices publicly disclosed. Bring trading of swaps out into the open, the thinking went, and abuses would be prevented. Metaphorically speaking, there would only be good radium, medical isotopes and not nuclear fuel.

The Street, however, never tolerates any impingement on its freedom to do anything, and that includes trading swaps in the back alleys like real men. So now we have the Swap Execution Facility Clarification Act, which sailed through the House Financial Services Committee on Wednesday. It would prevent regulators from requiring that these swap execution facilities have a “minimum number of participants receive a bid or offer or respond to any trading system or platform functionality.” So just two could play, just as in the back-alley days of yore. And there would be no requirement to “display or delay bids or offers for any period of time.”

Translation: The prices would be secret, just as in the bad old days.

This marvelously senseless piece of legislation was sponsored by Scott Garrett, a New Jersey Republican, and Carolyn Maloney. Why Carolyn Maloney? Well, at least she’s reasonably honest about it. As Gretchen Morgensen pointed out in the New York Times over the weekend, Maloney “had heard concerns about the [Commodity Futures Trading Commission] rule from financial firms in her district,” and was “concerned about job losses on Wall Street.’

OK, the latter is legitimate enough. But the “rule” that she’s talking about was the CFTC simply taking charge of the swap market, which was precisely the point of Dodd-Frank. It was the absence of such oversight that resulted in misery for the entire nation—and job losses for the very financial firms in her Upper East Side district that have been carping to the congresswoman. We can never expect the financial services industry to favor sane regulation, and swaps dealers are very much like the banks that fought hard against Maloney’s credit card legislation. That is why we elect people like Carolyn Maloney, to stand up to people like that.

But let’s not tilt at windmills, shall we? The New York congressional delegation, progressive as it is in so many ways, reacts the way congressional delegations do when confronted with power constituencies. Maloney’s campaign coffers are not exactly overflowing with banker cash, by the way. Cantor Fitzgerald, which deals in swaps as in many other financial products, is among her biggest campaign contributors. I personally doubt that the $10,000 that it donated to her 2012 reelection campaign was much of a factor in her deciding to sign on to this weakening of Dodd-Frank.

No, it’s not payola but the kind of ingrained constituent loyalty that made Maloney's colleague, Queens Rep. Gary Ackerman, go to bat for the banks in 2010, opposing a proposal to force banks to spin off their derivatives subsidiaries. This is the same Gary Ackerman who browbeat regulators when they crawled up to Capitol Hill to discuss their Bernie Madoff failings in February 2009.

It’s how the 1 percent stays that way. It’s not just the ideologically rigid Republicans that we read about every day, but the active participation of liberal Democrats who know what side of their bread the butter can be found. Joining Ackerman in his letter was Michael E. McMahon, another New York City Democrat, and I guess that’s where you might find the moral of the story. Which is: Bad as the New York Dems may be when it comes to the Street, there is always a worse alternative waiting in the wings.

McMahon’s subservience to Wall Street was insufficient to keep him in office. In 2010 he was defeated by the aptly named Michael Grimm, a conservative Republican who co-sponsored yet another effort to weaken Dodd-Frank. It exempts “end users”—companies that use swap contracts for hedging—from the law’s margin (that is, leverage) provisions. It sailed through the Financial Services Committee on Wednesday, alongside Maloney’s bill.

Grimm says the legislation frees up “capital to be used for job creation and to help our companies remain competitive in the global economy.” It might also serve to free up capital to fund his 2012 reelection campaign. During his brief career in Congress, McMahon’s two top contributors were JPMorgan Chase and Goldman Sachs. Grimm didn’t do nearly as well. Securities firms were the third-biggest source of funding when he ran for the seat in 2010, but he’s working hard to even the score.

Carolyn Maloney is no Mike McMahon. She’s more of a fire-breather, more of an Ackerman. But she’s also a New Yorker. So she’ll fight for consumer rights and, if it’s not too high-profile, she’ll go to bat for Wall Street. She won’t lose her job for doing that. The alternative, as she knows perfectly well, can be awfully Grimm.

Shares